What Comes Next?

While the outlook for the balance of 2020 is clouded by uncertainty, the GIC devoted time at its last meeting to discussing how the longer-term outlook might influence—or already be influencing—our investment processes. Many industries face existential risk as fears of the virus affect consumer behavior and business investment. Assets tied to travel and leisure continue to trade at distressed levels. We think leisure travel will rebound before business travel, as families look to take vacations while companies continue to cut travel-related costs and reduce risks.

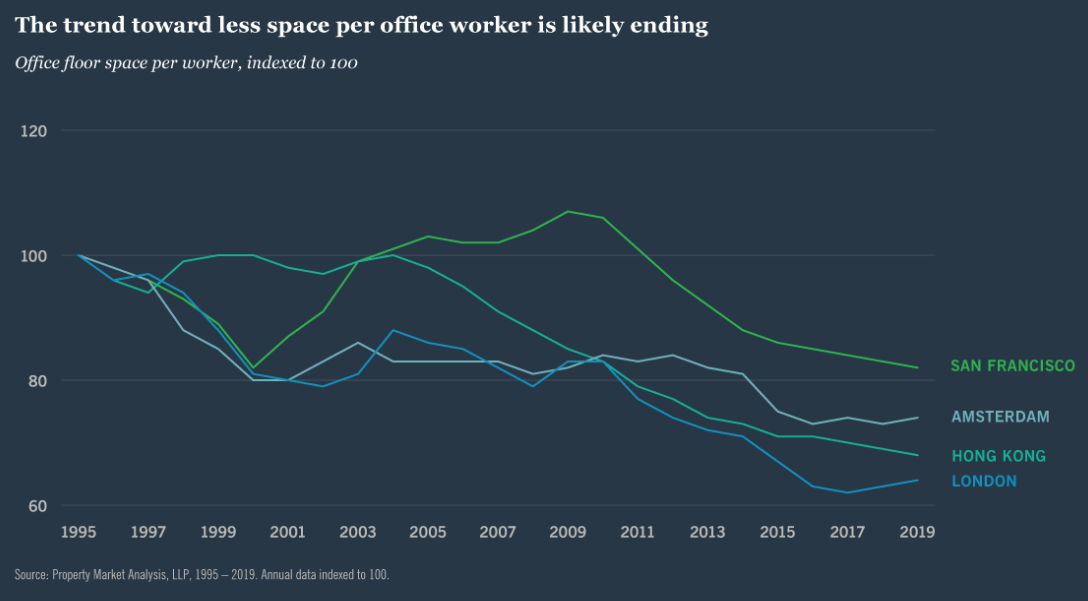

Speaking of companies, what will become of all the office space leased to global firms, especially in densely populated cities, that were disproportionately affected by the coronavirus? While we don’t think 2020 will be the beginning of the “end of the office” by any means, we see the potential for significant changes in how offices are designed. As the figure shows, more employees have been pushed into less office space over the past 25 years. That trend may be primed to reverse as social distancing and employee safety take on greater importance. The average worker may commute less often to work, but once there will need more room to operate and a design built for greater flexibility, learning and collaboration.

Health care is another industry likely to reinvent itself on the fly given its experience during this crisis. As the coronavirus became the primary focus for patients and providers alike, spending on other health care services fell precipitously. The industry will likely make greater use of telemedicine and ambulatory surgical centers. More countries may also incentivize domestic pharmaceutical production to exert greater control over drug manufacturing and avoid supply chain bottlenecks.

We also see this recovery leading to even lower interest rates around the world. Central banks have all but sworn an oath not to raise interest rates until well after the economy has healed, and the bond market seems to have gotten the message.

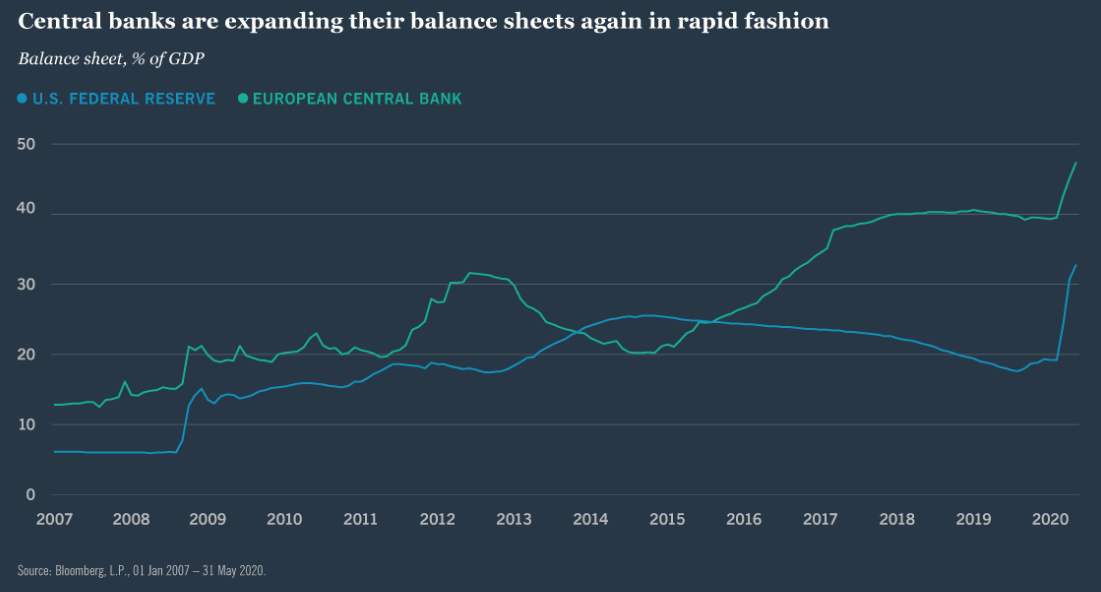

During the previous recovery, long-term interest rates initially rose quickly in anticipation of higher short-term rates. But this time rates in the most of the developed world remain at historical lows close to zero out to 10 years or more. Central bank balance sheets have ballooned as policymakers commit to quantitative easing policies as a means to reinforce their verbal commitments as the figure shows.

Where does that leave investors looking for income? That question dominated the discussion at our June GIC meeting and serves as the foundation for our major investment theme for the balance of the year.

What To Do About ‘Even Lower For Even Longer’

To state the obvious: It’s a lot harder to generate income than it used to be as shown in the figure. The long-term effects of the global financial crisis and aging global demographics created a heightened demand for “risk-free” income and—ballooning fiscal deficits notwithstanding—too few securities to supply it. And the coronavirus crisis has pushed rates down even further. Before 2008, a foundation could almost meet its distribution requirement using U.S. Treasuries alone, and a retired couple could sustain a reasonably comfortable lifestyle with a nest egg subject to relatively little market risk. Today that is no longer the case, requiring us as managers to consider not only how to meet and beat a benchmark, but also how to remain responsive to the persistent and growing demand for income.

In 2020, any solution for targeting higher income comes with increased portfolio risk. Diversifying the sources of those risks is key to an income strategy. Fixed income is the place to start, where investors are paid for credit, interest rate and liquidity risk. With yield curves flat in most of the world, it doesn’t really pay to focus on duration risk. But credit spreads remain well off their early-2020 lows, and even high-quality corporate and municipal bonds still trade at significant discounts due to lower levels of liquidity. Given the currently high corporate debt burden, however, managing risks in a bond portfolio requires careful research, especially in high yield. Investors can also consider allocating to emerging markets debt, which tends to provide more income than U.S. high yield corporate debt for a given level of quality.