The main act is almost upon us. There’s not much point in speculating at this late stage over exactly what the Federal Open Market Committee will announce at its Wednesday afternoon meeting. But if you’re concerned about investment, it’s hard to think about much else.

Here are some questions and concerns that the FOMC will need to ponder, as will the rest of us.

The Labor Market: It’s Still Hot

The slowdown in the latest gross domestic product numbers was greeted as evidence that higher bond yields were already having an effect. Less economic activity should, all else equal, mean less inflationary pressure.

Unfortunately, the latest JOLTS numbers on job vacancies suggest there’s still ample upward pressure on prices (Source: Job Opening and Labor Turnover Survey by the Bureau of Labor Statistics). There have never been more open jobs in the U.S. than there are now. Even with the economy plainly reopening from the pandemic, companies are still finding it hard to find anyone:

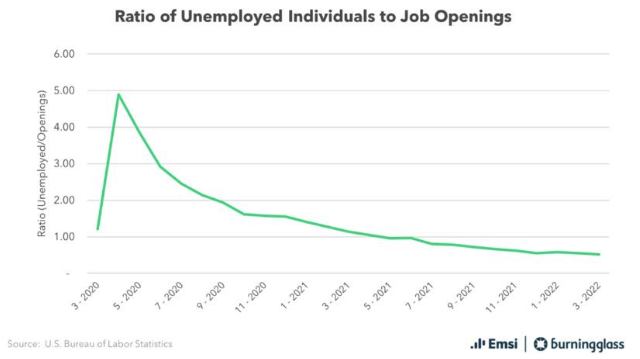

EMSI Burning Glass shows just how difficult it is for employers to keep wages low by illustrating the number of unemployed as a percentage of vacancies. Amazingly, each unemployed person has two jobs to choose from. If everyone signed on the dotted line tomorrow, there would still be approaching 6 million job vacancies:

Fed Chair Jerome Powell would be very unwise to follow his counterpart at the Bank of England and urge employees not to ask for a raise. That’s not the way the world works, and it’s not fair to expect of anyone. Any limits on an incipient wage-price spiral will have to come from deliberate policy to slow the economy.

New Dream Scenario: Soft Landing

Not long ago, there were real hopes of a return to Goldilocks—an economy that’s not too hot and not too cold. Now, the ideal outcome would be a Sully—an economy that somehow engineers a soft landing just as Captain Chesley Sullenberger once managed to ditch a passenger jet on the Hudson River. At present, the maneuvers to get the economy to slow down gently without tanking look as difficult and perilous as those undertaken by Captain Sullenberger as he tried to avoid crashing into Manhattan. But it could happen, and it would be great.

Perversely, however, the surprises of the last few months might just make it easier to execute such a landing. Dario Perkins of TS Lombard suggests that what’s been scary might actually be good news: