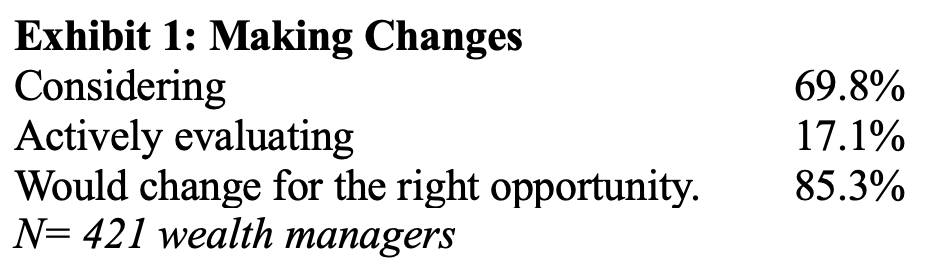

Advisors rely on platforms such as broker/dealers, custodians and other firms to function. In a survey of 421 wealth managers, 70% reported having considered alternatives to their current platform arrangements (Exhibit 1). This means switching platforms, such as going from one bank to another or one independent broker/dealer to another, going independent or adding custodians.

While many have expressed interest in making changes, only 17.1% of wealth managers say they are actively evaluating their options and expect to make changes by 2025 or 2026. While many wealth managers say they will make a change within a couple of years, fewer will probably do so because of factors such as inertia, the demands of their practices and life. Meanwhile, 85% say they would change if an appealing opportunity arose.

Regarding the wealth managers who will more likely switch platforms, a higher percentage of the more successful ones, as measured by annual income, intend to act. There are several reasons for this, including the need for more operational and business development support and being in a better position to negotiate terms.

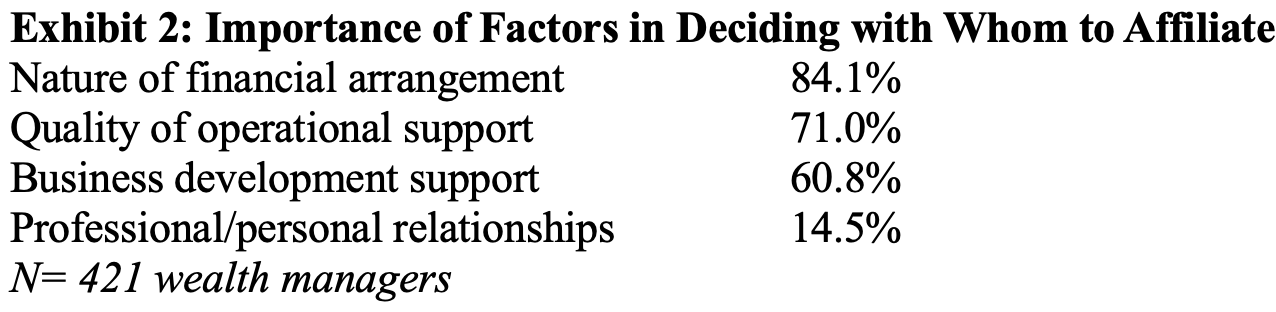

Different factors were identified as instrumental in wealth managers deciding the platforms they use (Exhibit 2). Almost 85% of wealth managers point to their financial arrangements, which does not necessarily mean the highest payout. Seven of 10 identify the quality of the operational support as critical. Three-fifths point to business development support, and 14.5% say their professional or personal relationships with platform executives are a significant factor.

Considering Your Options

The starting point is to remove professional/personal relationships from the table. Although they can be why some wealth managers affiliate with a specific platform, they tend to be loose bonds that can easily fray under pressure. Moreover, these relationships are usually more professional than personal, so they do not hold wealth managers well when better opportunities arise and then tend to be discounted, if not forgotten.

Quality of operational support is essential as you want to be as efficient as possible doing business. For instance, the technology platform needs to be as good as possible. However, although important, the technology platform is not much of a differentiator. The best wealthtech is increasingly available to all wealth managers, a trend that will only accelerate. Still, you need to understand all aspects of your platform's operational support and compare them side-by-side with other platforms.

It is a good idea to discuss their experiences with the operations with wealth managers on the platform. You want to know how responsive the platform is and how this all impacts your finances.

Most wealth managers pay close attention to their financial arrangements. They can often make deals with platforms, from payouts to equity participation to forgivable loans. For example, you have substantial negotiating power with the dozens of aggregators and hundreds of wealth management firms looking for bolt-on acquisitions and independent broker/dealers supporting lift-outs.

If you want business development support from their platforms, it is wise to be clear about what that means and if the platforms you are considering can deliver. For example, of the 421 wealth managers surveyed, 65% want to move upmarket, which they define as working with more affluent clients. While so many platforms have in-house programs to help wealth managers work with the wealthy or have arrangements with money management firms or consultants, coaches, and training firms to assist in this regard, many of these programs fail to help wealth managers move up-market.

One of the most appealing forms of business development support is showing wealth managers how to find “ideal” clients. Referrals from clients and centers of influence, mainly accountants and attorneys, are the best way for wealth managers to find “ideal” clients. Although most wealth managers get most of their new clients because of client referrals, they get their best new clients from centers of influence.

Few wealth managers are unaware of the potential of creating strategic relationships with accountants and attorneys. However, relatively few wealth managers have created a steady stream of new “ideal” clients from these centers of influence. This has led many platforms, money management firms, and a slew of consulting and coaches to profess to provide the means to source business from centers of influence. If this is important to you, when you are informed that the platform you are considering has such a business development program, you need to be highly critical and find out if it really delivers, as many do not.

The platforms you rely on are foundational to the success of your wealth management practice. Paying close attention to what they offer and making extensive comparisons is wise. At the same time, you will likely be well served if you dig into the platform from the strategic positioning, including your relative contribution to platform revenues, to verify their claims.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.