Federal Reserve officials don't seem particularly concerned that stock valuations have plunged. They are, however, sensitive to significant movements in credit markets. The central bank would probably pull back on its plan to aggressively tighten monetary policy if corporate America showed signs of having trouble raising debt financing.

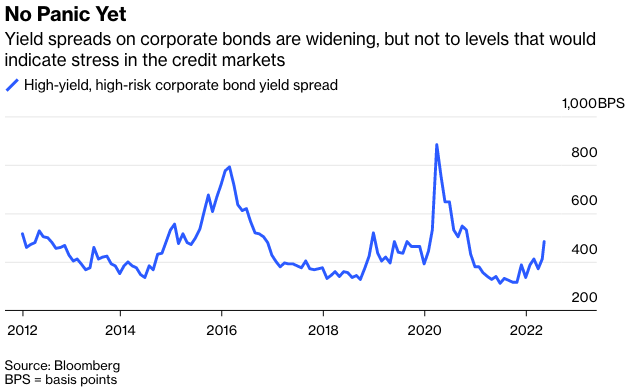

But despite some historic losses in credit markets this year, we're not anywhere close to that point. Corporate balance sheets are in some of the strongest positions in 20 years, and defaults are expected to stay “comfortably below” the long-term average of 4% this year, Goldman Sachs Group Inc. analysts wrote in a note last week. Bank of America Corp. credit analyst Eric Yu concurs. "Even if we are headed into a recessionary scenario, we think that high-yield defaults will peak at under 6%,” he wrote in a research note last week. “We suggest taking materially more risk here."

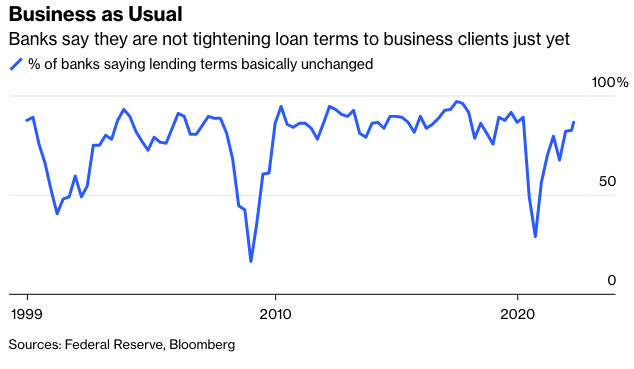

Even the Fed's quarterly senior loan officer survey of banks shows a willingness to lend. No banks reported significantly tightening lending standards in the latest survey, even with higher interest rates and concerns about higher inflation and a slowing economy. Lenders have confidence because companies aren’t desperate to borrow right now to stay afloat. They mostly took advantage of historically low rates to refinance a significant amount of their obligations, pushing out maturities years into the future.

It's not like there hasn’t been any pain or cause for concern. US investment-grade bonds are down 13.4% this year, and high-yield, high-risk, or junk, bonds have fallen 10.4%, according to Bloomberg indexes. But the losses are mostly due to a broad repricing linked to higher rates on US Treasury securities rather than worries about deteriorating credit quality and potential defaults. Stripping out the government-debt component from the returns, junk bonds are up 0.7% and investment-grade bonds are down just 0.5%.