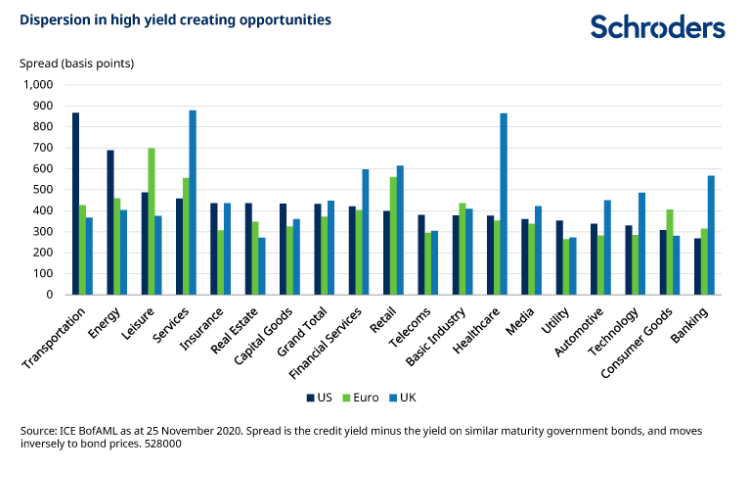

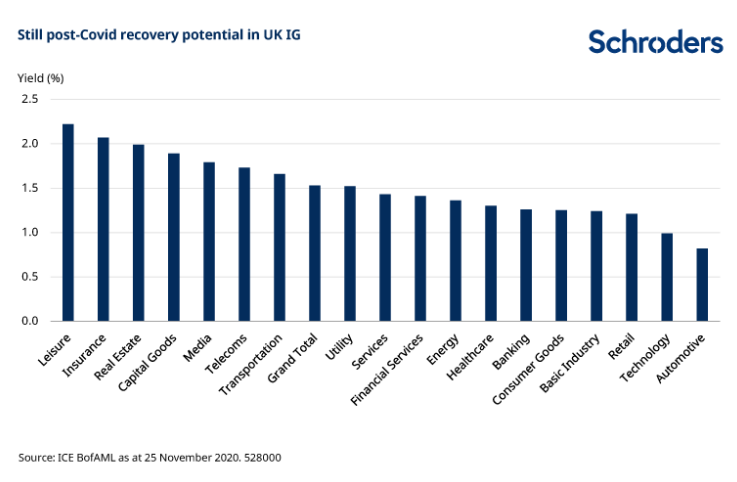

Martha Metcalf, head of US credit strategies, said: “High yield has the potential to deliver good returns in 2021 from present valuation levels and the variation and dispersion in valuations means there are opportunities to generate returns through security selection. If the development of vaccines enables a normalisation in growth and company revenues, this is a potential kicker, but it will be very important to remain selective and focused on company analysis. In the meantime, many issuers have bolstered their liquidity and are positioned to navigate this challenging environment.”

Angus Hui, Head of Asian and EM Credit, sees a similar dynamic at work. “Asian corporate earnings have shown some recovery from the trough in the first half. There is divergence, however, with investment grade companies generally doing better than high yield. Security selection will be key.”

Solid Base For Improvement In Corporate Fundamentals

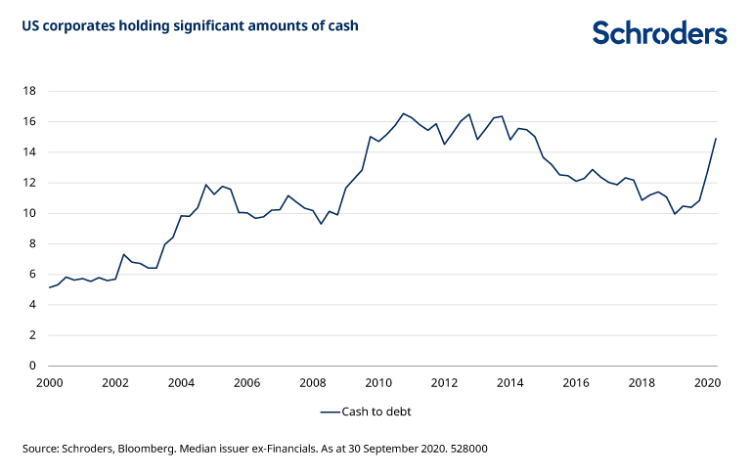

We think this underlines the need to be selective in 2021. The level of balance sheet debt has now stabilized and companies are mostly sufficiently able to cover their interest payments. Many companies have accumulated cash “war-chests” and cut dividends, and we could see companies start to reduce the level of debt on their balance sheets. Some companies will emerge from the crisis in reasonably good shape, but others may have overreached.

“Company revenues have suffered in 2020, but there have been encouraging examples of company revenues either holding up well in the crisis or rebounding quickly,” said Rezek.

Hui said: “In 2021, credits which are deleveraging (reducing balance sheet debt) and which have sustainable corporate strategies are likely to be the outperformers.”

The rise in corporate debt to record levels has raised concerns for some. The increase in debt came about largely due to the severity and indiscriminate nature of the crisis. Companies had to ensure they had enough liquidity (literally sufficient cash to cover short-term costs and liabilities). With the help of policymakers this issue has been substantially addressed, though there are still potentially more insolvencies to come, and the large issuance has been readily absorbed by investors.