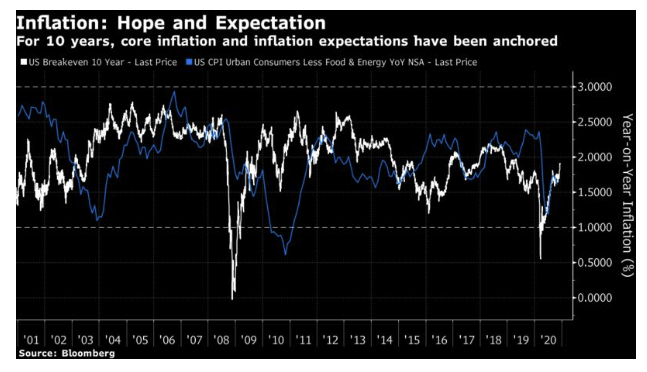

The U.S. publishes its last inflation data for the year on Thursday. The anticipation is that numbers will continue to be in line with the controlled outcomes to which the country has become accustomed. As this will be a column on the risks of a resurgence, it is important to start by making clear how utterly anchored inflation has been in this century. This chart shows how core inflation (excluding food and fuel) and 10-year expectations have varied over the last 20 years.

Neither has ever exceeded the Federal Reserve’s upper range target of 3%. Actual inflation dipped below the lower limit of 1% for a few months in 2010, in the aftermath of the Great Recession, while expectations briefly dropped below that level during the worst months of the global financial crisis and the Covid shock. Both times those deflationary shocks were over within weeks.

So, with the economy still struggling to find its legs, and the last wave of Covid likely to dampen economic activity for months to come, why would anyone worry about inflation? Here is the case.

First, there is the housing market. It has roared back. Homebuilding companies are saying these are the best conditions in more than three decades (including, therefore, the bubble that blew up into the GFC). Their share prices are now above their pre-GFC peak, although this surge is plainly not as overdone as in 2005:

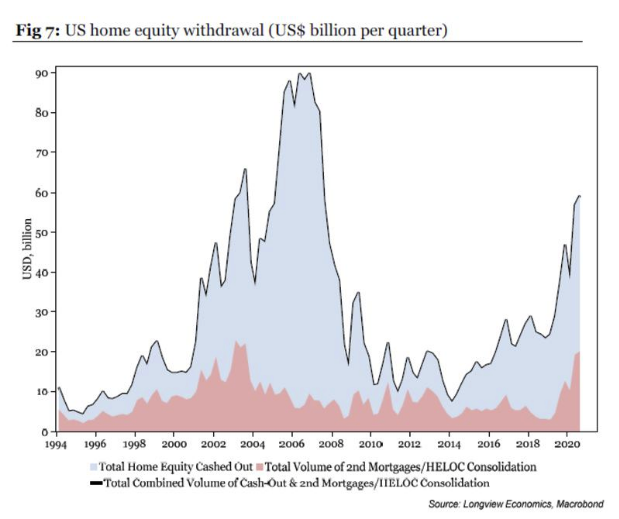

More ominously, people are starting to use their houses as ATMs again. This is what is happening to U.S. home equity withdrawal (in a chart from Chris Watling of London’s Longview Economics):

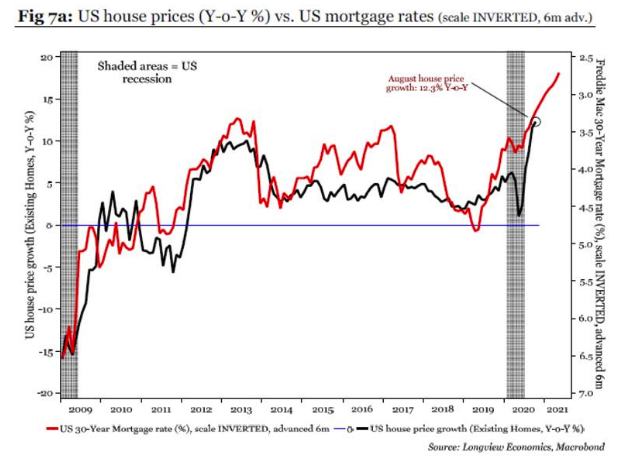

And there is every reason to think that the homebuilding boom can continue. As this chart from Watling shows, house prices tend to appreciate as mortgage rates fall — and mortgages are now very, very cheap:

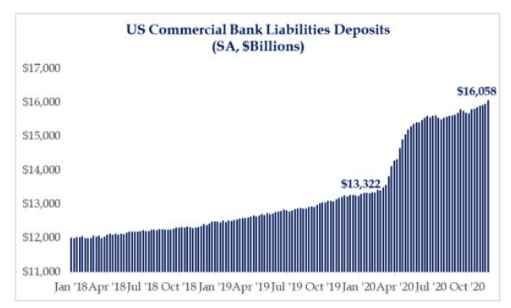

That implies there will soon be more money to be withdrawn from Americans’ brick-and-mortar ATMs. But it looks as though Americans don’t particularly need to go to the ATM, because the money they already have on deposit has shot up since the first lockdown. This chart is from Strategas Research Partners: