A number of leading wealth managers are addressing future health-care problems and treatments by working with leading concierge medical practices and related organizations to produce health-care contingency plans that would use the most advanced medical care in the world.

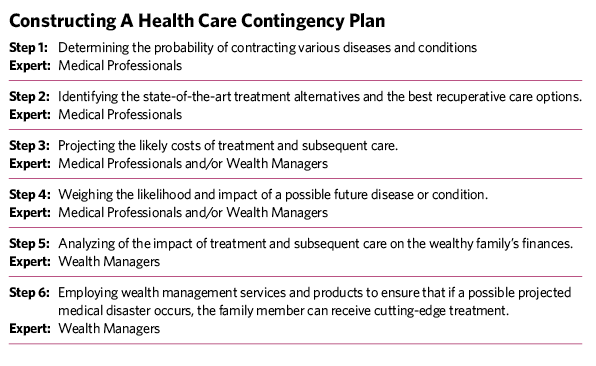

Constructing a health-care contingency plan involves a number of steps (see the chart). To start, medical professionals, using technologies like genome mapping, determine the probability of contracting various diseases and conditions. Then they identify the latest medical treatments available, and find out where they are located.

The medical professionals, often with the wealth managers, project the likely costs of treatment and subsequent care. At the same time, they determine what the impact of the disease on the individual and the family would be. That allows wealth managers to determine the financial repercussions. Lastly, the wealth managers specify the financial planning and the products and services they can bring to the table to ensure the wealthy family can afford the cutting-edge health care they desire.

Wealth Managers

It is important to realize that health-care contingency plans require constant updating. As the medical revolution progresses, as the world of high-end financial solutions evolves, there is a constant need to update a wealthy family’s health-care contingency plan.

This approach is, of course, less available to a prosperous family with illiquid wealth, maybe wealth primarily stored in a privately owned business or in investments that are difficult to exit. Such families may have difficulty coming up with the millions of dollars that will be required and will have to make very difficult choices about wealth allocation if a family member is stricken.

While immortality might forever be out of reach, living a highly productive and enjoyable life to age 120 (or beyond) is not. Advances in medicine over the next decade will certainly bring us closer and closer to this reality. The complication is that money matters.

Today and for the foreseeable future, traditional health insurance will not pay for all the various treatments available—especially the latest and most revolutionary treatments. This requires people to cover the costs themselves. Even in the world of multi-millionaires, without concerted and sophisticated planning, they too will not be able to have the health care to extend their lives.

Russ Alan Prince is president of R.A. Prince & Associates.

Brett Van Bortel is director of consulting services for Invesco Consulting.