Wage growth trending upward

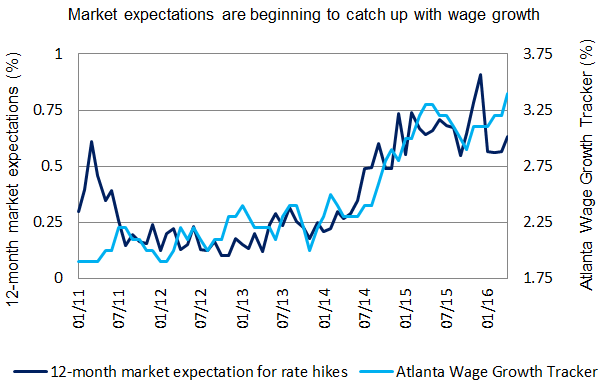

Contributing to higher inflation is a nascent upward trend in wage growth. Our preferred measure, the Atlanta Fed Wage Growth Tracker, has registered at above 3% for five months. Not only is this positive for personal income and consumer spending for the rest of the year, but it should also contribute to inflation reaching the Fed’s target sooner rather than later.

This wage growth is a product of the U.S. labor market nearing full employment, with job growth of approximately 200,000 each month for most of the past two years. While the most recent job growth data disappointed markets, expectations of job growth should adjust down to a more realistic 150,000-160,000 per month. With adjusted expectations, the current magnitude of growth is still relatively good for an economy with 5% unemployment.

Sources: Bloomberg, Federal Reserve Bank of Atlanta, Columbia Management Investment Advisers, LLC, May 20, 2016

GDP growth slow, but steady

At an annualized rate of 1.9%, real GDP growth is slow, but not nearing a recession. Growth in the first quarter was well below this trend, but first quarter GDP has been notoriously low over the past several years and has bounced back in the subsequent three quarters. We believe the potential growth rate for the U.S. economy is approximately 2%. And while we strongly believe expectations about growth must be recalibrated for this slow growth environment, early projections for second-quarter GDP growth are encouraging, with the Atlanta Fed’s GDPNow Tracker forecasting 2.5%. That level of growth would help ease concern over growth in the first quarter, however messy that number was.

Gap between market expectations and Fed views will narrow

It’s easy to be less than ecstatic about the state of the U.S. economy, but it continues to move along at a steady speed. The fundamentals point toward higher interest rates over the next year, and almost certainly more than the market is currently expecting. The divergence between market views and Fed views will narrow, and as it reverts to a more neutral stance, the market will expect more rate increases.

Alex Christensen is associate analysts, global rates and currencies at Columbia Threadneedle Investments.

Edward Al-Hussainy is senior rates analyst at Columbia Threadneedle Investments.