Nothing speaks to why someone might consider investing in a market neutral fund better than the recent performance of Vanguard’s Market Neutral Fund. During the rocky third quarter of 2015, when the Standard & Poor’s 500 lost 6.4%, the fund rose 7%. In the first six weeks of 2016, when the S&P 500 slipped over 8%, the fund rose nearly 3%.

Despite strong inflows in the wake of market volatility, John Ameriks, who oversees the Quantitative Equity Group at Vanguard, is quick to dispel any notion that the fund is a short-term escape hatch or a way to notch big gains in a down market.

“Timing should be the last thing on someone’s mind with this fund,” he says in response to a question about whether this is a good time to be investing in a market neutral strategy. “The real issue is whether market neutral makes sense in a portfolio over the long term.”

At the same time, he emphasizes that shooting out the lights in a bear market isn’t the goal here, and if the stock market is down, the fund’s portfolio won’t necessarily be up. “Investors need to understand this is a market neutral fund, not a market inverse fund,” he says. “The value here is having a return that is unrelated to other asset classes over time. We treat this fund as a diversifier with modest expectations for outperformance over risk-free assets.”

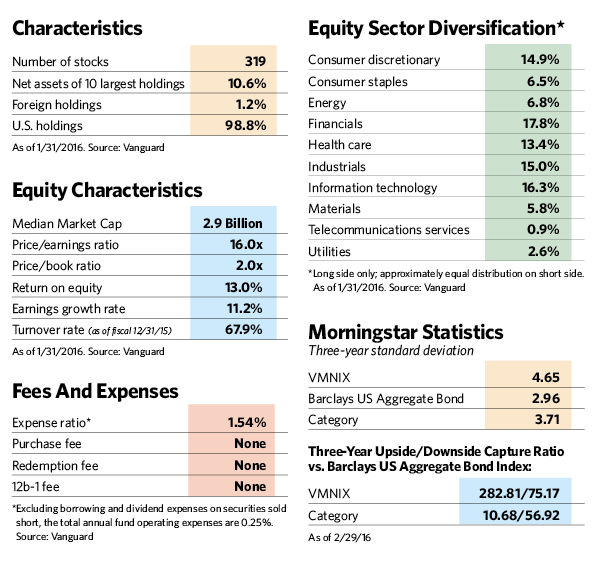

As their name implies, market neutral funds seek to neutralize market risk by investing in long and short positions in roughly equal proportion. In this fund, the quantitative management team of James Troyer, Michael Roach and James Stetler focus on identifying securities that are mispriced. Those that appear underpriced go on the long side while overvalued securities that could deteriorate go on the short side.

In a best-case scenario, stocks on the long side appreciate, while those on the short side go down. Under a worst-case scenario, the opposite would happen.

There are lots of in-between possibilities as well. In an upward-trending market portfolio, returns would be positive if long positions do better than short positions. In a down market, the portfolio would still earn a positive return if the shorts fall further than the longs. That’s what happened in the third quarter of 2015 and earlier this year.

During bull markets, people don’t pay much attention to market neutral funds because they underperform traditional equity funds, sometimes by a wide margin. In 2013, for example, when the S&P 500 rose 32%, the average fund in Morningstar’s market neutral category gained just 3%. And given that returns for equity markets tend to be positive, market neutral funds can be expected to underperform traditional long-only funds for extended periods.

But as both recent and historic performance illustrates, the benefits of playing both sides of the market fence come into sharper focus during sideways or down markets. Over the long term, the fund has the modest goal of delivering a return of 100 to 150 basis points over cash. From its inception in 1998 through the end of 2015, it’s produced an average annualized return of 3.34%, versus 1.98% for three-month Treasury bills.

More recently, the fund’s returns have beaten ultra-low interest rates by a wide margin. Over the five years ended December 31, 2015, its average annualized return was nearly 5%, compared with 0.04% for T-bills. The strong performance was one reason Morningstar named the fund Alternatives Fund Manager of the Year for 2015.