Sophisticated investors are often looking for ways to retain some level of control over their more complex assets—things such as real estate, collectibles and artwork. They not only hope to enjoy these items personally while in their possession, but later benefit from tax savings after donating them.

An ideal way to do this is to give these assets to a private foundation. By doing so, the investors avoid capital gains tax and also get a charitable income tax deduction. And even better—for those charitably inclined—they obtain a great deal of flexibility and control over their giving.

Unlike other charitable solutions, asset donations to a private foundation do not need to be liquidated; they stay under the donor’s control and financial management. The donor gets immediate income tax savings, yet the funds or items don’t need to be distributed to charitable causes right away.

In their efforts to both save on taxes and effect positive change in the world, clients can employ different strategies using a private foundation. Here are three different ideas:

1. Donating Appreciated Securities

Clients with highly appreciated stock can contribute shares worth up to 20% of their adjusted gross income (AGI) to a private foundation. The stock must be publicly traded and unrestricted, and it has to have been held for at least a year.

The alternative is that they sell these securities, which could burden them with a tax liability from their long-term capital gains. If they’re in the highest marginal tax bracket, the effective long-term capital gains tax rate would be 23.8% (when the 3.8% net investment income tax has been taken into account). However, if clients were to instead take that stock and donate it to their foundation, they would be eligible for a fair-market value deduction and would avoid the substantial capital gains tax.

The alternative is that they sell these securities, which could burden them with a tax liability from their long-term capital gains. If they’re in the highest marginal tax bracket, the effective long-term capital gains tax rate would be 23.8% (when the 3.8% net investment income tax has been taken into account). However, if clients were to instead take that stock and donate it to their foundation, they would be eligible for a fair-market value deduction and would avoid the substantial capital gains tax.

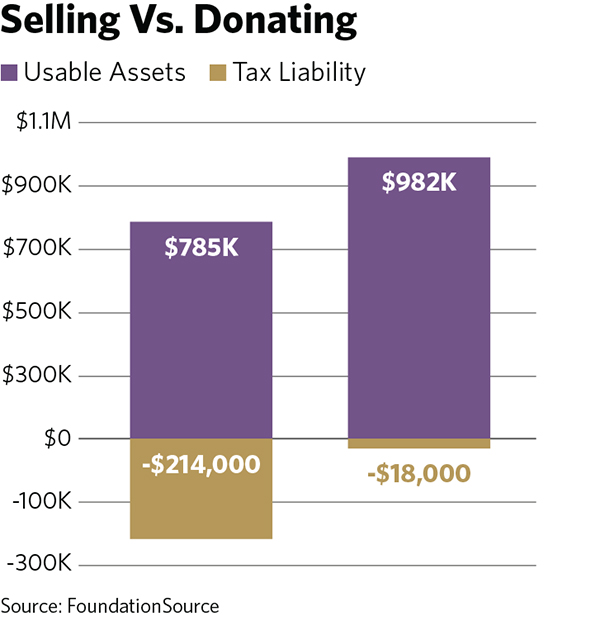

Let’s say a hypothetical client named Mary Smith, who is in the highest marginal tax bracket, bought stock for $100,000 five years ago, and it has since appreciated to $1 million. If she were to sell the stock for its current value, her tax bill would be $214,200 (23.8% of her $900,000 gain = a tax bill of $214,200), which leaves $785,800 for her personal benefit. If instead she donated the stock to her private foundation, her foundation’s tax rate would be, at most, its 1.39% excise tax. The resulting tax bill would be $18,000, leaving $982,000 for charitable purposes under her direct control.

2. Making A Combined Donation Of Stock And Cash

Alternatively, Mary could combine her donation of highly appreciated stock with a cash donation.

Let’s say her AGI is approximately $5 million. The most of this she can contribute in stock is 20%, or $1 million. If she were to donate cash as well, she’d be permitted to contribute an amount totaling 30% of her AGI—an additional 10%. She could therefore donate that same $1 million of highly appreciated stock along with an additional $500,000 in cash. If we assume she has no other limitations (this example is exclusively for illustrative purposes), she would be eligible for a deduction of up to $1.5 million. Meanwhile, her private foundation would pay an excise tax of only 1.39% on the stock’s gain of $900,000, resulting in a tax bill of $18,000 and a $982,000 endowment for her foundation.

3. Donating Other Types Of Appreciated Assets

Private foundations can be funded with a wide variety of assets. But unlike other giving vehicles that often require the liquidation of those donations, private foundations can hold on to them. This can be particularly advantageous if the assets are expected to keep increasing in value. Such assets could include:

• Publicly traded securities;

• Alternative assets, including private equity;

• Real estate;

• Tangible assets (such as art, jewelry and collectibles);

• Intangible personal property (such as copyrights, patents and royalties);

• Life insurance and annuities; and

• Cryptocurrency.

Note that not all contributions are treated the same with respect to their cost basis and deductibility. Whereas cash donations can be deducted at up to 30% of AGI, other assets are generally deductible at the lesser of cost basis and fair market value (with the exception of certain publicly traded stock, as we mentioned before) for up to 20% of AGI. Any contributions that exceed the applicable AGI caps can be carried forward for up to five years. And if the individual has a charitable remainder trust they can name their foundation as the beneficiary.

The Additional Benefits Of Private Foundations

Tax savings aside, private foundations offer nearly endless capabilities for investors to engage in philanthropy. Here are just some of the things one can do with a foundation:

• Make grants to nonprofit organizations—nationally and internationally;

• Make grants directly to individuals in times of emergency or hardship;

• Issue loans to nonprofit organizations that are aligned with the foundation’s mission;

• Create and run charitable activities (for example, a camp for children with special needs or a shelter for victims of domestic violence);

• Establish scholarship/award programs for individuals; or

• Invest in for-profit companies that are aligned with the foundation’s mission.

Additionally, private foundations afford investors the opportunity to build a meaningful legacy of giving and to unify their families through philanthropy.

Jeffrey Haskell, J.D., LL.M., is chief legal officer for Foundation Source, the nation’s largest provider of technology, administration and expertise for private foundations and planned giving. Contact him at [email protected].