Gary Gensler, the U.S. Securities and Exchange Commission’s new chair since April, has been making hawkish sounds about risky assets lately. In August alone, he slammed the crypto world as “the Wild West,” one that’s “rife with fraud, scams and abuse.” He labeled the likes of Alibaba Group Holding Ltd. and other New York-listed, Cayman Islands-incorporated Chinese tech companies as mere “shell companies.”

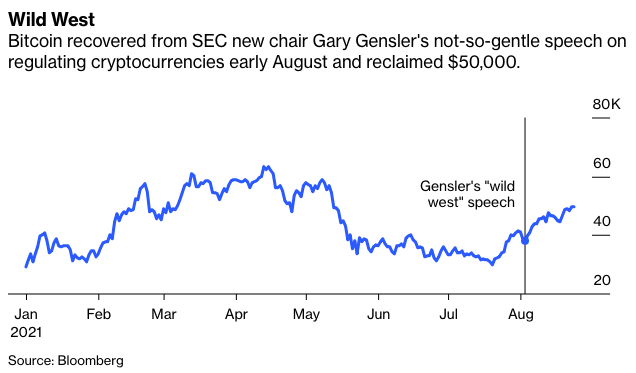

Keen to rein in his bêtes noires, Gensler is engaged in a turf fight with the Commodity Futures Trade Commission, over the nature of crypto tokens. On Aug. 3, he staked out his territory by saying many of them may be “unregistered securities.” That claim was rebuffed a day later by the outgoing CFTC chairman Brian Quintenz, who is seen as an ally by crypto traders. Gensler is now seeking Senator Elizabeth Warren’s help for authority to regulate such exchanges.

To deal with Chinese companies, Gensler called for a “pause” in their U.S. initial public offerings last month. The SEC is starting to issue new disclosure requirements to those contemplating a New York listing, asking about their corporate structure. That would be their “shell” nature, in Gensler’s vocabulary. It will also require listed companies to disclose more regulatory and political risks, Bloomberg News reported. With the passing of the Holding Foreign Companies Accountable Act last year, the SEC can now force a delisting if a company refuses to provide information requested by the agency or by the Public Company Accounting Oversight Board, the auditor of auditors established as a result of the 2001 Enron scandal.

Despite all the thundering, can Gensler’s SEC, which has an annual budget of about $2 billion, simply march in and police this wild, wild west? The agency already has a full plate, overseeing about $100 trillion in annual securities trading, 24 national exchanges, and the disclosures of 7,400 reporting companies, among others.

For one thing, forcing a delisting is much easier said than done. There are 248 Chinese corporate names on U.S. exchanges, boasting over $2 trillion market cap as of early May; the SEC cannot possibly have the time nor the money to investigate them all.

The agency’s record isn’t promising. It was slow and reactive between 2018 and 2020, despite the Trump administration’s hardline rhetoric on China. That was the conclusion of a study by CLSA and Mithra Forensic Research. By looking at the exemptions the SEC used to deny Freedom of Information Act requests, the study found that only five companies—iQiyi Inc, TAL Education Group, GSX Techedu Inc., Alibaba and China Petroleum & Chemical Corp.—were investigated in that three year period. All, except for the state-owned China Petroleum, were short-seller targets.

In other words, the SEC appeared to have relied mostly on whistleblowers instead of its own internal investigative methods—such as accounting forensics or big data—to identify suspect companies. In June, Gensler fired William Duhnke as chair of the PCAOB, a win for liberal senators Warren and Bernie Sanders, powerful voices on the Senate’s banking and budget committees. The Trump appointee was criticized for being ineffective and taking record low actions against auditors.