Expectations for inflation are breaking upward, as are stock markets. In the U.S., 10-year inflation expectations are their highest since 2014, at just above 2.2%. German inflation expectations are also rising sharply, but the gap between the two is now the widest it has been since the global financial crisis in 2008:

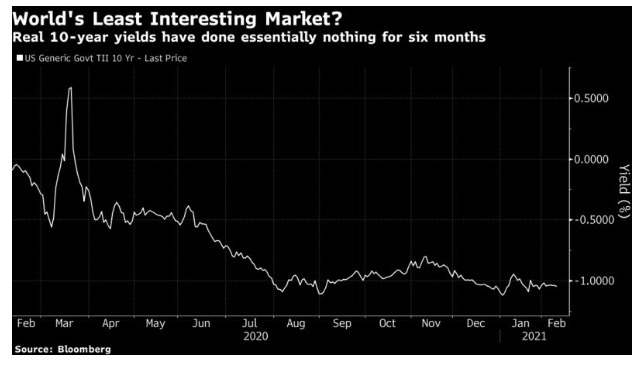

Rising inflation can be a problem, but it can also be a symptom of growth. The strength of the stock market suggests that investors are looking solely at the good side for now. And that, as ever, can be explained by the bond market, which continues to give equity investors room to operate. As Brian Chappatta notes elsewhere, the yield on the 30-year bond is now above the round number of 2%; but what really matters is the way that real yields, taking account of inflation, have moved. And they have barely moved at all. This is the yield on 10-year Treasury inflation-protected securities:

There has been a huge change in inflation expectations since last summer, and it has had no effect whatever on real yields. This allows stocks and alternative assets like bitcoin to flourish. The reason inflation-protected yields can stay stable is that investors are confident the Fed really will allow inflation to “run hot” — meaning that it will average above 2% for a while — and that inflation in turn won’t take off in a serious way to levels of or 4% or 5% or beyond. If that were to happen, the Fed would have to raise rates, and people buying bonds at current prices would lose a lot of money.

If the market is correct about this set of assumptions, then we have about as perfect a set of conditions for equities and risk assets in general as one could ask. Are they right?

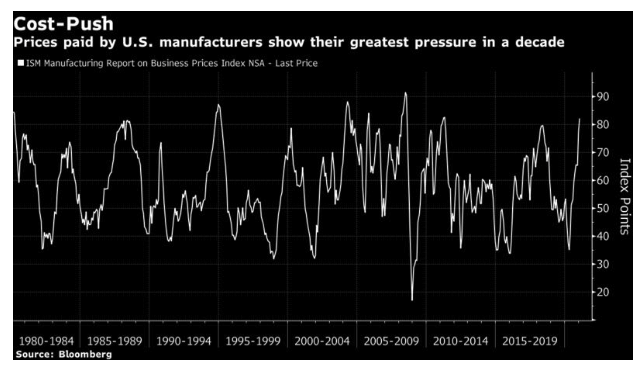

Recent macro numbers suggest that inflation pressures are worryingly high, even if they have not yet broken out. Prices paid by manufacturers, as measured by the ISM survey, are showing the greatest pressure in almost a decade:

Meanwhile, unit labor costs, measured quarterly, also suggest that labor is getting more expensive, in a way that hasn’t been seen in decades:

So is the market really right to be so confident that inflation will remain under control?