I am not a fan of one-size-fits-all financial strategies. Yes, I see the value of making investment as simple as possible, but the right balance of risk and reward is a personal decision, and the most common strategies are either arbitrary or agnostic about crucial details.

Which brings me to the subject of this column: the popular yet endlessly criticized 60/40 asset allocation strategy. With bond prices tanking and correlations flipping, last year the 60/40 portfolio had its worst returns in decades. Then again, maybe that was just a blip and investors just need to wait it out.

Whether 60/40 is failing or just having a bad year comes down to how you define success. And the main problem with a 60/40 portfolio is that its objective is so poorly defined. A transition to a high-rate environment will mean choppy markets for years to come, and this will test the simple strategies the finance industry relies on. The ones that will fail will be the ones that aren’t clear to start with.

The 60/40 portfolio is a 60% allocation to stocks and a 40% allocation to bonds. Nobel laureate Harry Markowitz is credited with coming up with 60/40 as part of his dissertation on modern portfolio theory, though the version of the paper published 71 years ago does not mention it. Still, many financial advisers and personal finance columnists suggest the 60/40 as the portfolio that promises that perfect balance of risk and return.

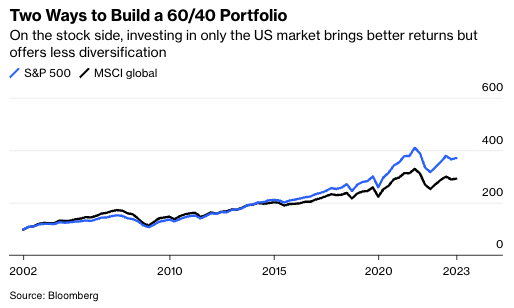

If that sounds too simple, that’s because it is. First, the optimal portfolio in the 60% stock part is not clear. Is that a global stock portfolio—which offers more diversification—or mostly U.S. stocks, as it is in some of the large funds with 60/40 portfolios? If you are committed to the view that more diversification is better, then a global portfolio is the answer. But most claims of how great 60/40 performed in the last few decades assume a fund dominated by U.S. shares, with returns largely driven by a few big stocks in the last few years.

That’s a performance that may not be repeated—and anyway, counting on a just a few high-flying stocks violates the central premise of diversification that underlies the supposed philosophy of 60/40.

What happens in the 40%—the fixed income part—is even more confusing. It is not at all clear what the fixed income strategy is. Is it meant to balance risk and reward by tempering the risky stocks with a low- or no-risk bond portfolio? If that’s the case, then the 40% should mostly be short-term securities issued by the government (or the equivalent). Or is the goal diversification? Because some bonds are also risky, but they tend to have a negative correlation with stocks (until they don’t, and usually the correlations flip at the worst possible time), and in that case longer-term and corporate bonds belong in there.

The distinction between investing in bonds for safety or for diversification may not sound all that important—after all, diversification is also meant to reduce risk. But diversification and hedging are different strategies with different objectives and require buying different bonds. Diversification aims to find an efficient portfolio, or the combination of risky assets that achieves the most reward for as little risk as possible. Hedging is de-risking—taking less risk by balancing your risky assets with something risk-free and giving up some reward.

Based on the holdings of the most popular funds, the 40% objective appears to be diversification, as it is mostly in riskier and longer-term bonds. Then again, the move to riskier bonds may have happened because in the late 2010s cash-like bonds offered no return, and some people underestimated long-term bond risk when inflation seemed improbable.

Clarity on whether you want hedging or diversification also determines how success can be measured. If an investor is promised a fund that will hold its value no matter what happens to markets, then the risk-free hedging should dominate the fixed-income strategy, and big drops are a problem. If the goal is simply a diversified asset portfolio that will occasionally experience some big drops (and will drop when you need the money most) but over time will probably perform well, then diversification should be the strategy. In that case, investors should realize 60/40 is not a complete strategy and hedge on their own.

60/40 can do a little of both diversification and hedging, but it is important to be clear on what risk-free means and make it a distinct part of the fixed-income strategy rather than lumping it into the 40% part of the portfolio, as most funds do.

There is value in keeping investment simple. And sticking with a 60/40 portfolio is still probably a better bet than many other strategies, provided you aren’t paying high fees, because it does offer diversification in an easy and accessible way. But the outlook for bonds and the possibility of a recession suggests that the 60/40 portfolio could use some improvement—beginning with more clarity on what its objective is.

Allison Schrager is a Bloomberg Opinion columnist covering economics. A senior fellow at the Manhattan Institute, she is author of An Economist Walks Into a Brothel: And Other Unexpected Places to Understand Risk.