With the stock market on an upward trajectory for most of the last decade, hedge fund managers and others who include short selling in their investment toolbox have had a tough time persuading investors to hope for the best but prepare for the worst.

The coronavirus pandemic, which sparked a swift and brutal stock market descent from late-February through March 23, breathed new life into that argument. The Standard & Poor’s 500 lost nearly 20% of its value in the first quarter, even after a late March rebound shaved a peak-to-trough loss of 34%. By contrast, the RiverPark Long/Short Opportunity Fund (RLSIX), which includes short selling in its investment toolbox, was up 9.48% in the first three months of the year.

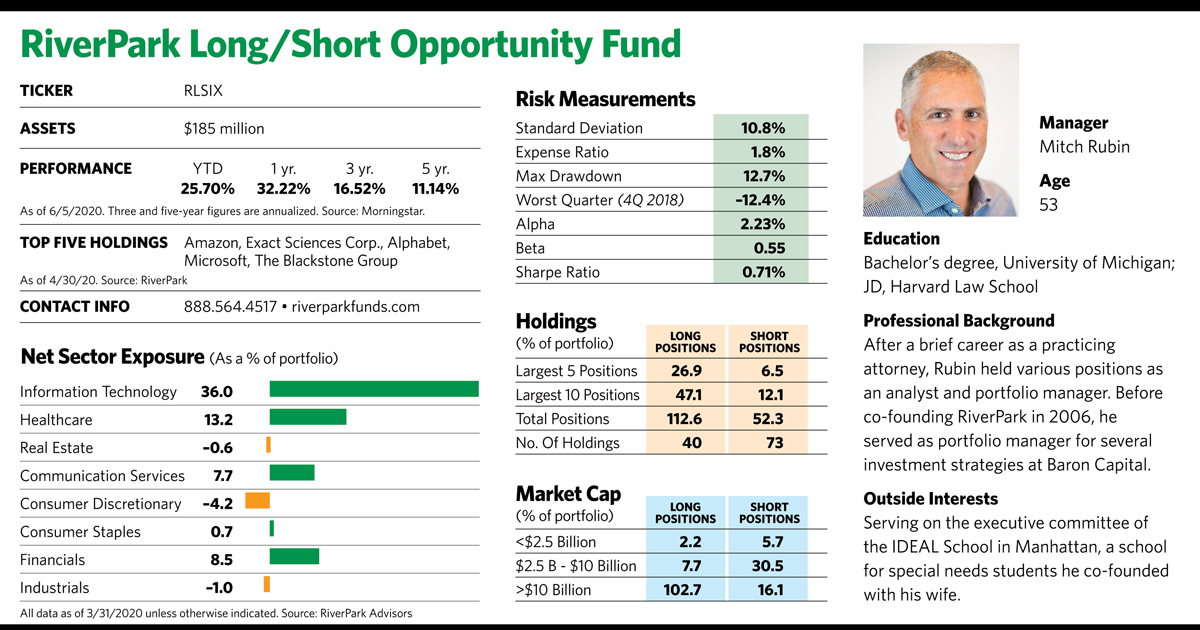

Mitch Rubin, who has managed the fund since its inception in 2009, says that investors lulled into a false sense of security by a prolonged bull market are waking up to the periodic “black swan” events that make the hedging strategies his fund employs a lifeboat in a sea of losses.

“It’s often been said that if there is just a 2% chance of something happening, then there is a 100% chance of it happening over the next 50 years,” he says. “The best way for an investor to be truly prepared for these predictably unpredictable events is to have part of a portfolio invested in a long/short strategy before the next drawdown begins.”

RiverPark Long/Short had trouble spreading that message when it started life as a traditional hedge fund partnership in 2009. As relatively new players in the space, the team had to compete against much larger, better-known hedge funds with more established reputations. Hoping to have better luck among a more familiar territory of financial advisors and individuals, Rubin and RiverPark CEO Morty Schaja, both alumni from the Baron Funds, converted the portfolio to a mutual fund format in 2012.

In the ensuing years, a roaring bull market drew few investors to this hedge fund product or other ones. But in 2020, a swift pandemic crash and the RiverPark fund’s strong performance turned the tide. By mid-May, it had $185 million in its coffers, more than twice as much as it held just four months earlier.

“We always thought the fund wouldn’t shine until we had a significant drawdown, and that turned out to be the case,” says Rubin, who believes the strategy will remain valuable to investors as market turbulence continues. He also sees a growing performance gap between the market’s winners and losers, which argues for active management on both the long and short sides. “The pandemic has highlighted that trend by accelerating both the creation and destruction of profit-making opportunities,” he says.