Financial advisors increasingly offer charitable planning as a way to enhance their value to clients by helping them incorporate philanthropy into their overall financial planning. As we approach giving season, we want to offer four key ways advisors can help clients increase their giving power at a time when philanthropy has never been more important.

Strategies For Maximizing Impact In 2021

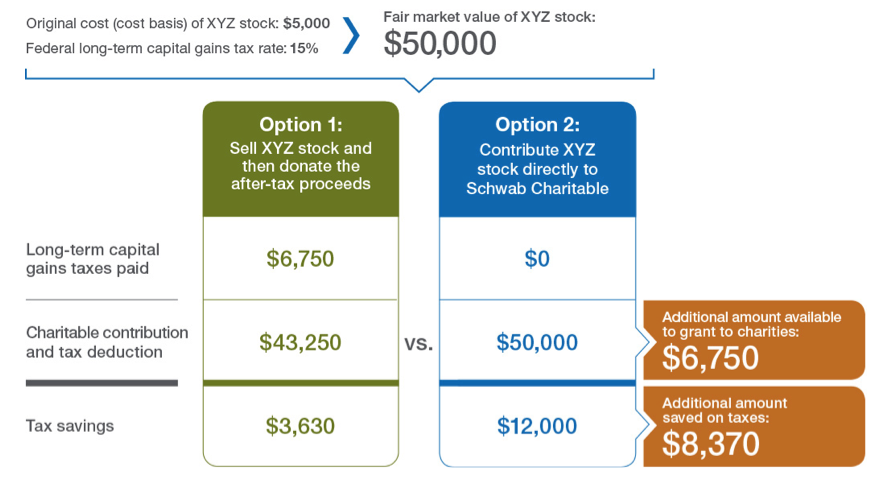

1. Give appreciated non-cash assets instead of cash. One of the most powerful tax-smart strategies is donating appreciated non-cash assets held more than one year. Clients who use this strategy can generally eliminate the capital gains tax they would otherwise incur if they sold the assets first and then donated the proceeds, potentially increasing the amount available for charity by up to 20%. This strategy can also significantly increase their tax savings, as shown in the example below.

In fiscal year 2021, approximately 60% of contributions to Schwab Charitable were in the form of non-cash assets, including publicly traded securities, restricted stock, and private business interests.

This hypothetical example is only for illustrative purposes. The example does not take into account any state or local taxes or the Medicare net investment income surtax. The tax savings shown is the tax deduction, multiplied by the donor’s income tax rate (24% in this example), minus the long-term capital gains taxes paid.

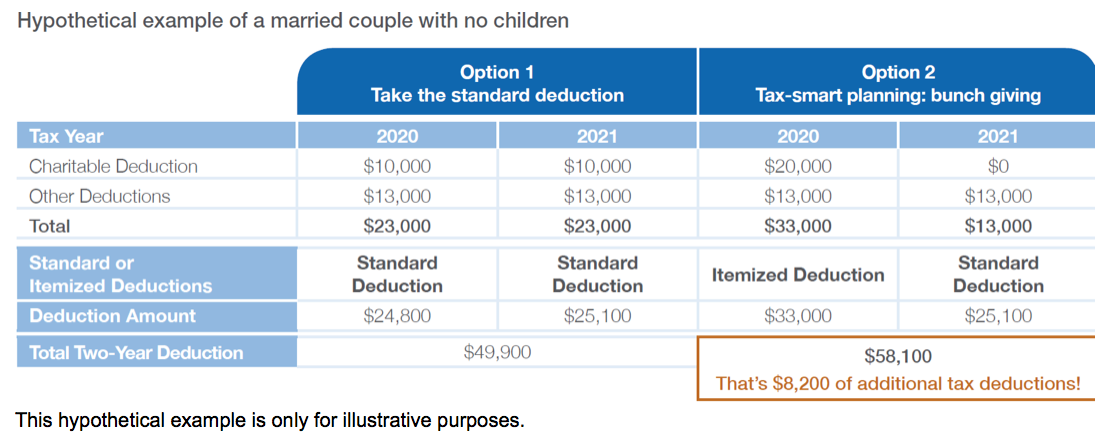

2. Leverage a charitable deduction strategy. Some clients may find that the total of their itemized deductions for 2021 will be slightly below the level of the standard deduction. It could be beneficial for them to bunch or combine 2021 and 2022 charitable contributions into one year (2021), itemize deductions on their 2021 tax returns, and take the standard deduction on 2022 taxes. In addition to achieving a large charitable impact in 2021, this strategy could produce a larger two-year deduction than two separate years of itemized deductions, depending on income level, tax filing status, and giving amounts each year.

Charitable clients who bunched two or more years of contributions into 2020 and subsequently will take the standard deduction for 2021 may also consider taking the special $300 or $600 CARES Act deduction for cash donations made to operating charities in 2021, as described below.

Keep in mind that donors seeking a 2021 tax deduction must have their gift received and processed by December 31, 2021, and some non-cash assets require additional processing time.

3. Give more by donating retirement assets. Clients who are in or near retirement or reviewing estate plans might consider using three tax-smart tips to help maximize their charitable impact this year as part of their overall legacy planning.