Return Generation

One of the more compelling arguments for investing in an active low volatility strategy is the ability of an active manager to infuse return forecasts into the portfolio construction process. In fact, the passively managed minimum variance portfolio, which selects stocks solely based on their squared standard deviation, takes the extreme and naïve view that every stock has the same expected return. In contrast, an active manager can favor stocks with higher expected returns.

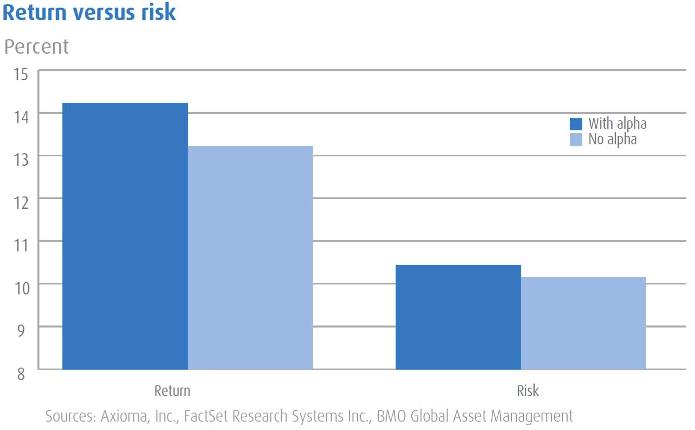

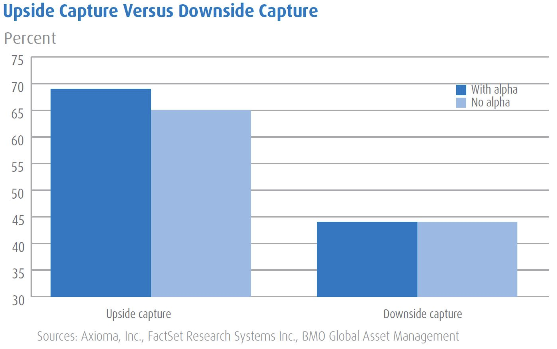

Our research suggests adding a return expectation to a low volatility strategy potentially increases returns by enhancing the upside capture with little to no impact on downside capture—and with little to no impact on overall portfolio risk.

Adaptive Process

Over the long term, smart adaptability should benefit both the upside and downside capture ratios of a low volatility portfolio.

A final consideration is whether a low volatility strategy can adapt to changing market conditions. By definition, passive low volatility strategies follow rigid and predetermined portfolio construction techniques. In contrast, an active low volatility manager has the flexibility to adapt the portfolio as market conditions warrant. For example:

For passive strategies with regularly scheduled rebalancing, their inflexibility also means portfolios become increasingly risky as the calendar progresses, only to be rebalanced at an arbitrary point in time.