Post-Depression era redux?

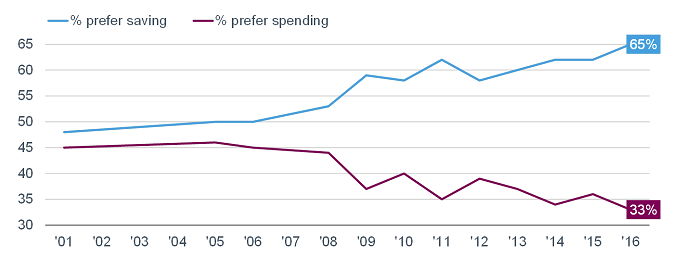

Source: Gallup Poll Social Series: Economy and Personal Finance. Based on results of Gallup Economy and Personal Finance poll conducted on April 6-10, 2016.

An important consideration is whether the financial crisis unleashed a secular change in how the private sector thinks about debt and consumption. We may already have the answer, as you can see in the chart below. Households today have a notable bias toward savings over consumption and we believe this trend will be “sticky.”

The trend is not dissimilar to what occurred in the 1930s and 1940s. According to BCA, nominal growth in U.S. private sector debt turned negative in 1931 and did not move sustainably into positive territory until 1947. In real (inflation-adjusted) terms, the level of private debt did not reach a new peak until the mid-1950s.

Debt service is “easy”

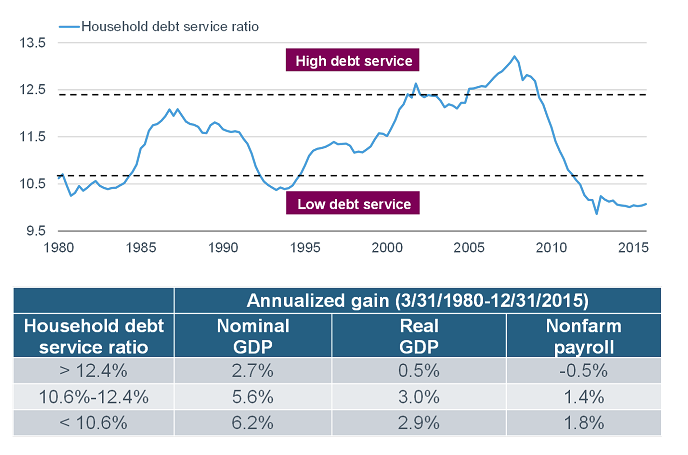

At present there is a positive double-whammy of lower debt levels and significantly lower debt servicing costs, courtesy of extremely low U.S. interest rates (which obviously won’t last if/when rates begin to rise). As you can see in the chart below, the debt service burden is in a very low zone, during which (historically) the economy has behaved well.

Source: FactSet, Federal Reserve, Ned Davis Research (NDR), Inc. (Further distribution prohibited without prior permission. Copyright 2016(c) Ned Davis Research, Inc. All rights reserved.), as of December 31, 2015. Household service debt ratio is an estimate of ratio of required debt payments to disposable personal income. Required minimum payments of interest and principal on outstanding mortgage and consumer debt are included.

In sum

The disposition of both borrowers and lenders regarding debt changed markedly during and in the aftermath of the financial crisis. And regardless of the efforts of the Federal Reserve, it’s unlikely a major new expansion of private sector debt is coming. The debt supercycle, lasting over three decades, allowed demand growth to exceed underlying income growth. That era has seemingly died and continued sluggish growth for the U.S. economy will likely continue to be a byproduct of that potential death.

Liz Ann Sonders is senior vice president, chief investment strategist at Charles Schwab & Co., Inc.

Beast of Burden (No More): Households Choosing Savings Over Debt

June 21, 2016

« Previous Article

| Next Article »

Login in order to post a comment