There’s no shortage of research showing how investors are often their own worst enemies, sabotaging themselves by making emotional decisions or resorting to market timing and performance chasing (Source: 2018 Dalbar Quantitative Analysis of Investor Behavior).

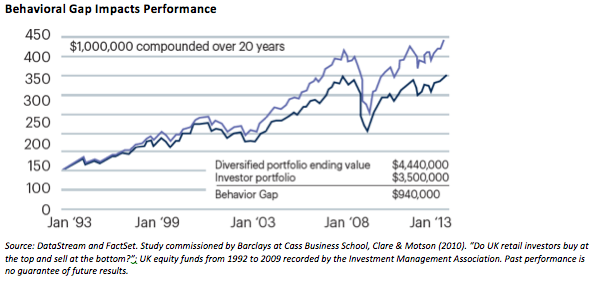

Industry analysis shows this type of behavior can reduce investment returns by 1–2% a year on average—a “behavioral gap” that would compound to a 21% shortfall compared to a diversified buy-and-hold strategy over a 20-year period, as shown in the following chart (Source: “Behavioural Finance Matters.” (n.d.) Barclays Research).

Fortunately, there’s also evidence that working with a qualified financial advisor can help investors avoid some of these behavioral pitfalls. One study, for example, found that investors working with a human financial advisor boosted their investment returns by 3% a year (Source: Kinniry, Francis et.al. “Putting a value on you value: Quantifying Vanguard Advisor’s Alpha,” September 2016, Vanguard research). About half of this benefit came from “behavioral coaching,” which the study identified as the most influential action an advisor can take.

The fact that investors don’t necessarily see the need for this type of help—which may not be surprising, given most people don’t like to think they’d fall prey to their emotions—presents a marketing challenge as well as a call to action. Advisors can add value to their businesses by educating their clients on ways to avoid behavioral investing traps, and reinforcing positive behaviors that will pay off in the long run.

Behavioral Traps Can Derail Investment Progress

Advisors may be able to help improve client outcomes and satisfaction by educating clients about the role emotions and cognitive traps can play in investing. Research firm Dalbar (Source: 2018 Dalbar Quantitative Analysis of Investor Behavior) outlined several of these negative tendencies, including loss aversion, herd mentality, anchoring (locking in to an initial impression or piece of information), endowment (emotional attachment to an investment), and familiarity bias (e.g., investing in a stock because you buy the company’s products). But two of the biggest problem behaviors they identified were:

• The temptation to leave the market during volatile periods.

• Engaging in short-term market timing.

These errors can prevent investors from following through on long-term strategies. In fact, according to Dalbar’s research, investors seldom stay invested in one equity mutual fund for more than four years, on average. Holding periods were even shorter for fixed-income funds, something that suggests risk aversion isn’t the only reason for this restlessness (Source: Ibid). Other factors that could be at play include investors’ overconfidence in their ability to predict market changes, or their attempts to chase performance.

Such missteps can prove costly, as advisors know even one month of bad decision-making—such as missing out on a big market rebound—can potentially derail years of sound decision-making.

How To Promote Sound Investment Behavior

Helping clients curb their emotions and biases is a powerful way to deliver value. This requires not only understanding, but speaking the language of emotions and motivation, while having strategies in place for when client emotions are high. Here are a few ways you can improve your business by helping clients avoid investing traps:

• Be responsive. According to a 2017 investor study, failure to respond promptly to phone calls was the number one reason investors fired their advisors. Clients often call when they are anxious and looking for reassurance, and if they don’t get it from you they may turn to another advisor.