Quote Of The Week

“Customers were asking us to do something different, which was get Covid materials in 2020, and in 2021, get any materials. And we grew market share because we did that really effectively. In 2022, we’re expecting our customers’ environments to become a little less chaotic.” — Holden Lewis, chief financial officer of Fastenal Co.

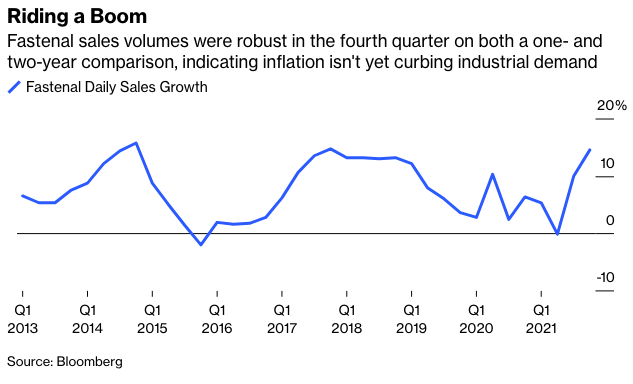

Lewis made the comments on a call this week to discuss the industrial distributor’s latest results. Fastenal’s sales and gross margin for the fourth quarter were higher than analysts expected, thanks to robust demand from manufacturing and construction customers and price increases that neutralized the impact of rising raw material and logistics costs. Product availability should improve in the first quarter of 2022 and stabilize throughout the year, although initially that will largely be a reflection of Fastenal’s efforts to gobble up more inventory than normal to ensure supply for customers. Supply chains remain strained, Lewis said. In fact, ocean transit times for goods Fastenal imports actually worsened in November and December after easing a bit in the fall. “At some point in time—and I don't know when that point in time is—that will get better,” CEO Dan Florness said.

The third-quarter industrial earnings season brought some cautious optimism that supply chain logjams had peaked. That theory appears to be holding in aggregate, but as I have written repeatedly, peaked is much different from solved, and the disruptions wrought by the omicron variant are creating fresh headaches, particularly in Asia. Companies that struggled with shortages and rising costs in the fall likely kept struggling in the final stretch of 2021, and investors’ patience appears to be wearing thin. The fourth quarter is shaping up to be a tale of two kinds of companies: those, like Fastenal, that have a handle on the operating environment and others, like Sherwin-Williams Co. and PPG Industries Inc., that don’t.

In a sign that supply chain and inflation pressures have leaked into businesses with longer selling and development cycles, Siemens Gamesa Renewable Energy SA warned this week that its profit margin may turn negative this year because of higher raw material costs for its wind turbines. The shares plunged as much as 16% on Friday for the worst intraday showing since July. That, coupled with a sales warning earlier this month from health-care equipment maker Royal Philips NV, raises questions about the extent to which supply chain pressures will weigh on General Electric Co.’s rival businesses. GE reports earnings on Tuesday, kicking off a jam-packed week of reports from industrial giants including 3M Co., Raytheon Technologies Corp. and Rockwell Automation Inc.

Looking ahead to the rest of 2022, this week also brought news that Peloton Interactive Inc. is trimming production and cutting costs as demand fades for one of the pandemic’s top sellers. Peloton’s woes indicate that the long-awaited shift in consumer spending back to services may finally be happening, as my Bloomberg Opinion colleague Robert Burgess notes. That would help curb the relentless, record-breaking flow of physical goods into the U.S. and give the West Coast ports an opportunity to clear logjams—perhaps at the expense of companies that may find themselves stuck with a glut of unsellable inventory.

Deals, Activists And Corporate Governance

GE’s digital business still exists. The operations—which former CEO Jeff Immelt once said would compete with the top 10 largest software companies in the world—have largely faded into the background amid GE’s debt and cash-flow problems. But the business is set to be packaged with the spinoff of GE’s gas turbine and renewable energy divisions targeted for early 2024. And this week brought the news that GE Digital is getting a new CEO. Scott Reese, executive vice president of product development and manufacturing solutions for Autodesk Inc., will take over the job in mid-February. This continues a string of outside hires by GE’s CEO Larry Culp, who spent most of his career at Danaher Corp. The current head of the digital unit—Patrick Byrne—will remain at the company as CEO for GE’s onshore wind business. In other GE news, the company announced it would freeze the accrual of pension benefits for around 800 employees in Canada, effective Dec. 31, 2023. The freeze doesn’t impact retirees already collecting benefits or active workers covered by union agreements. Recall that GE announced in 2019 that it would freeze U.S. pension benefits for approximately 20,000 salaried employees and supplemental payouts for 700 executives.

American Airlines tapped former Boeing CFO Greg Smith to join its board. Smith retired from Boeing in July 2021 after about a decade in a CFO role that was later expanded to give him additional responsibilities. He was well-respected on Wall Street, but his legacy at Boeing was tainted by the 737 Max crisis and an embarrassing string of production issues. This included an almost complete halt in deliveries of Boeing’s 787 Dreamliner that has been dragging on since October 2020. American offered some good news on this front this week, saying it expects to take delivery of all 13 of its delayed Dreamliners this year, with the first on track to arrive in April. The 787 issues have left the airline with less flying capacity than it might otherwise have wanted, and Boeing is compensating it for that, American executives said this week. The planemaker has also committed to pay for losses tied to additional delays, should they arise. Boeing is scheduled to report earnings on Wednesday.

Ford Motor Co. and ADT Inc. are jointly investing $105 million in a new venture to provide security systems for cars and vans that link up to a smartphone app. The technology combines ADT’s professional security monitoring services with Ford’s artificial intelligence-driven video cameras. The companies are pitching their new security offering to commercial drivers, pointing to an FBI estimate that thieves stole more than $7.4 billion of work equipment from vehicles in 2020. The venture, known as Canopy, will launch the security product and subscription-based monitoring service early next year in the U.S. and U.K. The ADT tie-up is another example of automakers seeking out unconventional partners to expand in more lucrative corners of the car market, cut out middlemen or take greater control of vulnerable parts of their supply chain. Ancillary services such as security monitoring tend to be less volatile than new car purchases in the face of economic swings. Elsewhere in this trend, General Motors Co. is launching an online parts marketplace featuring a catalog of 45,000 repair and maintenance products including brake pads and windshield wiper blades.

Brooke Sutherland is a Bloomberg Opinion columnist covering deals and industrial companies. She previously wrote an M&A column for Bloomberg News.