I love spending time outdoors—except when it’s 20 degrees outside. For me, winter in Boston is a time to focus on self-improvement, whether that’s working on fitness goals or taking a class, so I can enjoy the warm weather when it finally arrives. Still, the winter can seem very long, as did 2022 and 2023 for many businesses. Companies saw margins contract, sought to lower their debt loads as rates rose, and made efforts to right-size their businesses for what seemed like an oncoming recession.

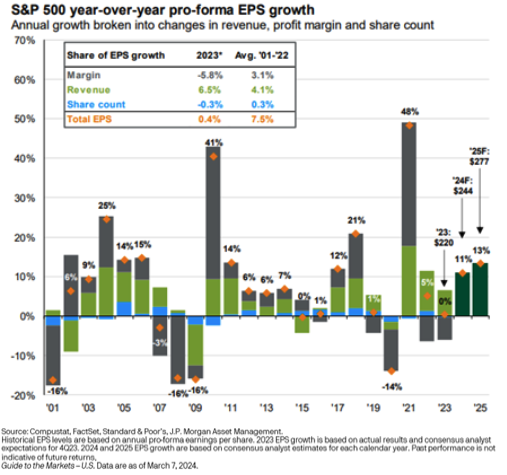

Now, the recession predictions for 2023 seem like they’re in the rearview mirror, considering the 44% rise in the price of the S&P 500 from the low on October 12, 2022, to March 7, 2024. Although there were a few quarters of negative year-over-year earnings growth during 2023, we’ll likely end the year just slightly in the green, with earnings per share growth at 0.4% for 2023 (as of March 7) with most of the S&P 500 done reporting for the year. While inflation has started to come down, companies were able to keep revenue growth high enough to offset the declines in margins during the year.

Avoiding A Recession Vs. Beating High Expectation

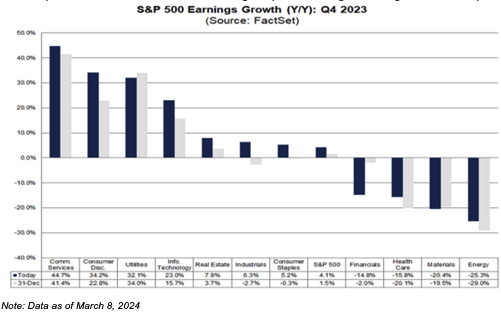

The rise in prices in 2023 was largely a result of beating low market expectations, and the fourth quarter was no exception. We came into the quarter expecting earnings growth of only 1.3%, but most sectors beat expectations to report 4.1% earnings growth (98% of the S&P 500 has reported as of March 8). The biggest difference between the third quarter and the fourth quarter was that expectations for the future remain high. During the third quarter, the fourth quarter bar was lowered from an expectation of 8% growth to the 1.3% growth that was expected at the beginning of earnings season.

In addition to beating that bar in the fourth quarter, we saw expectations for earnings remain high for 2024. Earnings were expected to be 12% for the year and dropped by only 1% to 11%. Although a good portion of the declines in analyst estimates were frontloaded to the first quarter of 2024, this may be a more challenging year to live up to expectations compared to last year, when just avoiding a recession was the backdrop. The two-year-out expectations for 13% growth won’t make it easy for companies to push out growth to the future if they miss in 2024.

Growth And Value Sectors Diverging

The three largest sectors by weight in the Russell 1000 Growth Index are tech, consumer discretionary, and communication services. All three saw significant year-over-year growth in earnings relative to both the prior year and expectations. Earnings beats by several of the largest companies helped drive returns in these sectors. Meta drove nearly half the gains in communications services, Amazon drove nearly all of the increase within consumer discretionary, and Nvidia drove about half of the gains in tech.

Three of the largest weights in the Russell 1000 Value Index are financials, healthcare and industrials. While industrials managed to beat expectations and see gains, financials and healthcare had significant losses. Healthcare (even with those losses) did beat expectations, but financials significantly underperformed expectations, largely because of FDIC charges levied on banks to help with the situation caused by the regional banking crisis at the beginning of the year. Energy and materials are also heavily represented in the value index and saw significant declines in the fourth quarter. Utilities were the one bright spot, with significant gains as companies have been able to pass on price increases resulting from inflation; however, this result was just in line with expectations.

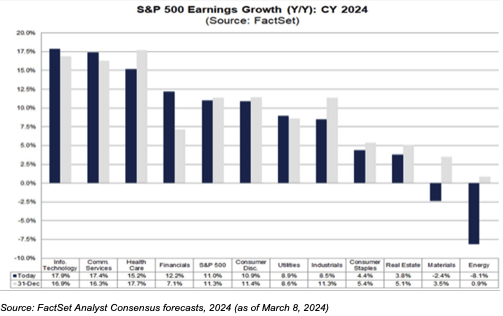

Growth Needed To Support Valuations

Analysts are expecting some significant growth in earnings in 2024 across a range of sectors. While earnings growth is still dominated by growth sectors, analysts expect some sectors like financials and healthcare to rebound in 2024. They also anticipate solid revenue growth to continue at 5% for 2024, but it will require a rebound in profit margins to support earnings growth this year.

Indeed, earnings growth will need to be robust considering S&P 500 valuations are approaching the levels we saw at the beginning of 2022 when the S&P 500 was trading at 21.4x forward earnings. Now, we are seeing the S&P 500 trade at 20.7x forward earnings, although we’re in a much higher interest rate environment, making the hurdle a bit higher.

Enjoy The Warm Weather While It Lasts

Yes, the bar is high and valuations are high. But we believe companies are still in a good place and continue to see an improving economic picture. Even if we just match earnings expectations, equity markets can rise as valuations come down. Companies that invested over the past few years due to a tight labor market can now see increasing productivity, even without accounting for possible future benefits of AI.

I’m looking forward to getting outside after a long winter, although at some point I know it will be time to buckle down and prepare for winter again. But, for now, it’s time to break the clubs out of the basement and enjoy the warm weather.

Rob Swanke is senior equity strategist for Commonwealth Financial Network.