This summer, major world central banks are re-igniting their monetary accommodation. But one decade and billions of dollars, euros and yen of stimulus later, monetary policy seems almost exhausted. Instead, could fiscal easing kick-start growth and take us out of the low rate, low growth economic paradigm that we have been in since the 2007-08 financial crisis?

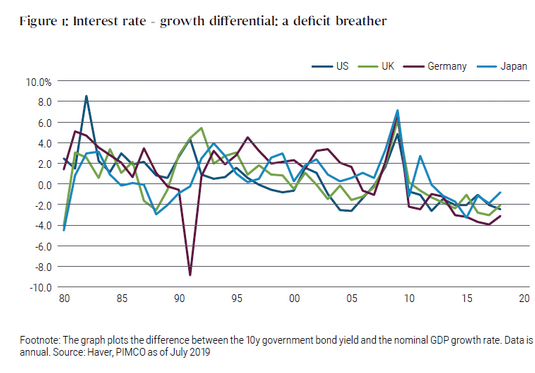

International support for fiscal easing is on the rise. The ascent of populist parties in recent years has brought increased support for fiscal easing, not only from populist leaders, but also from influential academics: Olivier Blanchard and Larry Summers, for instance, have stressed that debt is more affordable in the current low interest rate environment. As Figure 1 shows, sovereign yields are below nominal gross domestic product (GDP) growth rates in most major developed economies, implying that governments can run primary deficits on a sustained basis without seeing sovereign debt/GDP ratios rise.

International policymakers, including former Federal Reserve (Fed) Chairman Ben Bernanke, current European Central Bank (ECB) President Mario Draghi and his soon-to-be successor Christine Lagarde, have also called for countries with fiscal space to spend more. And from a more extreme position, Modern Monetary Theory advocates promote looser fiscal policies, arguing that governments would never need to default on debt denominated in their own currency as they can always print more.

While most leaders and scholars agree that fiscal easing can be stimulative, the effects of fiscal policy depend on a number of factors. In this respect, we highlight three scenarios:

1. Effective: Standard economic theory says that expansionary fiscal policy increases output, inflates prices, boosts nominal and real policy rates, steepens the yield curve and supports risk assets. If this expansionary policy was concentrated in one country, say the U.S., the easing should strengthen the country’s currency, leading to increased imports and therefore, a deterioration in the country’s current account.

2. Ineffective: If the fiscal boost is perceived as temporary, and quickly reversed to restore equilibrium in public finances, any additional public spending could be met by increased savings by the private sector, in anticipation of future fiscal tightening. Economic activity and asset prices would largely be unaffected as a result. This would resemble a “Japan scenario,” given that Japan has failed to lift growth and inflation meaningfully over the past two decades despite multi-trillion yen fiscal deficits.

3. Loss of control: In this scenario, fiscal easing has adverse macroeconomic effects, as policymakers lose control of the system. Usually, profligate governments engage in fiscal easing financed by aggressive money printing. Institutional structures are not solid to start with, or become fragile in response of the loose policies, making markets and economic agents lose confidence in the institutional system. In consequence, inflation spikes, growth and risk assets sink, rates rise steeply and the currency depreciates. Some emerging markets have followed this route before.

Lessons From The Past

To test our scenarios, we identify 54 fiscal expansions in 20 different Organisation for Economic Co-operation and Development (OECD) countries since 1970, normalizing various macro and market variables to make them comparable.