In some ways, David Eiswert’s working life has been very different in the months since “coronavirus” became a household word. Eiswert, who manages the $2.4 billion T. Rowe Price Global Stock Fund, works from a home office instead of the firm’s busy Baltimore headquarters. He’s expanded his personal IT setup with an additional computer monitor and a new iPad. As he manages $15 billion in the firm’s global focused growth strategy for the fund and institutional investors, his four children sit downstairs attending school remotely.

Yet in other ways, things are pretty much the same as they’ve always been. The firm’s army of analysts around the world remain available by phone, videoconferencing or video chats. His local team members, who once gathered weekly in-person, now connect through the digital channels as well. “There’s a little less spontaneity than in-person discussions, and of course traveling has been halted,” he says. “But otherwise things aren’t that different.”

Lately, Eiswert has been using global disruption to pick up what he considers great stocks at great prices from countries around the world, including the United States. He’s aggressively raising the cash to do that by paring back or eliminating positions in stocks that could face debt-related challenges in the grueling months ahead, or that have simply lost their comparative allure.

Boeing, whose balance sheet was loaded with more debt than Eiswert felt comfortable with going into a likely recession, got the boot in February as the potential for an economic fallout came into clearer view. China multinational conglomerate Tencent Holdings and Chugai Pharmaceutical were also eliminated around that time because better opportunities came along.

These sales early in the crisis made way for what Eiswert considered to be high-quality stocks selling at compelling valuations, names better suited to the difficult, fast-changing environment. By mid-to-late March, he had turned his attention from selling to buying stocks, mostly in the health-care and technology sectors.

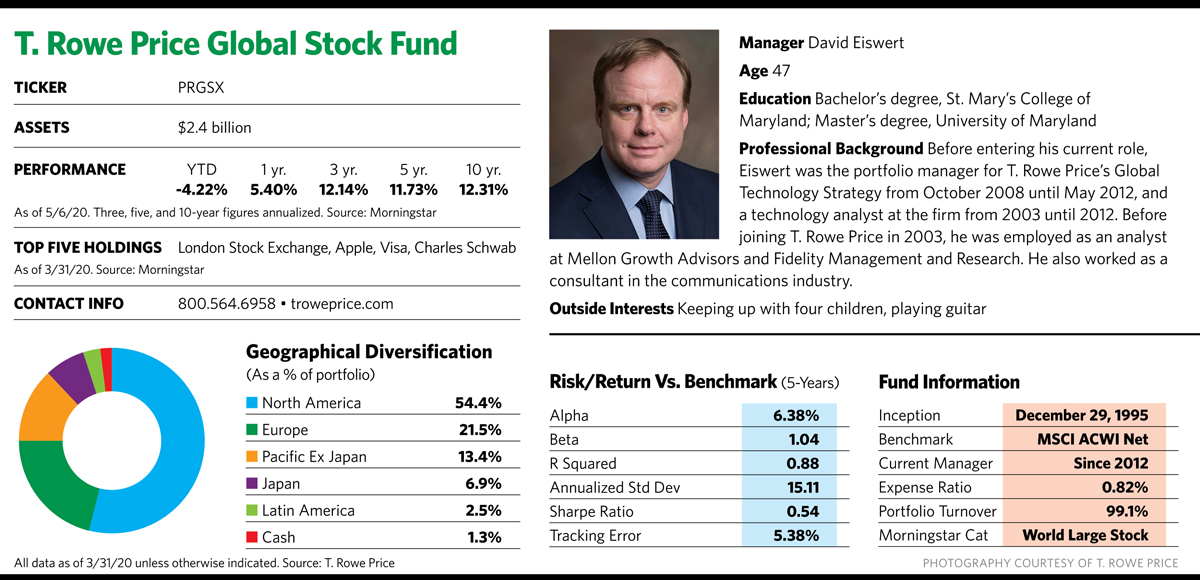

This recent flurry of activity reflects his willingness to sell off ideas that he thinks have run their course and move on to greener pastures. His annual portfolio turnover of 100% or more isn’t that unusual for the fund, and with the recent activity there’s a good chance the turnover will run on the higher end of the fund’s historic range.

“When one of our analysts brings in a new, compelling stock, we have a terrible time deciding what to sell so we can buy it,” he says. “But we won’t hesitate to sell a good idea to buy a great idea.” The portfolio of 70 to 80 stocks create a fund with an 85% active share, giving it only a passing resemblance to the holdings in its benchmark, the MSCI All Country World Index.

The distinctive approach has paid off. Eiswert’s annualized returns over the last one, three, five and 10 years have beaten those of the index by a significant margin, and the fund’s performance beat 96% of Morningstar’s world large stock peers over the last 15 years (it surpassed 93% of the funds over 10 years and beat 97% of them over five years). The fund’s upside/downside capture ratio of 114/60 relative to its benchmark is also notable, although its volatility has been slightly higher than that of its peers and the index.

Eiswert credits the fund’s success to a large army of analysts who unearth companies that either miss most investors’ radar screens or otherwise offer value that’s been underestimated by the investment community. Pension funds and other institutional investors dominate in the global growth asset space; that competitive environment drives Eiswert’s team to zero in on companies whose stocks are in a good position to outpace the market. The style represents a departure from some of T. Rowe Price’s better-known funds, whose more moderate, middle-of-the-road style appeals to a broader swath of retail and retirement plan investors.