First, I want to express my shock and quiet despair over the events in Dallas this weekend. The shock comes from this actually happening in Dallas. If anything, Dallas police are accommodating and work with the community as well as any police force in the country. But this event is a reminder that tragedies don’t just happen somewhere else. All it takes is one or two lone actors, and the world of somewhere else lands on your doorstep. This sad spectacle is part and parcel of what we will be discussing today: a world where common sense and reasonable discourse are breaking down, leaving us with social outcomes that only a few years ago would have seemed impossible. As Buffalo Springfield sang, “There’s something happening here; what it is ain’t exactly clear.”

I offer my prayers and express my condolences and deep sympathy to the families whose loved ones were killed and injured. (I’ll include some additional personal thoughts at the end of the letter.)

When the Future Becomes Today

Why do investors spend so much time thinking about the future? Any conclusions we reach are necessarily speculative. No one has a crystal ball. The efficient market advocates are correct when they note that we can’t predict the future. However, they’re wrong to say forecasting is useless (and they are off base with many of their other conclusions!). While we can never be 100% confident about tomorrow, we can often get close. Just as the universe abides by known physical laws, the economy follows known principles of human behavior. People try to minimize pain and maximize pleasure. If you can anticipate how they will do so, you can forecast economic results, not with perfect reliability but with high confidence. And so we spend a great deal of time forecasting outcomes for our businesses and investments.

Timing is the main challenge. We may know (or at least think we have a good idea) what people will do – but not when they will do it. How much pain/frustration/disappointment can they withstand before they give up and surprise us by opting for a totally different direction? That’s a key question for both sides of the Brexit decision.

While everyone was talking about Brexit for the last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national governments. (It also serves as a ready source of material for conspiracy theorists, and its legendary secrecy only adds fuel to the fire.)

More sanguine observers note that because it is relatively free from political considerations, the BIS can speak about economic issues more candidly than its member central banks can. Its candor has grown steadily in recent years, too. A few decades ago a BIS report was excellent reading if you wanted to fall asleep at night. Today, we find BIS using calm, qualified, central bank language to say, “We think things are likely to come off the rails!”

When central bankers like Janet Yellen or Mario Draghi speak, we have to discount their statements because they have policy agendas to promote. While the BIS has an agenda, too, the bank isn’t tied to any particular economy or government. Its analysts are paying attention to how the world functions in toto. We in turn should pay attention to their warnings. So in this letter we’ll dig into the BIS annual report, parse how their views differ from everyone else’s, and discuss why we are all feeling considerable angst about the future.

Everywhere I go, everyone I talk to seems to have the sense that there is a deep cultural shift coming. Everywhere we look, there are causes for concern. Ben Hunt says this shift will come because of a failure of narrative, an idea that we will discuss. Neil Howe, whose work we discussed a few weeks ago, says the shift is a natural feature of an 80-year cycle of generational change; and, lucky us, we are now entering the most volatile and critical period of that cycle, one that often produces crisis and catharsis. These global cyclical events don’t happen in days but play out over months and years. As Lenin is supposed to have said, “There are decades where nothing happens; and there are weeks where decades happen.”

We will start with the BIS report. The report’s first chapter has a provocative title: “When the Future Becomes Today.” That’s the one thing we know for certain about the future: it is forever arriving, and it is our job to face it head-on.

Risky Trinity

Just over a year ago, at SIC 2015, we had the honor of hearing Bill White speak. He is a former BIS chief economist and now chairs the OECD Economic Development and Review Committee. Bill is more plugged in to the international central banking network than anyone else I know. He famously pushed Alan Greenspan to raise interest rates in 2003 so the Fed would have a cushion to use in the next crisis – which Bill thought would come along in a few years. Sure enough, he was right. In my opinion, Bill is responsible for setting the current tone of research and analysis at the BIS.

Bill told us last year that the world’s central banks were making a mistake with their single-minded focus on monetary policy. He noted, correctly, that monetary solutions have not helped, and he stated emphatically that more of the same won’t help, either.

Here’s what I wrote right after the conference:

That is the problem with having a monetary policy that is influenced by the political temperament and decisions of a small group of people. What happens is that people look around for scapegoats when a recession comes along, and they will point to a central bank that wasn’t as accommodative as they would have liked and blame the bank rather than simply understanding that the business cycle is what it is.

Bill White is my favorite central banker. Central bank models, he told us, are artificial machines. His best quote was, “The basic problem with central banks: they think they know how the economy works.” Their models are built to be gamed and always assume a return to equilibrium. But there is no equilibrium – you are where you are. The problem with equilibrium models is that they don’t reflect reality.

An economy is like a forest ecosystem, not a machine. We are on a very bad path – debt is unsustainable. Notice the environment since the 2008 crisis: the Eurozone crisis is a limited variant on a global crisis; fiscal and regulatory restraint is not helpful; and monetary policy is the only game in town and is not effective.

Reflecting on these matters now, we see that central banks are no closer to finding the equilibrium they so desperately look for. They are actually farther away, having pushed rates negative in Japan and throughout Europe. I don’t know whether they are following their models or not, because I can’t imagine what model would lead them to the places they have taken us. Nonetheless, here we are.

Without naming names (because that would take too long), those central bankers who are extolling the virtues of negative rates are simply not paying attention to the facts on the ground. As Winston Churchill said, “However beautiful the strategy, you should occasionally look at the results.”

The results of negative rates in Europe have been disastrous for banks and insurance companies, not to mention pensions and fixed-income investors. The single-minded focus of current economic thinking is that the driver of the economy is consumption and/or the artificial replacement of private consumption by government debt, which will create desirable inflation. This tenet, trumpeted most famously by Paul Krugman, is going to bite us all – not just rear-facing economists – in our collective derriere. And that is the essential message of the new BIS report.

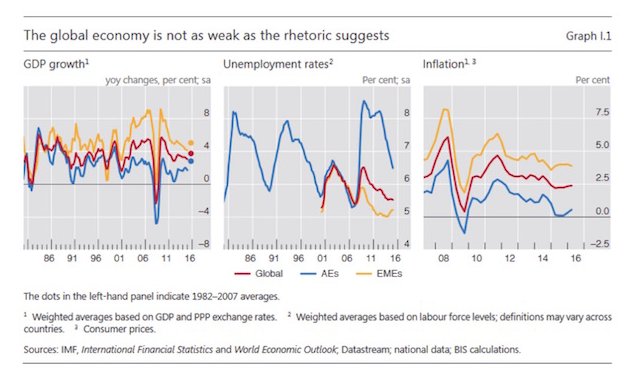

The BIS report doesn’t say that the global economy is in a terrible place. Growth is disappointing, sure, but it could be much worse. Unemployment is still too high but is getting better. Inflation isn’t a problem in most places.

What worries BIS, though, are the long-term consequences of what they call a “risky trinity” of unusually low productivity growth, stubbornly high debt levels, and little room for policy maneuvers. That combination is responsible for persistently low interest rates. This is an important point. Ultra-low, zero, or even negative interest rates are not themselves the problem; instead, they are symptoms of the “risky trinity” syndrome. We can (and must) treat the symptoms, but doing so won’t cure the disease.

Interest rates aren’t simply the cost of borrowing liquid capital. They are ultimately the price of money, the single most important price-signaling mechanism in the economy. Rates tell us a lot about confidence among both lenders and borrowers, not to mention consumers.

Right now they tell us nothing good. As BIS puts it:

The contrast between global growth that is not far from historical averages and interest rates that are so low is particularly stark. That contrast is also reflected in signs of fragility in financial markets and of tensions in foreign exchange markets.

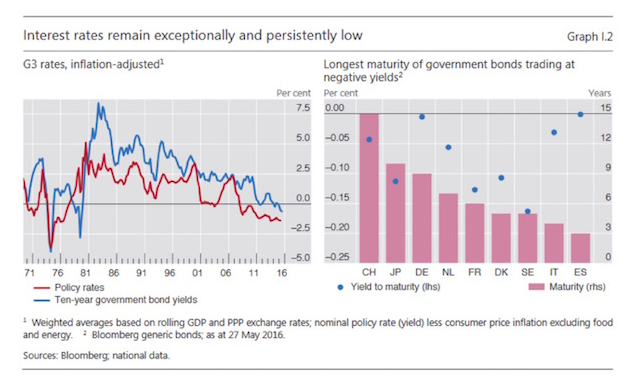

The following chart from the BIS report is already wrong, by the way. Last week Swiss interest rates went negative for the entire yield curve, all the way out to 50 years. (In the graph below, CH is the international abbreviation for Switzerland. It’s Latin for Confoederatio Helvetica or Swiss Confederation.)