As "open architecture" platforms become ubiquitous, an advisor's ability to access specialized financial products and services is no longer a distinguishing factor and, as a result, the platform itself doesn't drive the success of a wealth management business.

Attitude Is Everything

A

significant portion of an advisor's facility and effectiveness as a

wealth manager is derived from his vision for the role and how that

shapes the service and solutions he delivers. Advisors that migrate to

wealth management from another model must adopt a new operating

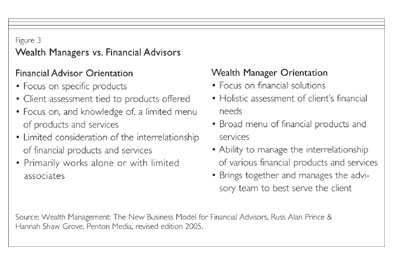

philosophy that reflects their new business approach. Figure 3

contrasts the mind-set and limitations of

average advisors and the perspective of wealth managers.

Wealth Management Is Process Driven

A

final shortcoming of the wealth management initiative at most financial

firms is their inability to create, adopt and use critical processes

that help business opportunities become revenue-generating

transactions. At a minimum, wealth managers must be able to:

1.

Identify the client-specific situations that may call for additional

products and services. This may require the involvement of outside

specialists and can be a complex and rapidly changing process depending

on the client's finances and needs. There are many ways to do this. We

created and continue to use a process based on the Whole Client Model

that allows advisors and their networks of experts to develop a

comprehensive understanding of an affluent client.

2. Convert a

specific opportunity to deliver new products or services into an

accessible and actionable recommendation that suits the client's style

and communication preferences, crystallizes the benefit and expected

results and presents a meaningful solution to a pressing issue or

concern. The best way to do this is with an individualized client

strategy that accounts for the unique qualities of each relationship.

The output from the Whole Client Model (see insert) will provide a good

deal of information for a client's strategy, as

will identifying a client's high-net-worth personality.

3.

Manage the many stages and facets of the implementation process in a

way that sustains momentum, keeps the client informed about timing and

results, galvanizes the team of specialists to work collaboratively and

continually measures the solutions against the client's goals and

objectives.

The Moral Of The Story

Affluent

individuals and families want the benefits of wealth management, and

financial services providers can be rewarded in numerous ways-not just

financially-by offering such capabilities to their wealthy clients.

Wealth management, however, is not a promise to be taken lightly, and

simply wanting or needing it will not be enough. The important lesson

for organizations and practitioners that advocate a wealth management

approach is that it requires dedication and commitment on the part of

everyone involved to do it well, deliver a worthy experience and reap

the rewards.