Emerging Inflation

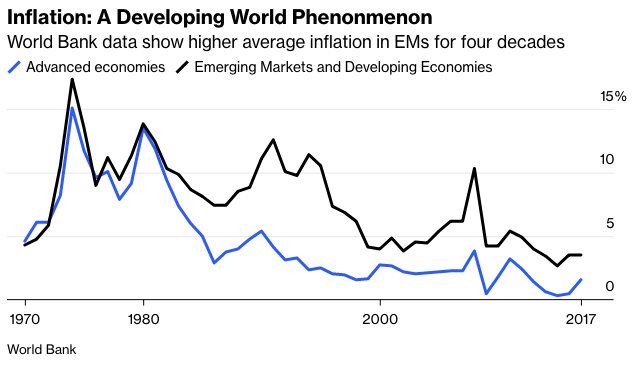

If these assumptions are difficult, an even bigger one is coming in for reassessment. For about as long as economists have made a serious effort to measure them, emerging economies have been prone to higher inflation than the developed world. The following chart is based on data from a World Bank book and go up to 2017:

That assumption no longer holds good. This chart compares Bloomberg’s measure of average consumer price inflation in emerging economies with U.S. headline inflation:

Even though emerging markets currently have prices under better control, their central banks have to remain far more vigilant than their developed-market counterparts, so they have already hiked rates. That raises their risk of stagflation. It should strengthen their currencies, which will help combat inflation but render them less competitive. And it’s in the world of foreign currency that the rubber will hit the road and these assumptions and contradictions will be resolved.

Something’s Gotta Give: Foreign Exchange Edition

Something in currencies has to give, thanks to the extreme divergences in monetary policy. This summary is from Larry McDonald of Bear Traps Report LLC:

The current policy divergence between the a) PBOC (cutting rates, 530B yuan additional liquidity), b) the ECB—wind down net asset purchases this quarter / set for a 2H rate hike—QT out of the question now, c) BOJ aggressive balance sheet expansion, d) Fed promising 9-12 rate hikes looking out a year with QT aggressively involved. This type of insane monetary policy divergence will clearly break something, that is certain—unsustainable.

This is strongly worded but not unreasonable. Central to everything, as ever, is the dollar. Following the popular dollar index, which compares the dollar against a basket of major developed market currencies, there is still much further to go. It has recently gone above an index level of 100. Excluding very brief spikes during the first Covid shutdown of 2020 and in the immediate aftermath of Donald Trump’s election in late 2016, it hasn’t been at this kind of level in almost two decades. However, prior history in the period since the dollar’s peg to the gold price was removed in 1971 suggests that the dollar could appreciate much more. The logic of current divergent monetary policies is that it should do exactly that:

There is no compromising in the world of currencies. Each currency pair is in effect a zero-sum game, with some traders winning and others losing by the same amount. Confused and divergent views of inflation and real yields in different countries must be reconciled into one exchange rate. The forex market will probably determine whether the current extraordinary conditions tip over into crisis.