It’s been another volatile year for municipal (muni) investors this year. While generally outperforming U.S. Treasuries, the Bloomberg Muni Index is on track for its second calendar year of negative returns—something that has never happened before. But, while volatility will likely persist over the coming months, we think muni investors may be able to catch a break, especially if the Federal Reserve (Fed) is done with its aggressive rate hiking campaign. Moreover, the next few months have historically been favorable for muni investors. So, with still solid fundamentals, the broader muni market may be in for a year-end rally, which would certainly be a nice reprieve for investors suffering from one of the worst muni drawdowns on record.

The broader fixed income market finally caught a break last week after the Fed and Treasury Department both provided positive catalysts to Treasury markets. Regarding the former, as expected the Fed kept its policy rate unchanged but seemingly acknowledged the risks were balanced between doing too much versus doing too little. As such, markets took that acknowledgement as the Fed was done raising rates, which has historically been a good thing for bond markets (more on this later).

As for the latter, after much anticipation, in its quarterly refunding announcement the Treasury Department, perhaps due to concerns around Treasury market volatility, announced plans to increase the amount of Treasury coupon securities by less than what markets were expecting. Treasury supply concerns have pushed yields higher recently, so this decision took some pressure off longer maturity Treasury yields. Throw in economic data that came in weaker than expected, and Treasury yields were lower across the curve last week.

So, what does this have to do with munis? The volatility in the muni market has largely been the result of what has happened outside of the muni market. The muni market has had to deal with numerous external factors— aftershocks of the regional banking crisis, tax season, elevated levels of selling by banks, unexpectedly large federal budget deficits, and a hawkish Fed. So, with the last two potentially out of the picture, we think the set-up for muni investors could be a positive one.

A Fed Pause Has Been Good For Munis

In an effort to fight generationally high inflationary pressures, the Fed has engineered one of the most aggressive rate hiking campaigns in its history. Over the past 20 months, the Fed increased its fed funds rate by over 5%, including four 0.75% rate hikes over the course of four Fed meetings. The aggressive response was a significant headwind for fixed income markets broadly last year and has carried into this year as well.

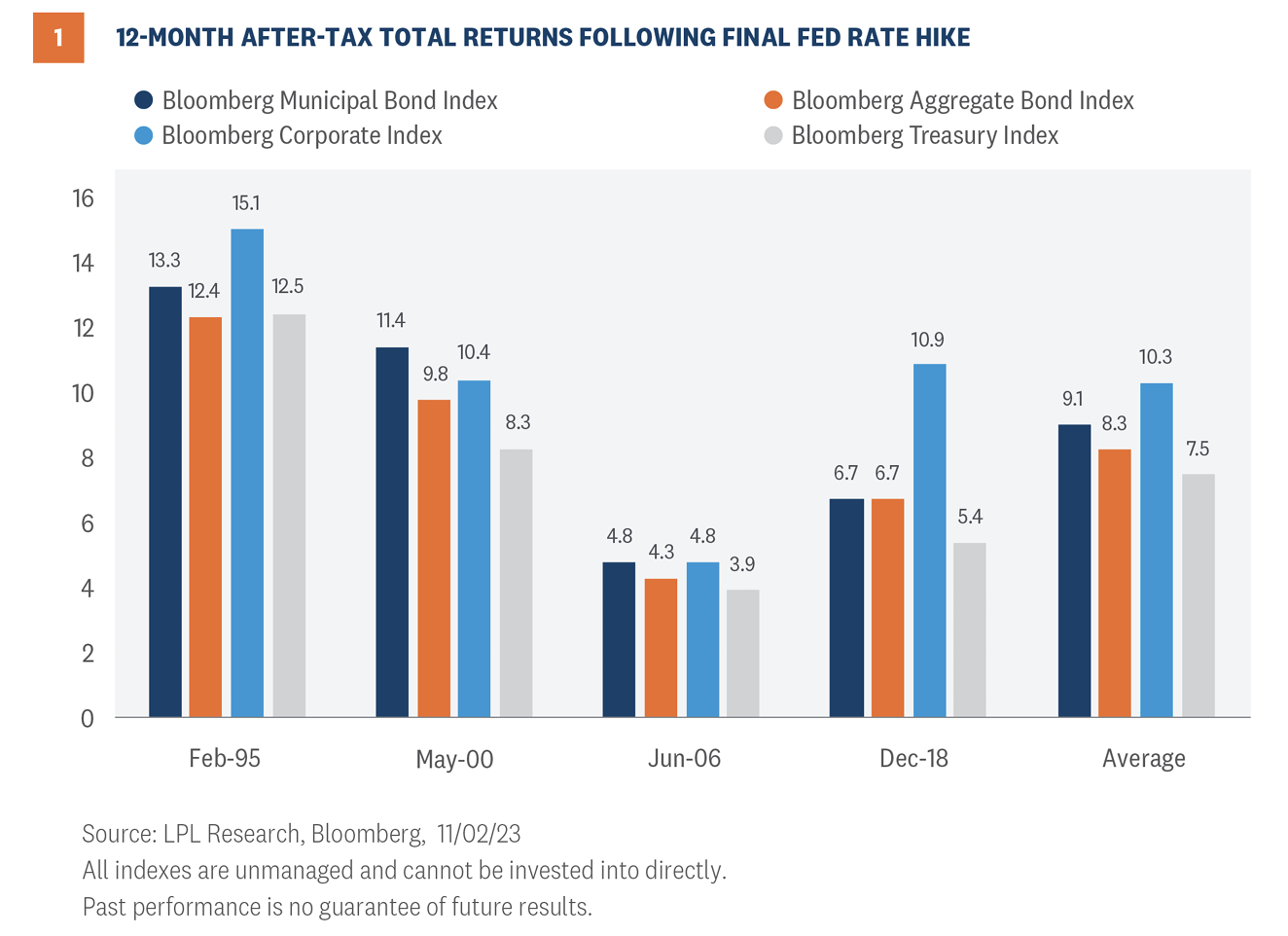

However, while the Fed has stated an additional rate hike may be possible, munis, which can provide additional tax-exempt income in higher-rate environments, have generated attractive after-tax returns at the end of Fed rate hiking campaigns. As seen in Figure 1 over the last four rate hiking cycles, munis averaged a 9.0% after-tax return over the 12-month period after the Fed was done raising rates. Additionally, muni returns were positive in each of those periods.

Our base case is the Fed may raise rates one more time but that would be the end of this rate hiking cycle, which has been the major headwind for markets. So, with the Fed out of the way, the muni market will likely go back to trading largely on internal dynamics which remain largely positive.

Set Up For Seasonality Tailwind?

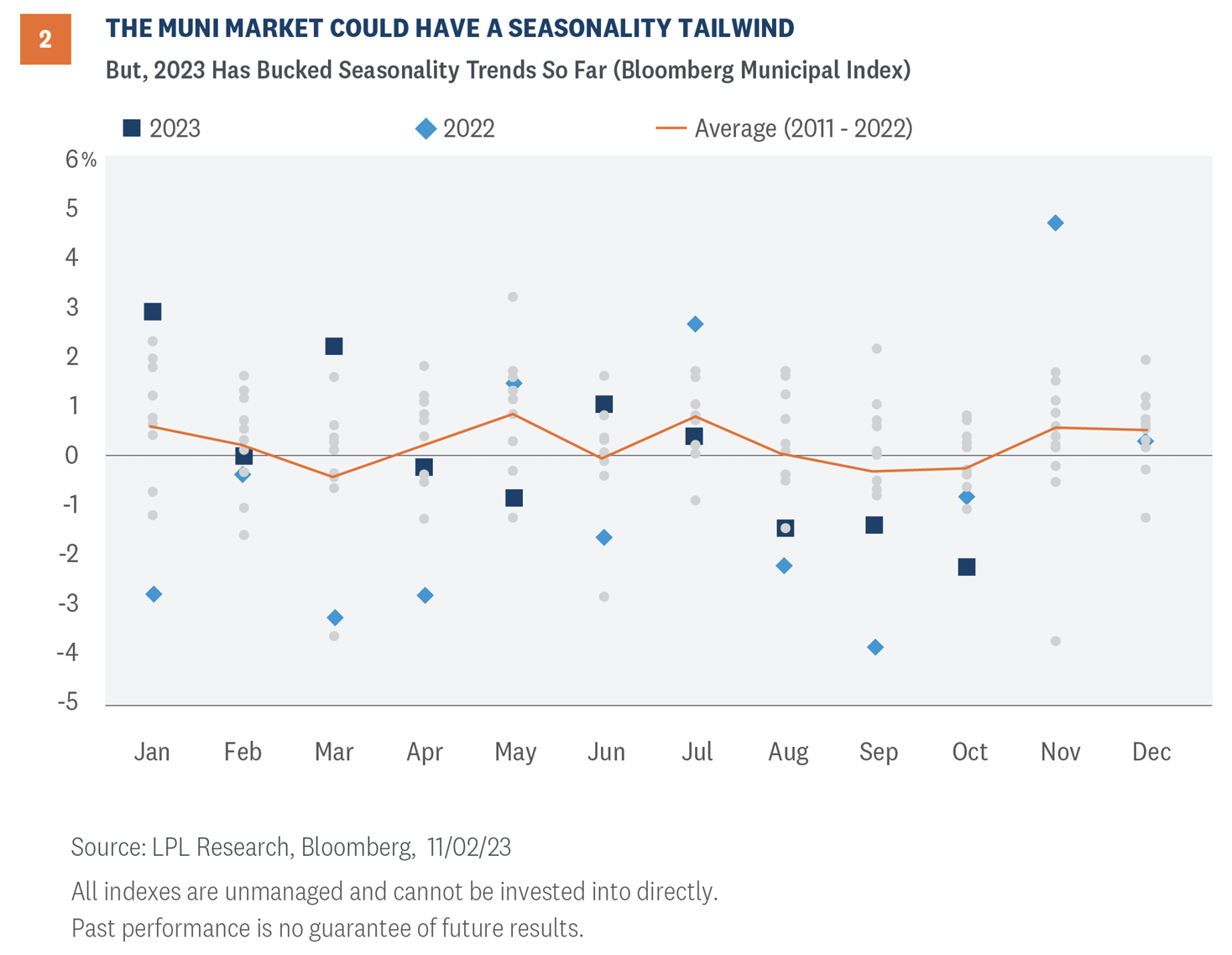

While many equity investors are familiar with seasonality trends, fixed income investors may not be as versed. Generally, after the summer doldrums, new issuance tends to pick up with October a heavy supply month. In the 10 years from 2013 to 2022, the month of October ranked highest among average tax-exempt municipal supply, as issuers sought to complete borrowing plans ahead of the winter holidays. The increase in supply has generally put downward pressure on prices (upward pressure on yields). However, average tax-exempt supply typically falls to below-average levels from November to February. The reduction in supply has tended to be good for muni returns (Figure 2). Since 2011, the average return for the muni index has been positive from November through February.

So far, 2023 has bucked the trend so the typical seasonal patterns may not hold throughout the rest of the year. According to recent Fed data, retail investors (66%) remain the largest ownership block of holders, with banks (15%) and insurance companies (11%) also large holders. So, despite higher yields, record outflows from retail investors in 2022 have been followed by further outflows this year. Despite still strong fundamentals and improved valuations, retail investors have, so far, been unwilling to stay the course, which has offset most of the favorable supply dynamics. Until retail investor outflows slow or reverse, the typical seasonal patterns may not hold. But if the seasonal patterns do hold, muni investors could end the year with a positive tailwind to returns.

A More Defensive Asset Class

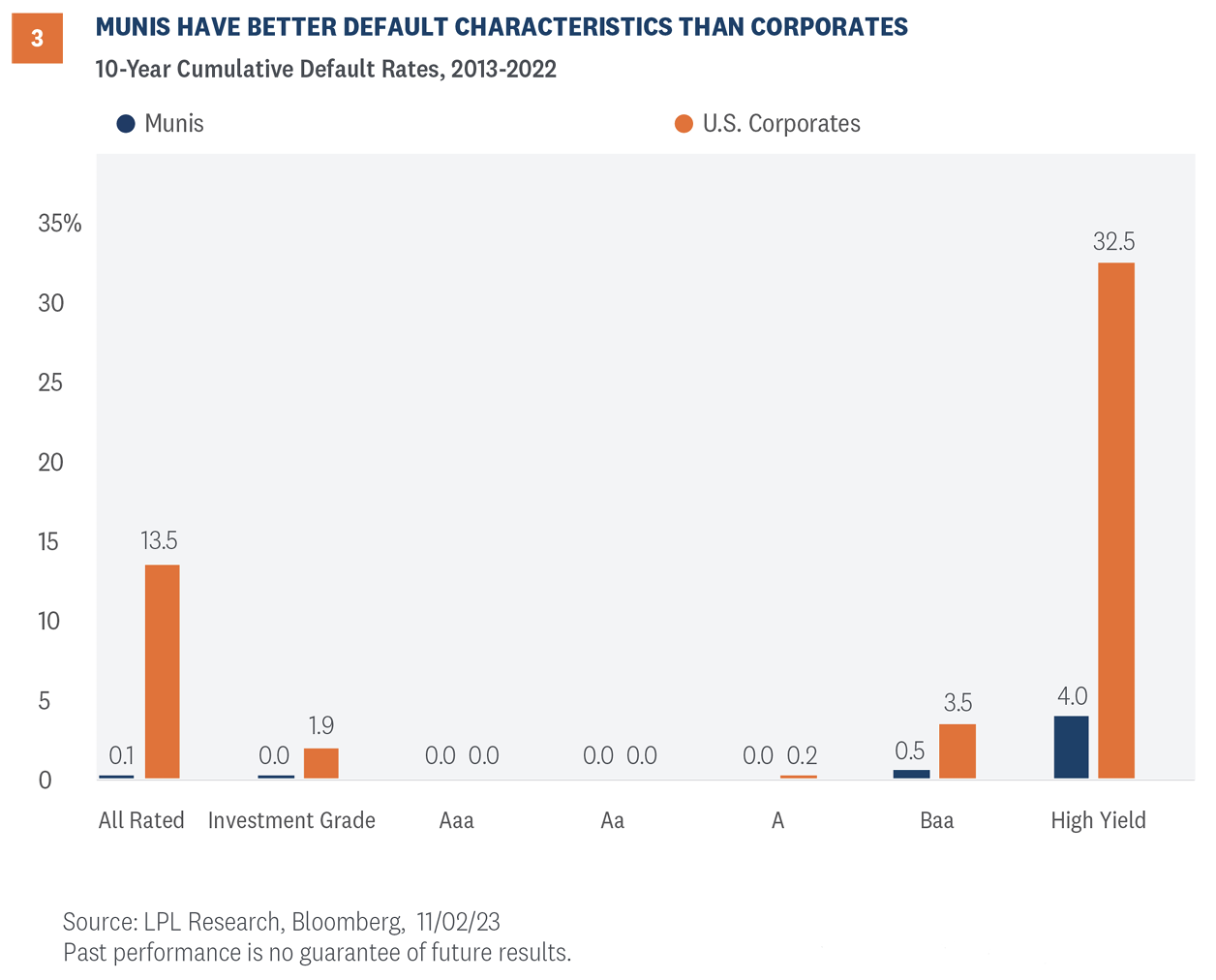

Earlier this year, rating agency Moody’s updated its historical default rate analysis between munis and corporates, and munis have, by far, better default characteristics. So, while investment grade munis have underperformed highly rated U.S. corporates so far this year (not tax-adjusted), munis tend to outperform corporate debt during economic slowdowns. Moreover, the default rate for munis is significantly better than corporate borrowers (Figure 3). The cumulative muni default rate for investment grade issuers (between 2013 and 2022) was just above 0% versus 1.9% for taxable corporate bonds. Additionally, the high yield muni credit default rate was around 4.0%, cumulative, versus 32.5% for high yield corporates.

And while there is still a lot of uncertainty surrounding the impact on commercial real estate (CRE) in general, the New York City comptroller recently provided some scenario analysis on that subject. According to their work, even in a doomsday scenario, where property values decline by 40% over the next few years, there would be a revenue shortfall of only about 1.4% of city tax revenues. Obviously, this is just a scenario for New York City but given the importance of real estate taxes to its operating budgets, it does provide some relief that muni budgets broadly won’t be severely impacted. And residential valuations are holding up, which helps offset some of the CRE issues. Nonetheless, it is an area we’re watching.

Conclusion

While munis have outperformed U.S. Treasury markets this year, after the historically bad year last year, it probably hasn’t been the year that many muni investors had hoped for. But, with the Fed at or very close to the end of its rate hiking campaign, we could see a smoother path for munis to finish up the year. Despite a slowing economy, fundamentals are still strong compared to history. And while tax revenues may have peaked, high cash balances and reserves should allow most issuers to adapt to an economic slowdown. Total yields remain above longer-term averages and since starting yields are the best predictor of future returns (over longer horizons), we think the prospects of solid muni returns have improved (no guarantees of course).

Lawrence Gillum is chief fixed income strategist for LPL Financial.