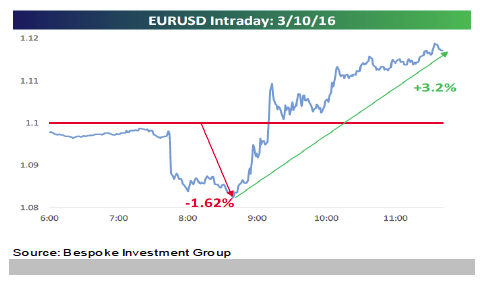

The big story coming into Thursday was the European Central Bank's (ECB) much-anticipated policy decision, and, just as our chief investment strategist, Jeff Saut, predicted earlier this week, the group did not disappoint the market this time by remaining passive. In fact, the stimulus measures announced by ECB President Mario Draghi were largely reported in the media yesterday to be the economic equivalent of a bazooka shot or the throwing of the kitchen sink at the continent's sputtering growth, and the immediate reaction saw the euro collapse and stock markets across the globe surge into rally mode.

Unfortunately, Draghi hasn't quite mastered the art of quitting while ahead, and after suggesting that this might be all there is when it comes to further stimulus measures, global investors quickly voiced their displeasure by reversing those early moves and buying up euros almost as soon as the words left Draghi's mouth.

Of course, in the long run, actions speak louder than words, so we will just have to see if a "hands off" approach in the future will actually happen and if Europe can sustain itself without further stimulus. Draghi obviously hopes this is the final round, and if Europe does experience stronger-than-expected growth that forestalls the need for more stimulus and at the same time the U.S. dollar becomes less of a headwind for U.S. companies, I can't really envision a scenario where the global markets don't react very positively to that over the next several months. Trends aren't made in a day, though, so we will also just have to see what effect this news has going forward for the euro and a U.S. dollar that already looked a bit toppy coming into the announcement.

The violent moves yesterday in the currency market were actually quite unprecedented, too, as Bespoke Investment Group reported that it was the first time in the euro's, albeit brief, history that such a sharp reversal occurred.

Bespoke Investment Group

March 11, 2016

« Previous Article

| Next Article »

Login in order to post a comment