Market volatility – Normal

Academics define risk as the volatility or unpredictability of returns. A more practical definition might be the probability of a loss or the probability of returns falling below some required return (i.e., 5% real return for a foundation). We incorporate this definition of risk in many of our models and analyses.

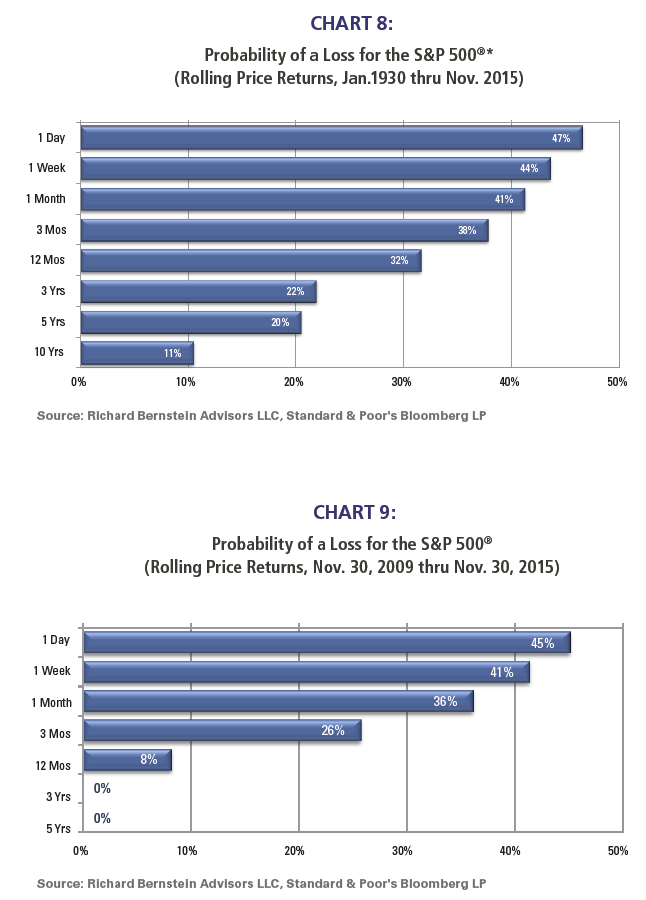

Chart 8, one we have published many times, shows the historical probability of a loss when investing in the S&P 500. The probability of a loss decreases as one extends investment time horizons because longer time horizons are influenced more by fundamentals and less by noise.

Chart 9 shows similar data for the current bull market. The higher frequency statistics for the current bull market are virtually identical to those of historical bull markets. Data during the current cycle does not support claims that the US stock market is much more volatile and risky than it was in past cycles.

U.S. dollar – Not even close to becoming the Peso

Those who invest with us know we have been US dollar bulls for quite some time, and have been hedging foreign currency exposure in many of our portfolios. Our view is very out-of-consensus because there remains a loud chorus that the USD is becoming a third world currency because of misguided monetary and fiscal policies. Rather than weakening, though, the dollar has been secularly appreciating.

Chart 10 shows the tradeable DXY Index, which is based on a basket of major foreign currencies and incorporates investors’ expectations. The trough in the DXY was actually during the Spring of 2008. That’s correct. The U.S. dollar has been appreciating for more than seven years!

There will likely be many opportunities in 2016We continue to invest dispassionately and objectively, and think that approach could be vital to portfolio performance during 2016. Both parties’ naysayers will likely be loud, but, as these charts show, the U.S. economy appears rather healthy. The bull market has been supported by that improving health, and we expect those trends to continue during 2016. Investors will need to realize and act on the gaps between political rhetoric and reality.

About Richard Bernstein Advisors

Richard Bernstein is CEO and chief investment officer of Richard Bernstein Advisors LLC, an independent investment adviser. RBA partners with several firms including Eaton Vance Management and First Trust Portfolios LP, and currently has $3.2 billion collectively under management and advisement as of November 30, 2015.