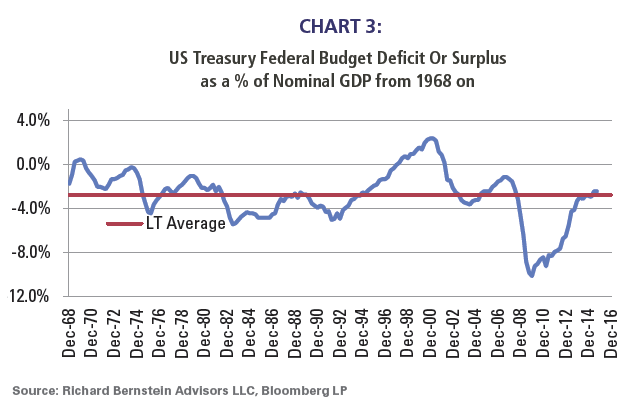

The smaller deficit is simply attributable to the combination of cyclical improvement in the overall economy with cyclical reductions in spending.

Workers – Better than normal

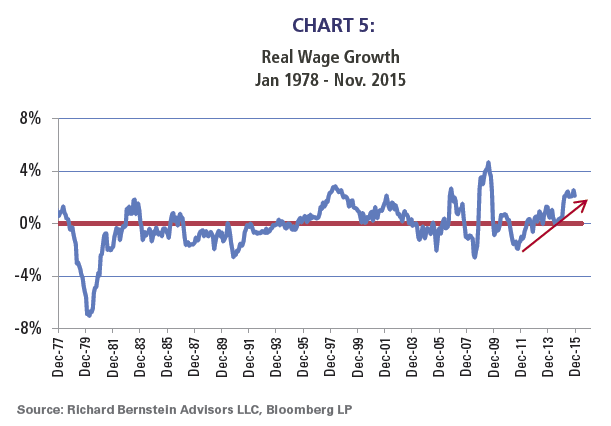

Real wage growth may be one reason consumers may not be as concerned as politicians say they should be. Average hourly earnings are currently growing 2.3% over the last 12 months, admittedly less than the long-term average of 3.6%. However, real wage growth (i.e., a measure of purchasing power) is near a cycle high (Chart 5). Although one could argue that wage growth should be faster, purchasing power is the strongest in 6 years and among the strongest in history.

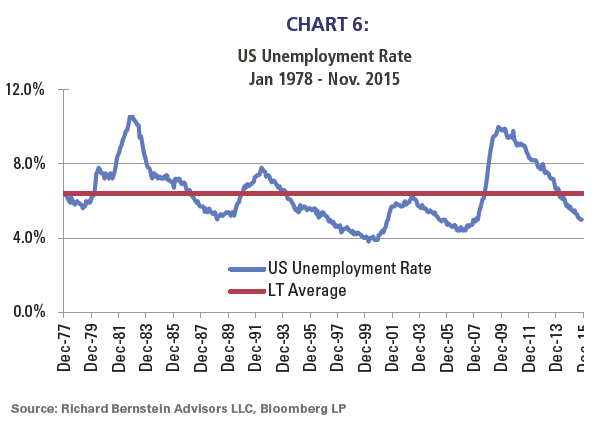

Unemployment is also much better than the long-term average. Chart 6 shows that the current unemployment rate of 5.0% is considerably better than the long-term average of 6.4%.

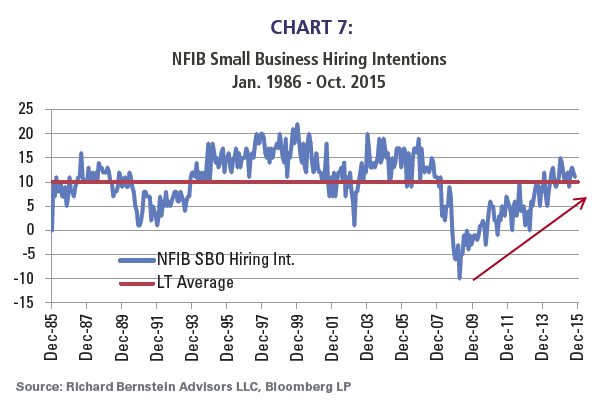

Small Business – Better than normalSmall businesses also seem to be in better shape than politicians would lead one to believe. Chart 7 shows the NFIB Small Business Hiring Intentions Survey. It, too, is above its long-term average. In other words, small businesses are intending to hire more people than normal. We doubt this would be the case if small businesses were faced with the adverse business conditions that some politicians have cited.

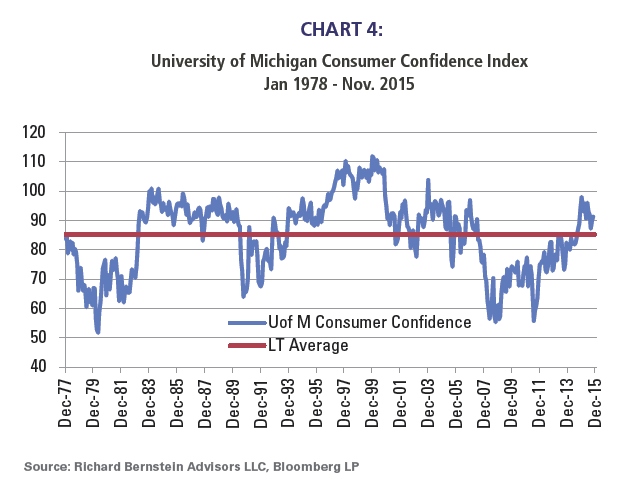

Some observers claim that workers are under intense pressure, but the data does not support such contentions. Objective surveys of consumer confidence presently show that consumers believe their status is better than the long-term average (Chart 4). It seems hard to argue that households are in terrible shape when they assess their own conditions as being better than normal.