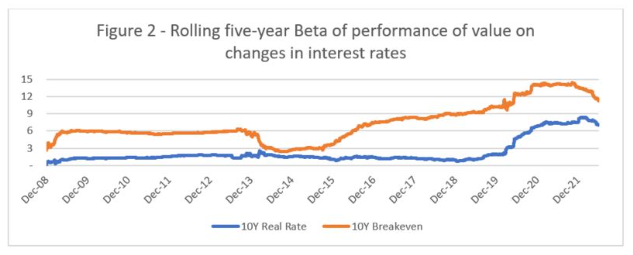

But my chart, unlike Asness’s, seems to show a regime change with the 2008 financial market, rapidly increasing betas, and both inflation and real rate betas moving in lockstep. That suggests the performance of value depends on nominal rates rather than inflation or real rates. It’s hard to come up with economic arguments for that.

Figure 2 is a similar chart focusing on the period of interest (Same sources as Figure 1, plus the St. Louis Fed). For these years I can estimate expected future inflation using the 10-year Treasury breakeven rate and use daily rather than monthly data for more precision (The yield on 10-year treasuries minus the yield on 10-year TIPS.). In this version value seems to react more to inflation than to real rates, and to have a strong positive reaction to both. The inflation beta started increasing rapidly in 2015, and the real-rate beta in 2020. This appears to be to be a regime change from the pre-2008 pattern of zero real rate beta and inflation beta ranging from zero to five, up and down.

Where does that leave us? One answer is to ignore the recent correlations and look to both theory and long-term patterns. Based on long-term history, value should deliver 17% extra total return over the next five years.

Another answer is to use the most recent five years of data and ignore theory and earlier performance. That predicts value will deliver 22% extra performance over the next five years if rates don’t move. If rates, both inflation expectations and real rates, fall to zero, value would have a negative 9% performance. If rates doubled, value would deliver 53% extra.

To me that makes value seem like a pretty good bet. While zero or even negative rates are possible, I think it unlikely they will fall low enough to bring value to negative territory, even if the last five years are perfect predictors of the future. A doubling of rates, while also unlikely, strikes me as more plausible than a drop to zero, and both inflation expectations and real rates significantly higher than today seem likely.

It’s certainly worth Asness’s time to think about a possible regime change in the effect of rates on the value factor, but even if you throw out all theory and evidence before 2017, the correlations do not seem strong enough to render value unattractive. You would need to be sure that falling rates kill value, and also very sure that both inflation and real rates will fall to near zero, to abandon value now.

Aaron Brown is a former managing director and head of financial market research at AQR Capital Management. He is author of The Poker Face of Wall Street. He may have a stake in the areas he writes about.