Have rate cuts hurt EM bank stocks? Financials make up nearly a quarter of the EM equity market and have lagged the highflying tech and consumer discretionary sectors this year. But we do not see rate cuts dragging the market down. EM rates have not hit zero and yield curves maintain a relatively normal slope. This has led to improving activity, which has eclipsed any impact of falling margins on bank earnings. Thomson Reuters data show Brazil’s financial sector is up over 30 percent in both U.S.- dollar and local-currency terms so far this year, outpacing the broader market by 8 percent. India financials tell a similar story, and we see their outlook as bright. A new $32 billion government package to recapitalize public banks should enhance lending capacity — especially to small to medium enterprises.

For The Love Of LatAm

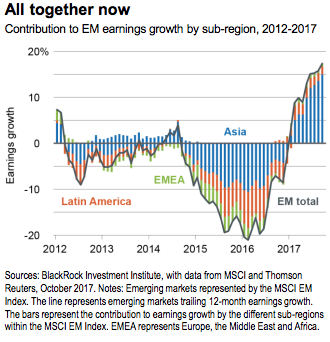

EM Asia has stolen the spotlight given impressive returns this year, but Latin America has been a bigger player in the EM profits recovery. LatAm has been contributing to earnings growth since mid-2016, with EM Asia catching up several months later, as shown in the All together now chart below. Today all three sub-regions within EM are contributing to earnings growth for the first time since 2012.

We see a favorable economic, political and fundamental environment for LatAm’s anchor market, Brazil. The largest companies by market cap were historically commodity producers, but today market leadership comes from banks and consumers, two areas we like. The country is less dependent on global trade than conventional wisdom suggests, a positive as trade pacts come into question. Nearly 80 percent of revenue comes from domestic sources, based on calculations using the MSCI Brazil Index.

We see Argentina as a small market with big potential. The MSCI Argentina Index, with a market capitalization of just $41 billion as of October, has soared 75 percent year-to-date in U.S.-dollar terms, according to Thomson Reuters data. The run-up comes as the country’s inclusion in the MSCI EM Index looms next year, and is further supported by favorable political and economic conditions, we believe. Economic growth is running at a 2.7 percent annual clip, according to the Argentine National Institute of Statistics and Censuses. Analysts estimate bank lending is improving at a 50 percent-60 percent year-on-year rate; inflation is falling; and entrepreneurialism is alive and well. The risks: Large fiscal and current account shortfalls make Argentina dependent on foreign capital and vulnerable to currency swings.

Mexican equities are more complicated. Domestic consumption is strong, but Mexico’s economic activity relies heavily on the U.S. NAFTA renegotiations and an upcoming 2018 presidential election have stoked uncertainty. This has kept fiscal and monetary policy tight, pending further clarity, and presents challenges for equities.

Raising Stakes, Recognizing Risks