Highlights

• The world is already emerging from the deepest and possibly shortest recession in modern history. But investing is likely to become more—not less—challenging.

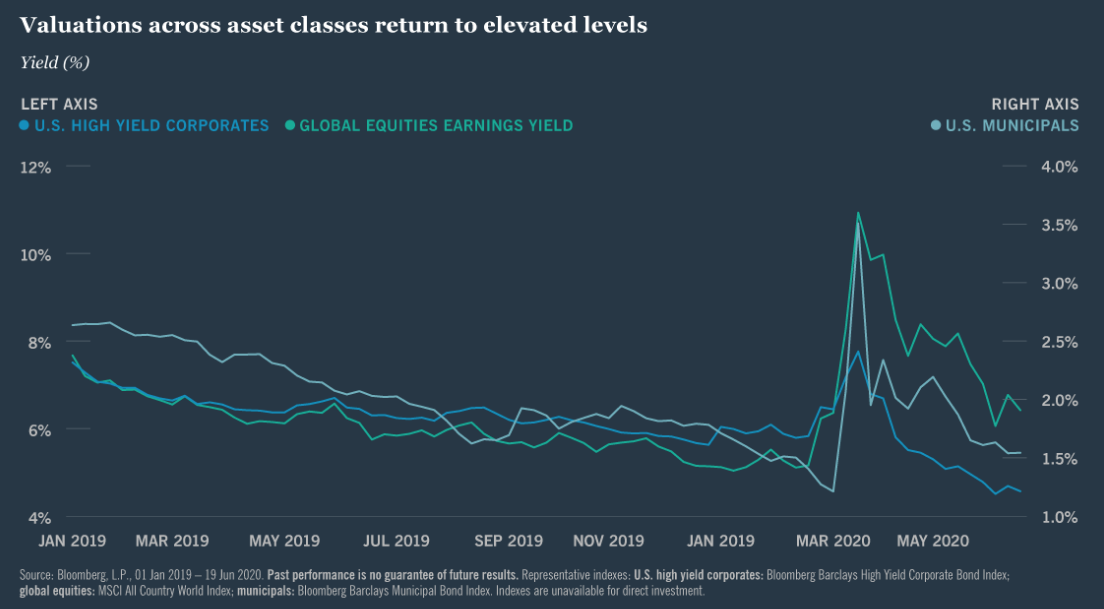

• Massive monetary policy stimulus has helped restore order and confidence. At the same time, lower yields mean investors have to take on more risk to generate income.

• We are seeing seismic shifts across financial markets and within key sectors and industries, creating more challenges and more opportunities.

The Bounce Has Begun; How High Can We Go?

Back in March, we were as stunned as anyone to be marching into an economic recession and an unprecedented global health crisis. We’re nearly as surprised to find, only three months later, that the global economy is once again expanding and financial asset prices are staging one of their strongest quarters in history. While health experts are quick to caution that the coronavirus remains a serious threat, high-frequency data—and our own eyes—tell us that commerce is returning as virus fears abate (wisely or not) and businesses reopen.

And so, it seems, passes the 2020 recession, the deepest and the shortest downturn the world has experienced since World War II. The National Board of Economic Research has pegged February as the end of the longest uninterrupted period of growth in U.S. history, but it also acknowledged that a new expansion may have begun as early as May. Asia, especially China, has been expanding for a few months now given its earlier and generally more successful experience with the virus. And Europe, which has experienced the worst of the fatalities per capita, is being supported economically by its strong social safety net and aggressive economic stimulus. In the wake of this severe global downturn, we find a recovery of highly uncertain trajectory.

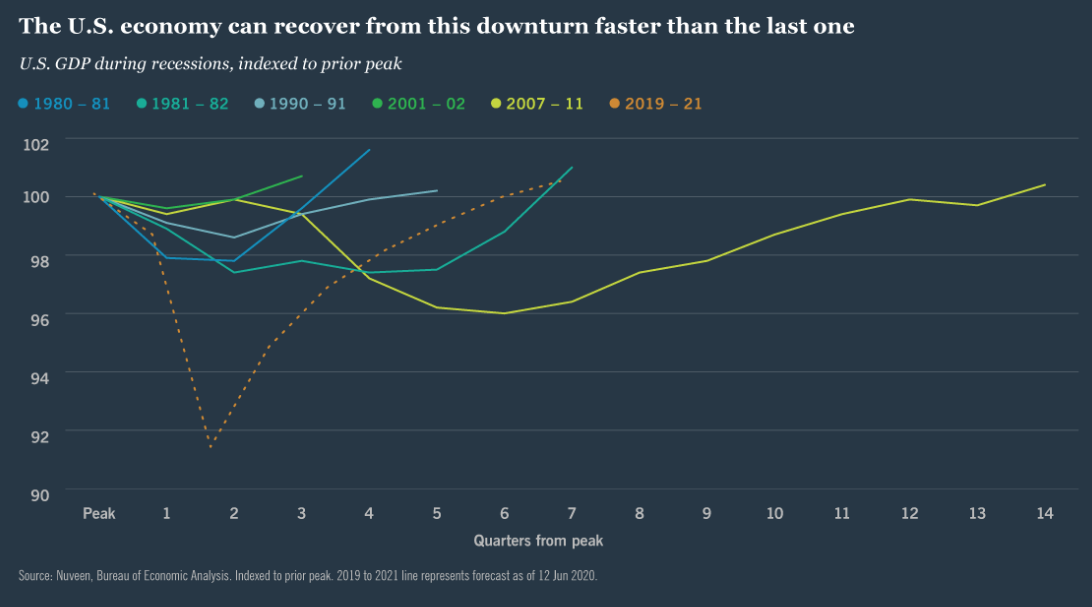

As the figure shows, we expect U.S. economic activity to return to its Q4 2019 peak in the second half of 2021, clocking this recovery at twice the speed of the one that began in mid-2009. While that forecast might appear optimistic, we also see unemployment remaining between 8% and 10% through much of 2021. That’s because restrictions on how certain businesses may operate in the phased reopening could cause job creation to lag even as the economy grows.

As we wrote in March, the speed and trajectory of this recovery will be largely determined by economic policy. Global fiscal policy has been effective so far at replacing lost income and helping businesses of all sizes stay afloat. With reopening underway, policymakers will need to do more to a) ensure financial conditions don’t tighten; and b) cushion the demand shock by assisting distressed industries and unemployed workers.

Proceed With Caution After A Fabulous Recovery Rally

It would have been nice to know with certainty in our last quarterly outlook how close we already were to “the bottom” in global financial markets, particularly equities. Stocks have staged arguably the most impressive and unexpected rally on record since their bottom in late March. The first stage of that rally was marked by subsiding panic about basic market functionality, thanks to a hefty dose of liquidity from the Federal Reserve and its global peers. The second stage was dominated by a relatively small number of high-growth companies, mainly in the U.S., that became more attractive for their abilities to generate profits during the economic shutdown. The latest stage since mid-May has been driven by evidence that the coronavirus is being contained and the global economy is getting back to work. Its leaders include non-U.S. markets and more cyclical companies with lower valuations.

Despite rising equity market volatility in June, stocks are not likely to retest their March bottoms because a return to that level of panic remains unlikely. However, risk assets have undoubtedly priced in an optimistic scenario for the next 18 months: no serious second virus wave, a strong recovery in corporate profits and near-zero interest rates across the developed world. Only the last of the three assumptions seems solid to us.

Even so, valuation has become a concern, as the figure shows, as it was heading into this year. Interest rates have plunged and credit spreads have narrowed, even on lower-rated securities with elevated risks of default. And global equity markets are at their most expensive levels relative to expected earnings since the bursting of the technology bubble in the early 2000s. Even if stimulative economic policy helps markets continue to post impressive returns in the coming quarters, the long-term prospects for holders of diversified portfolios of publicly traded assets looks precarious.