Long ago, people thought the business cycle was akin to a natural event, like the phases of the moon. That has since been disproven, but there are a number of other competing hypotheses. Many mainstream theories hold that recessions are the result of unpredictable events — changes in the rate of technological innovation, monetary policy or asset prices — that randomly speed the economy up or slow it down. Some alternative theories hold that booms cause busts, because good times allow bad investments to build up in the financial system. According to these theories, the larger the boom, the larger the crash that follows.

Then there’s the so-called plucking model. Proposed by the legendary economist Milton Friedman, it holds that the economy is like a string on a musical instrument — recessions are negative events that pull the string down, and after that it bounces back. Just as a string snaps back faster if you pull it harder, this theory holds that the deeper the recession, the faster the recovery that follows. But you can only pluck the economy in one direction; bigger expansions don’t lead to bigger recessions.

The plucking model, therefore, says that recessions aren’t just the mirror image of expansions. They’re special events that disturb an otherwise placid process of economic growth. This has big implications for policy. Standard theories hold that while the economy can be stabilized by monetary or fiscal measures, the best that can be done is to iron out the fluctuations. But if the plucking model is right, then fighting recessions can actually raise the rate of growth overall. Just stimulate the economy whenever it gets plucked, and it’ll go happily on its way.

But is the plucking model true? Friedman proposed the idea in 1964, and argued that if he was right, future recessions would show a correlation between the depth of the bust and the speed of the recovery that followed. He then waited 20 years to see if his predictions were borne out. In 1993 he looked at the business cycles that had happened in the intervening years, and concluded he had been right.

Since then, others have found more evidence to support the plucking idea. A 2005 paper by economist Tara Sinclair used advanced statistical techniques to confirm that in the U.S., bigger recessions are followed by faster recoveries — but not the other way around. After the Great Recession of 2007-2009, researchers Gregory Cleys and Thomas Walsh looked at European countries, and concluded that those that had it worse in the downturn ended up bouncing back faster. But there was no correlation between how well a country did before 2007 and how much it suffered afterward. All this evidence implies that recessions cause recoveries, but that booms don't cause busts.

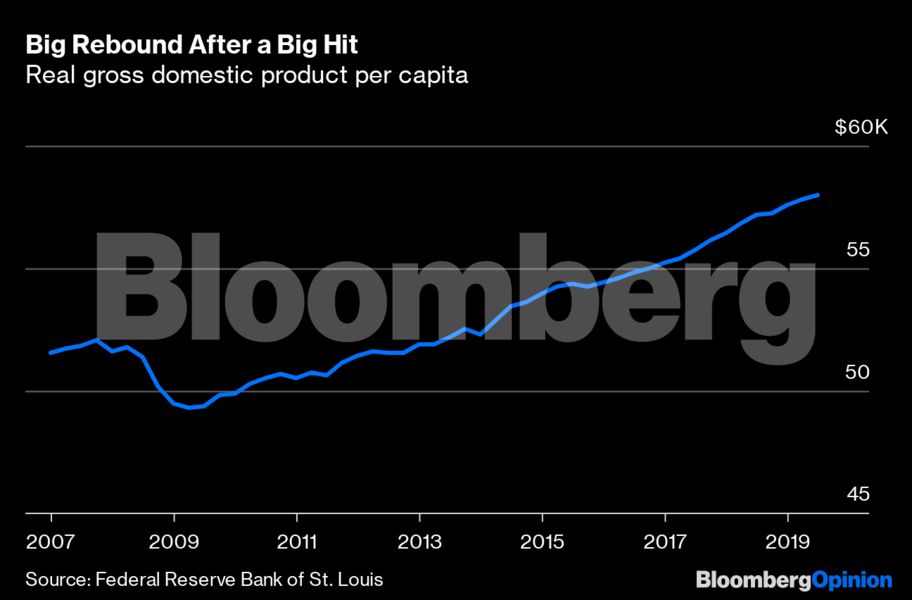

This fits with recent experience. Despite unusually low productivity growth, the U.S. economy grew strongly from 2010 through 2014:

According to Friedman’s theory, this was simply due to the size of the hole that the economy had fallen into.

That leaves the question of why the economy would act like a string that can only be plucked in the downward direction. Macroeconomists Stéphane Dupraz, Emi Nakamura and Jón Steinsson think they have an answer. In a new paper, they lay out a model suggesting it depends on the way companies set wages.

Basically, it’s easy to give people raises, but hard to make them swallow pay cuts. In good times, growth simply feeds into higher wages (as well as higher profits). But when a recession or other negative shock comes along and hurts corporate earnings, employers that might like to cut wages can’t. Instead, they lay off workers. The more workers who get laid off, the bigger a pool of unused labor there is, so the faster the economy can grow once the recovery takes hold.