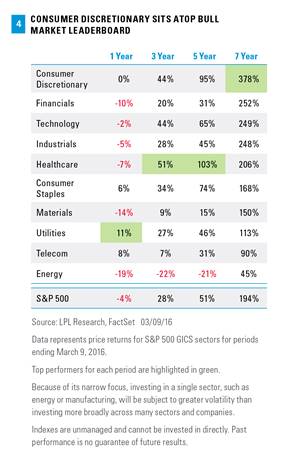

It comes as no surprise that more economically sensitive sectors have led this bull market. Consumer discretionary has led the way with a 378% advance (434% total return), roughly doubling the performance of the S&P 500 and far outpacing financials, the next best sector on a price return basis [Figure 4]. Consumer discretionary benefited from the automotive sector coming back from the edge of the abyss during the financial crisis, from the rebound in consumer wealth (both housing and financial assets), and the meteoric rise of internet retail. Consumer discretionary has been a consistent winner, placing near the top of the sector leaderboard for the one-, three-, and five-year trailing periods.

What may come as a surprise is the fact that financials are so far behind consumer discretionary during this bull. Financials had the steepest decline into the March 2009 lows; at those lows, the sector was pricing in extremely onerous scenarios, such as nationalizing banks, which are unthinkable today. Financials did lead all sectors from those bear market lows through the end of 2009, but began to lose relative strength in 2010 due to low interest rates and new (and tough) regulations, pressures that have not let up since.

Technology and industrials also solidly outperformed during this period as the market priced in economic recovery coming out of the deep recession. Lagging over the past seven years were the more defensive, dividend-paying sectors that investors had turned to on the way down during the crisis, i.e., telecom, up 90%, and utilities, up 113%. But no sector has done worse than energy, up only 45% and a victim to the sharp drop in oil and natural gas prices since the summer of 2014. Remarkably, the energy sector is flat since January 2010.

We continue to favor the technology and healthcare sectors and are waiting for opportunities to become more positive on energy and industrials. Our neutral view on consumer discretionary reflects its historical pattern of mixed performance during the latter stages of bull markets and economic cycles. Furthermore, the sector’s gains from falling oil prices may be mostly behind it. Our recommended underweight sectors include financials, materials, and utilities.

No Recession, But Some Concerns

The indicators we watch that could signal the potential end of the economic cycle and an oncoming recession are currently not showing worrisome signs. Collectively, our Five Forecasters are not showing any cause for concern. We do not see evidence of the excesses in borrowing, spending, or confidence that have ended economic expansions over the past several decades (discussed here). The majority of the indicators we use to assess where we are in the business cycle point to mid-cycle or mid-to-late, rather than late.

That said, although the S&P 500 is one good day away from breakeven for the year, we do have some concerns about this market and maintain a slightly cautious stance in the short term:

1) China. We continue to worry about the potential for China to devalue its currency and spark a currency crisis. A trade war is also a concern given the rhetoric coming from the U.S. presidential campaign trail. At the same time, China’s recent support of the yuan and talk of financial reforms are encouraging.

2) Oil. Oil’s recent resurgence has been a big part of the stock market rebound. Oil is up more than 40% since February 11, 2016 (just a month) and is back to near the $40 level. We are concerned that the rally, based on little more than talk of a production freeze among Russia and OPEC members, lacks a strong enough foundation from production cuts to sustain itself.