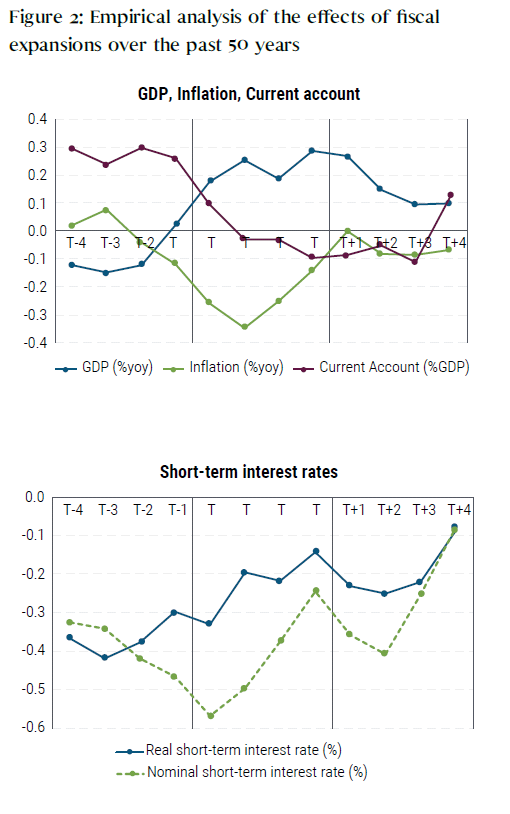

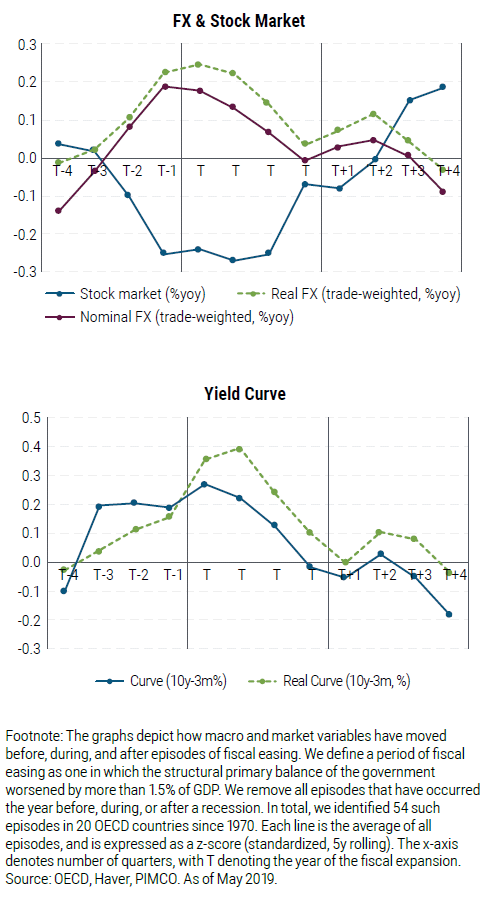

As Figure 2 shows, we find that fiscal easing tends to push output and inflation higher (the latter with a bit of a lag), lift interest rates and strengthen the currency. Current accounts tend to deteriorate, while risk assets generally rally. Granted, these relationships are not perfect – and there may be on the forces in play during periods of fiscal easing – but the overall message seems to support conventional theory: fiscal easing does kick-start economies.

However, these effects tend to be short-lived. Following a fiscal boost, firms initially hire more people and increase production. But after a while, and as production approaches full capacity, firms start raising prices, ultimately bringing the economy back to where it originally started, just at a higher price level. If the central bank also raises its policy rate in response to the fiscal easing, in order to stem inflation, the short-term expansionary effects also end up being more muted. In this context, it is not surprising that the effects of U.S. President Trump’s tax cuts in 2018 waned soon.