Carl reflects on the anniversary of the pandemic:

There are 73 sets of hash marks on the paper my wife uses to record the duration of her home confinement, five days at a time. The tally was kind of a joke at first, but it is now a sobering reminder that it’s been a year since lives and economies were turned upside down.

In early March of 2020, I visited several clients in Europe. It was a typically busy itinerary: seven cities in two weeks across five countries. The coronavirus had been in the news for several weeks already, but didn’t seem overly threatening. I found room for hand sanitizer in my luggage but didn’t expect to use it much.

When I arrived in Dublin to begin the journey, I learned the first Irish cases had been diagnosed and schools were to be closed. An outbreak in northern Italy had been spread to other European cities by skiers who had gone to Lombardy for a spring holiday. Clients began cancelling our meetings, and we ultimately decided to cut the trip short. I flew home a week early and spent a couple of days in the office upon my return. I haven’t been to the airport or the office since then.

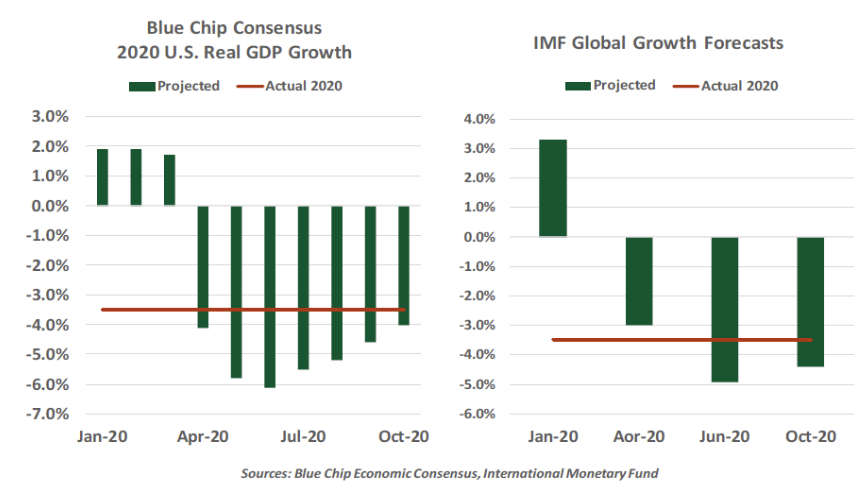

At the outset, many of us presumed we were facing a relatively temporary interruption. (For a time, I continued paying for a monthly train pass and a gym membership close to the office.) Early analysis of the situation determined it would manifest largely as a supply shock affecting production chains that snaked through China. Our forecasts, and those produced by others, were slow to recognize the extent of the damage that would ultimately be done to commerce.

As reality set in, markets found themselves behind the curve and facing an excess of unknowns. Trading became extremely volatile, and liquidity was drained from financial markets. In response, the U.S. Federal Reserve cut interest rates to near zero in two huge chunks, and opened a series of support programs for troubled sectors. The market frenzy of March 2020 eventually calmed, but the global economy had been deeply damaged.

No Country Has Done A Flawless Job Of Dealing With The Pandemic

Societies have had to make difficult choices over the past year as they’ve balanced public and economic health. Some have remained more open, finding restrictions untenable; others took more aggressive steps to limit contagion. In between are a large number of countries that have vacillated between the two. It hasn’t been easy to set a steady course: information used to guide policy has undergone update and revision; local circumstances and local politics have introduced complications. While leaders have been hailed and faulted for their management of the situation, no country has handled Covid-19 flawlessly.

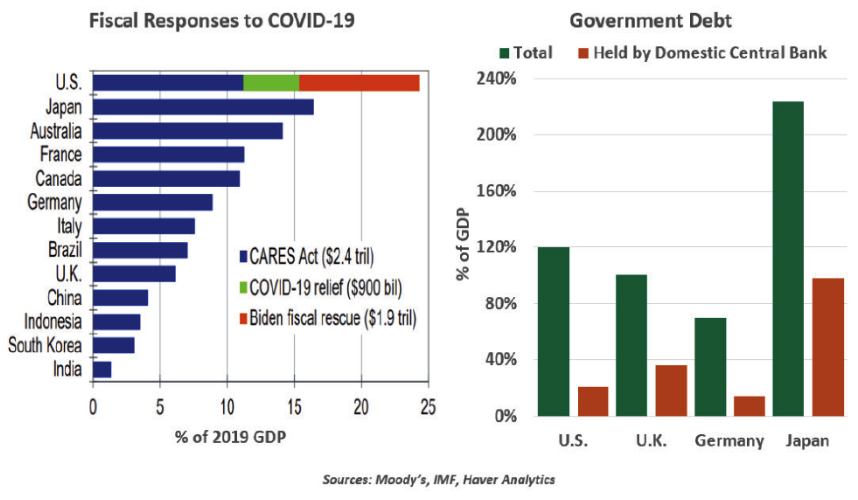

Richer countries have spent immense sums to cushion the impact of the pandemic. Balancing the speed of action and care in the design has not been easy. The U.S. has decided to go very big, Europe has lagged, and some emerging markets have barely gotten started. These differentials will be reflected in relative economic performance. Central banks have served as enablers, absorbing substantial volumes of government debt.

Many countries did not enter the pandemic in the best long-run fiscal shape. While addressing the proximate challenge required aid on a large scale, the issue of how much debt is too much debt will be debated even more actively in the years ahead. So will the proper scale of central bank balance sheets, which have grown by leaps and bounds.