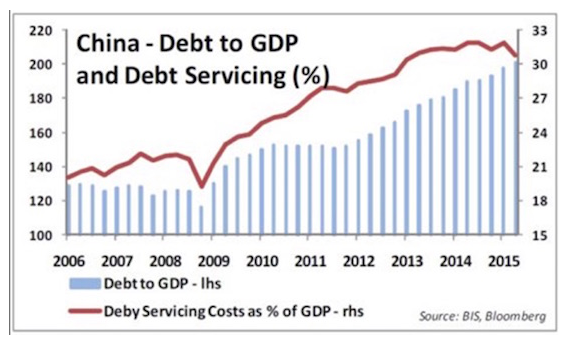

You don’t do that on the back of a weak currency – but then we come to the problem of a strong Chinese currency. Oh, by the way, their debt service is up to 30% of GDP, but that’s a detail that is mostly overlooked. (Please note more than a hint of sarcasm.)

Weak link number three is Japan. I have been talking about Japan for years. The line I coined six years ago is one that everybody tosses around now: “Japan is a bug in search of a windshield.” Japan is doing exactly what I said it would do in my book End Game five years ago and in Code Red over two years ago. It will get honorable mention in the next book.

Japan is monetizing its debt and putting it into the central bank. They are going to continue doing this at an astounding rate. I shorted the yen when it was at 100. I should have shorted it when it was at 90, because I was already writing about it then, but at the time I didn’t have the money or the testosterone. I was a lot happier when it was at 125 than now when it is back down to 102. One of the things I try to avoid when I place money with money managers is a “true believer.” A true believer’s certainties can take you over the cliff. But I must confess to being a true believer about the ultimate weakness of the yen. I still think 200 is a real possibility. For what it’s worth, I still have my money exactly where my mouth is. Only now, the cash value is back to where I started almost 21Ž2 years ago. Oh well… We true believers are a hardy bunch. By the way, have I introduced you to some of my gold bug friends? And then there’s the survivalists. Just saying…

The Japanese have placed 30% of their total government debt on the balance sheet of their central bank. It is going to 70–80% – count on it, says the true believer. That is a lot of yen to put into the system, and that is what I think drives the ultimate valuation of the yen.

Emerging markets are the fourth weak link. How do they dig out? They borrowed $10 trillion in dollars that they have to pay back from income earned in their local currencies. Dollar valuation can create serious problems for their debt. And it happens at the worst possible time, during a crisis or global recession when the US dollar is the cleanest dirty shirt in the closet. The value of the dollar will rise at precisely the time when the profits and tax revenues of the emerging-market corporations and countries will fall.

Then there is a final weak link – and that is us, the US.

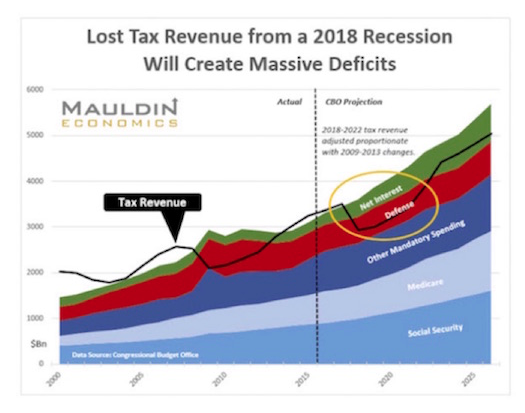

We are the most global, powerful, incredible, fabulous country in the history of the world. But here is our problem. When we next fall into recession, the deficit explodes to $1.3 trillion, even if we lose only the revenue we lost last time. If we have to add in the extra cost of safety nets, it’s $1.5 trillion minimum, plus the almost three quarters of a trillion dollars of “off-balance-sheet” debt. US total debt will be rising at over $2 trillion per year in short order.

All in, we are adding $2 trillion plus a year to an already huge total national debt. In five years we could be at $30 trillion debt. We are into 2020 and we are now facing $30 trillion in debt and people are going, “Whoa, what the hell are we doing?” You think there is angst today in the Tea Party?

Lacy Hunt is right: debt constrains growth. It constrains nominal GDP; and if we don’t get nominal GDP, we won’t get wage growth; we won’t get the labor participation rate up; we’ll get more of the gig economy; we’ll get a recession where we are back to 8–9–10% unemployment. People are going to be upset. Juan Williams may be right that Clinton is a shoo-in. That may be the best thing that ever happened to Republicans, because she will have to figure out what the heck to do, and she has no clue. Because it doesn’t make any difference which of these links breaks. We are all connected. The whole chain breaks.

When it breaks, the result is a global recession every bit as serious as the last one; it’s just different in its causes and effects. But there is a common denominator in each of the weak links mentioned above: Debt. And I do mean debt with a capital D. You can’t just wish debt away or declare a jubilee, because there are banks and pension companies and you and me on the other side of that debt. Somebody owns that debt, and that somebody is you and I in our pensions, in the insurance we buy, in the bond funds in our portfolios, in our foundations, our banks, and corporations. Those bonds silently permeate every part of our lives. Kill them and it all goes pear-shaped.

WWTFD

And so then you have to ask the question “WWTFD” – what will the Fed do? Well, I can tell you what I think they are going to do. The answer actually takes us back to my seminary days. This is one of the few times my theological education actually informs my economic views.

Cornelius Van Til was a Dutch theologian who came over to the United States, went to Princeton, got his PhD, taught at Westminster, and created a philosophical school called presuppositionalism. He said, if I know what your presuppositions are, if I know your true core foundational beliefs, I can tell how you are going to act. I can tell you what your values are; I can tell you who you are. I know how you will ultimately interpret the Scriptures. Your presuppositions determine how you act and work and think in the world.