When the pace of events accelerates and perception travels faster than information, it’s sometimes difficult to keep up. Just a few days after we issued our expectation for interest rate cuts this spring, the U.S. Federal Reserve reduced its benchmarks by fifty basis points. It was the Fed’s first move of more than a quarter-point, and the first move outside of formal meetings, since 2008.

The urgency surrounding the decision was likely informed by the spread of the COVID-19 virus and the reaction of public health officials and the private sector. Restrictions on human movement and assembly have hindered production processes and taken a toll on service businesses around the world. With testing beginning in earnest in the United States, it seems likely that the number of reported cases will mount, as will the steps taken to contain the contagion.

It may be a few weeks before we see the accumulated business interruptions reflected in the normal flow of data, but the escalating number of anecdotes suggests upcoming economic announcements could be negative. That shortens the time frame for policy makers to react and reassure.

Fed Chairman Jerome Powell promised on February 28 to “use our tools and act as appropriate to support the economy.” European Central Bank (ECB) President Christine Lagarde said the bank was “ready to take appropriate and targeted measures.” Comparable statements from other central banks, and communication from G-7 finance ministers, clearly suggested a coordinated effort to combat the spreading malaise.

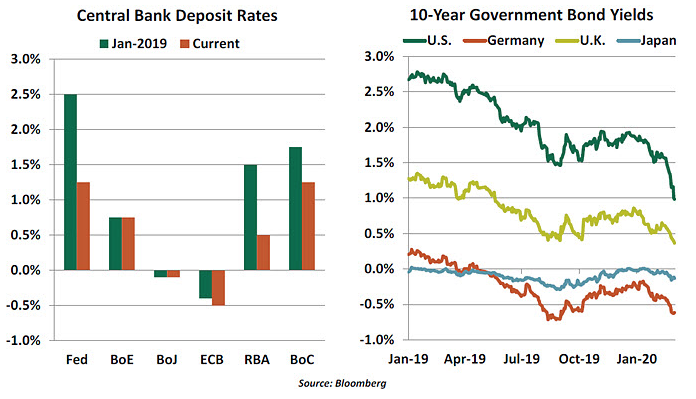

Unfortunately, central banks don’t have much room to reduce interest rates. Those that do have chosen to use it: the Fed, the Bank of Canada and the Reserve Bank of Australia have already moved, and the Bank of England will almost certainly act at (or before) their next meeting in late March. But other monetary authorities will have to rely on what we used to call unconventional policies, like quantitative easing or support programs for lending.

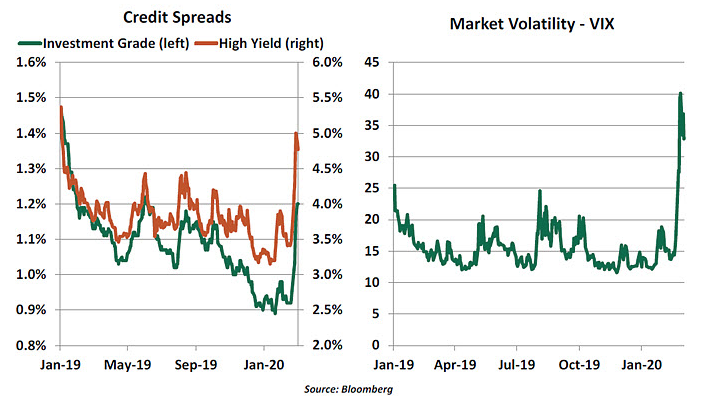

Given the size and timing of its action, the Fed was likely aiming to deliver a knockout blow to bearish sentiment. But the markets ducked and covered. The 10-year U.S. Treasury yield has fallen to below 1%, and equity markets remain unsettled. There is a possibility that market participants are interpreting the Fed’s urgency as a sign that conditions are worse than previously suspected.

Monetary policy may not be the best tool to address a pandemic. Lower rates will certainly not prevent the spread of the virus, ease the strain on global supply chains, or encourage travel in the face of corporate restrictions and personal anxiety. But central banks can address flagging psychology and tightening financial conditions: The reduction in interest rates might, at the margin, help some borrowers to avoid default. And as a side benefit, easier credit might help lift inflation.

But the more direct route to address both the virus and resultant economic dislocations is fiscal policy. Aid to support medical efforts, subsidies to protect impaired industries, and temporary tax reductions could all be considered. The U.K. is set to announce its formal budget plans next week, and they are expected to include meaningful support for the economy. But formulating and passing a stimulus package of sufficient size will face political complications; it might be a long time before new programs show meaningful effects.