In recent years, volatile equity markets spurred a huge influx of investor dollars into relatively low-risk, cash-like investments such as T-bills—and these high “cash” allocations have lingered. With T-bill rates now over 5%—a level not seen in years—cash has been an effective enough strategy for many investors over the short term. But history suggests it’s a bad strategy for the longer term.

Indeed, changing markets always remind us that fixed income is a dynamic asset class that demands as much attention to proper analysis and allocation as do equities.

Looking at three decades of market data, we can see several periods—roughly, 2000-2001, 2006-2008, and 2018-2019—when money market fund assets continued to climb steadily while short-term yields (the 3-month T-bill rate) were dropping. In coming months, if recent history repeats—with a downward rate trend accompanied by ongoing growth in short-term assets—many fixed income investors will lose out.

‘Cash’ Not Competitive When Yields Fall

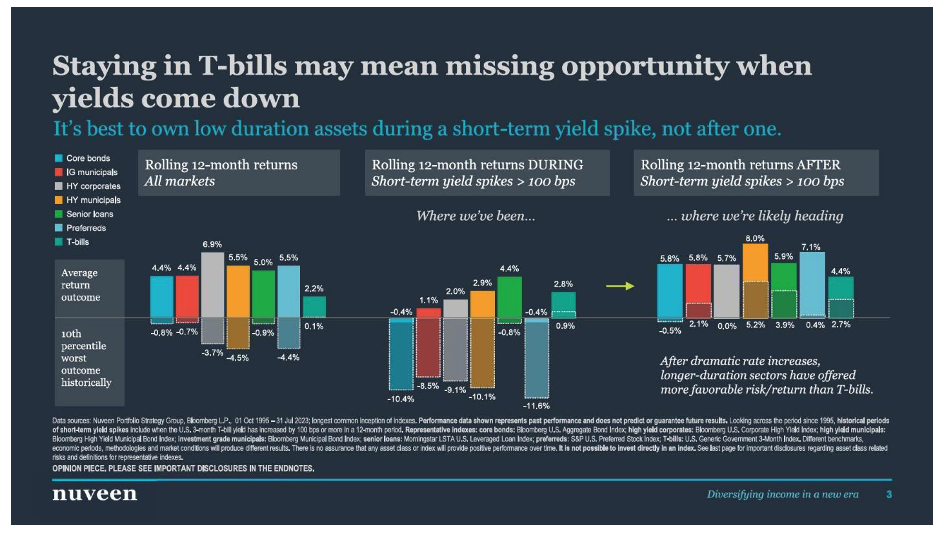

During upward spikes for short-term yields (100 basis points or more), rolling 12-month returns show T-bills generally performing well compared with other fixed income assets, including core bonds, investment grade munis, high yield corporates, high yield munis, leveraged loans and preferred securities.

But after a yield spike—if we look at similar return periods for those asset classes—T-bill returns are simply not competitive at all.

The lesson is clear: It’s best to own low-duration assets during a short-term yield spike—not following one.

Look Further Afield For Fixed Income Opportunity

From here on, investors should consider tapping a far more varied selection of fixed income assets, with allocations designed around specific portfolio objectives and risk/yield tolerances.

Moving up the risk/yield ladder, such allocations can include defensive income, a traditional, conservative asset mix highly correlated to interest rates and designed for a “risk-off” environment; alternative income, balancing public and private assets and—due to the private asset exposure—providing a low correlation to macro factors, and credit income, seeking a higher yield per unit of risk with a high correlation to credit spreads and designed for a “risk-on” orientation.

It’s the investor’s choice, and an advisor can be invaluable in thinking through the options. But it’s undeniable that in fixed income, just as in other asset classes, no one asset type will serve every investment environment. And opportunity is easily lost when conditions change—as they inevitably do.

Mike Perry is executive vice president and head of Nuveen’s Global Client Group.