Getting referrals from centers of influence is the most effective way for wealth managers to grow their practices with wealthier clients.

Trusts and estates (T&E) attorneys are recognized as excellent centers of influence, meaning they can be great referral sources for new wealth management clients. At the same time, despite their best efforts, many wealth managers receive no more than a handful of quality referrals from T&E attorneys.

A few wealth managers have built strategic relationships with T&E attorneys, resulting in a steady stream of new high-quality wealth management clients. Aside from strong personal relationships, such as the T&E attorney being a family member, the key to building powerful strategic relationships is providing economic glue.

Staring With Discovery

Economic glue is the added value wealth managers can bring to T&E attorneys to strengthen their professional relationships. Wealth managers need to do discovery to ascertain what form economic glue takes regarding any particular T&E attorney. Moreover, through discovery, wealth managers can determine if any T&E attorney will likely be a good client referral source.

Discovery uses open-ended questions and probes to understand the nature of the practice, worldview, level of expertise, clientele, objectives and concerns of T&E attorneys. By developing a deep understanding of a T&E attorney, a wealth manager can identify, customize, and refine the form of economic glue that would work best for a particular T&E attorney.

Discovery will also enable wealth managers to determine how they need to help T&E attorneys refer them. Leaving it entirely up to T&E attorneys how to make interruptions can prove disappointing. Better results occur when wealth managers can provide the narrative.

Types Of Economic Glue

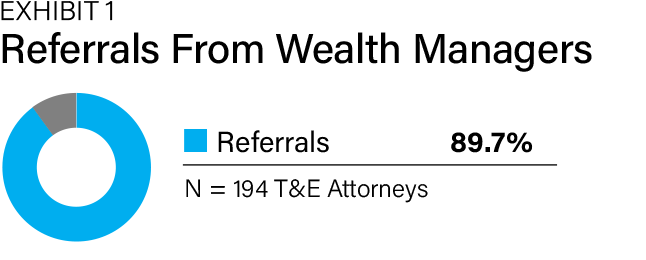

Although optimally, wealth managers do discovery with T&E attorneys, based on a survey of 194 T&E attorneys, certain types of economic glue stand out. Topping the list is reciprocal referrals from wealth managers. Nine of 10 COIs agree that reciprocal referrals are very or essential (Exhibit 1). Getting new high-quality clients from wealth managers appeals to nine of ten T&E attorneys.

The complication of reciprocal referrals is that the math never works. This is more to the detriment of the T&E attorney than the wealth manager. Generally, wealth managers are more likely to be able to refer clients to T&E attorneys than the other way around because of several factors, including the fact that usually, wealth managers are better at making professional referrals.

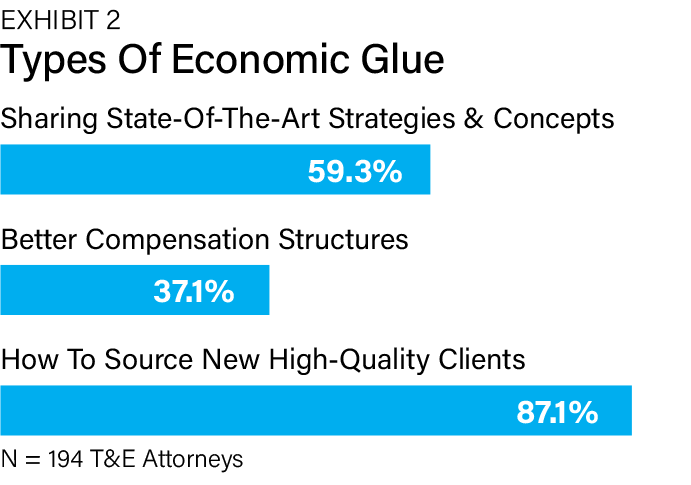

While T&E attorneys report wanting reciprocal referrals, provided the wealth managers are helping them become more successful, this issue becomes moot. The reality is that T&E attorneys who are good client referral sources are looking to build their practices. While most of these T&E attorneys think this is a function of more clients, the reality is that it can easily be a matter of more significant revenues. So, if wealth managers can help these T&E attorneys become more successful in growing their practices and revenues, not referring them clients is a non-issue. Exhibit 2 considers three types of economic glue.

Sharing state-of-the-art strategies and concepts

Sharing state-of-the-art strategies and concepts

Again, the T&E attorneys are turned off when wealth managers discuss the basics. They are only interested in cutting edge, esoteric and sophisticated strategies and concepts. Furthermore, for the greatest impact, the shared insights and possibilities must tie back to the expertise provided by T&E attorneys. Talking about bond durations or call strategies is usually ineffectual. For example, what tends to work well regarding the ultra-wealthy are discussions of wealth planning onshore and offshore with the different types of private placement life insurance.

Better compensation structures. Most T&E attorneys use a time-based compensation model. The more hours they and their team bill, the more money is made. Although this is the norm, when done well, project fee and retainer fee-based compensation models are more profitable for the T&E attorneys and preferred by most clients.

Many T&E attorneys have difficulty with project fee and retainer fee-based compensation models. They assume the economic risk; many say they have lost money with these approaches. They never lost money but could have earned more with time-based billing.

The opportunity for wealth managers is to show T&E attorneys how to:

1. Set project and retainer fees so that the T&E attorneys are better compensated and their clients as their clients continue to get exceptional legal service. Several methodologies enable T&E attorneys to efficaciously set project and retainer fees that wealth managers can share.

2. Effectively transition some or all of their clients to project or retainer fees and use these compensation models with new clients. Wealth managers often need to show the T&E attorneys how to communicate the value of project and retainer fees.

How to source new high-quality clients. Nearly nine of 10 T&E attorneys want to know how to better connect with and win new high-quality clients. Pretty much all private wealth industry professionals are looking for effective business development strategies.

Previous research shows that many T&E attorneys are not proficient at getting their ideal clients. Competent wealth managers sharing business development best practices with them regularly get client referrals. Several approaches work, but the most potent is sharing how to generate steady referrals from clients and accountants.

Regarding client referrals, the approach taken by most T&E attorneys is to wait for the phone to ring. And, over time, it tends to ring with very satisfied clients wanting to introduce someone who could benefit from wealth planning. This is reactive, but T&E attorneys can usually significantly generate significant new business by being proactive. When wealth managers show T&E attorneys how to use methodologies like Everyone Wins, the T&E attorneys can often quadruple the number of new clients they get, or they can work with fewer but much wealthier clients. Either way, they make a lot more.

The Everyone Wins Process can also be used by T&E attorneys to create a steady stream of new, often higher-end clients from accountants. When done well, the T&E attorneys are not only being introduced to wealthier clients with more complex situations; it will take some effort for the T&E attorneys to lose the engagements.

Not only will the client and accountant referrals be possible clients for the wealth manager, but a portion of the T&E attorney’s current book will also be introduced to the wealth manager.

The best way for wealth managers to consistently get high-quality referrals from T&E attorneys is to provide some form of economic glue. While trading clients might sound fantastic, it rarely works. By doing discovery, a wealth manager can determine the best type of economic glue for any particular T&E attorney.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.