The outperformance of emerging market (EM) stocks in 2017 has investors asking: Is this a game of catch-up or the start of a multi-year winning streak? Some of this year’s performance can be explained by investor efforts to close long-underweight positions. Some can be attributed to improving global growth. We believe there is more to the story, that it goes well beyond China and that EMs have room to run.

Highlights

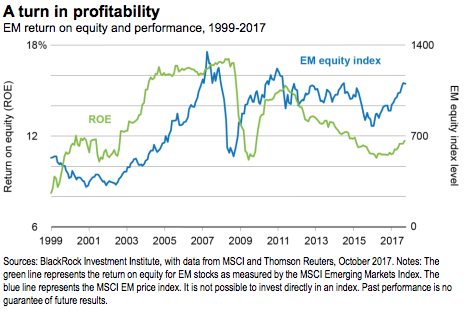

• The underlying fundamentals for EM equities are improving after five years of declining profitability and weak earnings growth. We believe the recent outperformance is the start of a longer trend and assign the asset class an overweight position.

• Reform progress is central to EM economies and markets reaching their full potential. EM reform is not new, but we are encouraged by a few countries making big headway—with positive implications for equity markets and future earnings.

• The spotlight has focused on EM Asia, led by powerhouse China. But all three major EM regions are contributing to robust earnings growth for the asset class. Our favored markets include India, Indonesia, Brazil and Argentina.

Game On

EM earnings and profitability have come a long way. But they’re not done yet, we believe. The past 18 months have brought a broad-based recovery, after earnings of MSCI EM Index companies had slid 7 percent a year since 2011. Both new and old economy sectors (tech, industrials, energy) have contributed. Performance has largely followed. MSCI EM valuations are at their highest since 2010, but 24 percent below developed markets (DMs)—not expensive, on a relative basis. Over-investment (mostly in the resource sectors) and capacity expansion weighed on profitability from 2011-2015. Companies have since slowed investment, which has increased return on equity, as shown below.

From Pain To Gains

A trio of forces offers support for EM equities today: structural reforms that are leading to higher profitability, synchronized global growth fueling improved demand, and stimulative fiscal and monetary policies.

Structural reforms in labor and banking can cause pain in the near-term, braking growth. But in the long-term, welltargeted reforms bring gains, we believe. Why? True structural reform improves the ease of doing business (reducing friction and transaction costs), provides greater flexibility for companies (particularly on hiring and firing), and supports aggregate demand. This feeds into domestically driven earnings growth. The stories go well beyond China.