The Certified Financial Planner Board of Standards today announced sanctions against 20 current or former certified financial planner professionals for violations ranging from regulatory actions, arbitrations and civil court litigation that involve professional conduct, bankruptcies, civil judgments and tax liens.

The board said more than a third of the public sanctions resulted from investigations it opened following background checks conducted on all CFP professionals to detect potential misconduct that previously had not been reported to board. The violations can range from regulatory actions, firm terminations, customer complaints, arbitrations and civil court litigation that involve professional conduct, criminal matters, bankruptcies, civil judgments, and tax liens.

“CFP Board enforces its ethical standards by investigating alleged violations and, where there is probable cause to believe there are grounds for sanction, presents a complaint containing the alleged violations to CFP Board’s Disciplinary and Ethics Commission,” the board said in a statement.

Among the sanctioned individuals, five were censured, three received administrative suspension, two were suspended, three were temporarily barred and three were permanently barred, and the rights of four to use the CFP marks were revoked. An administrative suspension is imposed for one year and a day whereas a suspension could last for up to five years, according to the CFP Board guidelines.

The board permanently revoked Charles C. Leonard Jr.'s right to use the CFP certification marks in October. The board said Leonard of Haddonfield, N.J., failed to timely respond to its complaint alleging that he violated board rules and conduct on account of outstanding federal tax liens filed against him totaling about $77,000 and other outstanding tax debt totaling about $490,000.

M. Imran Rana of Washington Township, N.J., was also issued a permanent revocation in October for failing to cooperate in an investigation into his 1990 and 2014 Chapter 7 Bankruptcy filings.

The board permanently barred Michelle R. Maccio of Beverly Hills, Calif., from applying for or obtaining the CFP certification. The board said Maccio’s failed to respond to its notice seeking information for an investigation into a cease and desist order filed against her by the U.S. Virgin Islands Division of Banking, Insurance and Financial Regulation on Oct. 1, 2020, that found “a breach of fiduciary duty and other misconduct related to her operation of a hedge fund and her lack cooperation with auditors, as well as a pending action initiated by the California Department of Financial Protection and Innovation on November 12, 2020, following the action taken in the U.S. Virgin Islands.”

Brett S. Ellen of Las Vegas was temporarily barred in October from obtaining the CFP certification marks for one year and one day for failing to provide a response to the board’s notice seeking information for an investigation regarding an arbitration filed against him on Sept. 4, 2020, for allegedly selling unsuitable products.

Among those receiving a suspension was David A. Dickson of Orangevale, Calif. Dickson received a three-month suspension after it was determined that Dickson “prioritized paying for his children’s private education over paying taxes to the Internal Revenue Service for nine tax years,” which resulted in the IRS filing a federal tax lien against him for $89,725, the board said. As of August 2020, Dickson has an outstanding tax balance of $239,156, but he is making timely payments to the IRS pursuant to an installment agreement, the board said.

Gerald A. Schmitt of New Lenox, Ill., was issued a suspension order in March for one year and one day. The board said Schmitt’s failed to file a response to a request seeking information to investigate a “2019 Order of Suspension and Prohibition from the Illinois Secretary of State Securities Department for, recommending and selling fraudulent and unregistered securities and obtaining money through the sale of securities by failing to disclose material facts.” The board said it also sought to investigate allegations that Schmitt misled board by failing to disclose the Illinois Order on his Ethics Disclosure forms.

Among those receiving a public censure was Melinda Crary of Mountlake Terrace, Wash. Crary agreed to a public censure in November after it was found that in February 2017 she “entered into a consent order with the State of Washington Department of Financial Institutions, Securities Division. The Washington order contained findings that between 2011 and 2017, Ms. Crary and her firm were not registered as an investment adviser, and that Ms. Crary was not registered as an investment adviser representative.” The order said Crary and her firm held themselves out as financial planners and solicited financial planning business without registering with the state, the board said. She and her firm agreed to pay a $10,000 administrative fine and $5,000.00 in investigative costs.

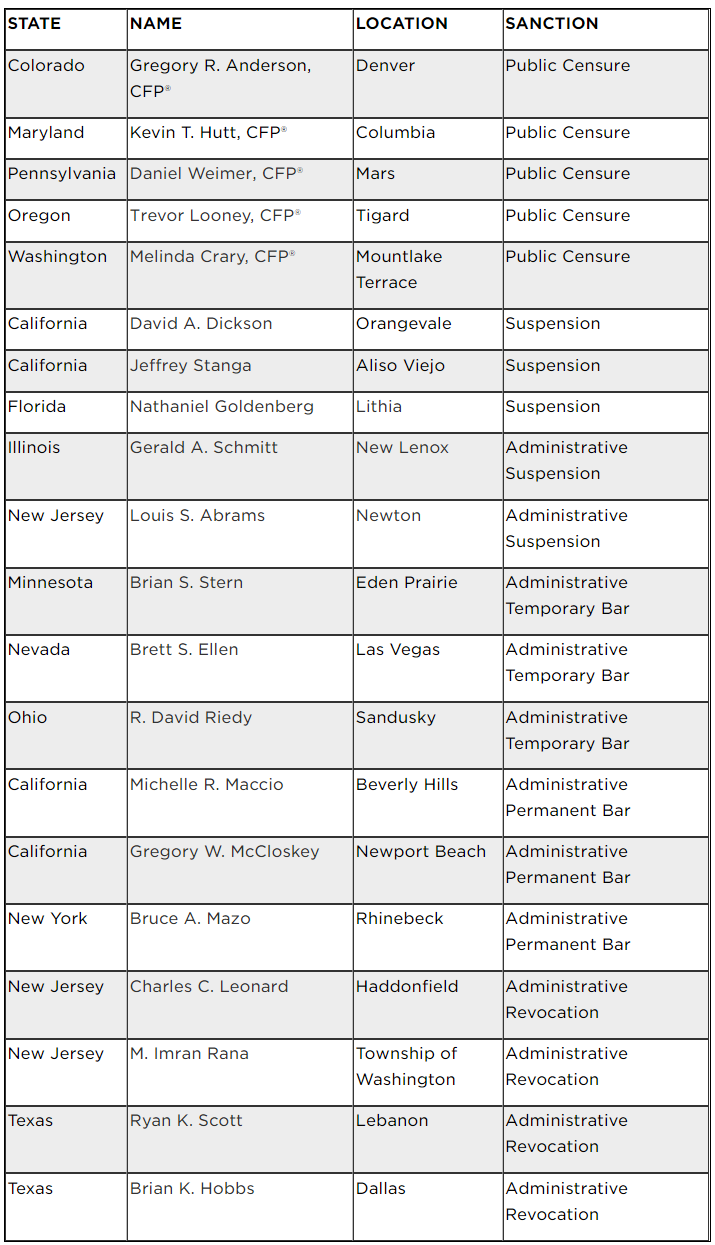

The complete list of those disciplined is as follows: