Success can be a self-fulfilling prophecy.

When RIA firms achieve success, their owners continue investing in growth. Some of the nation’s largest firms reinvest nearly 50% of their profits as a principle.

This creates momentum that then attracts talented people, whose ambition will help the firms grow and attract even more client relationships. Increased revenue and profits allow RIA firms to tap even more resources to grow.

There’s more to success, of course, than a firm’s size, but the biggest firms in the RIA space still enjoy a lot of the glamor. You could say they have the same kind of prestige that boxers in the heavyweight division often do. They have the “punching power” and all the Rocky-level drama. While heavyweights can occasionally be “flabby,” they command all the attention.

What It Takes To Be A Heavyweight (In The Top 100)

To be included in Financial Advisor’s list of the top 100 RIAs (what I call the “heavyweights”) a firm had to have more than $5.4 billion in assets under management at the end of 2021. To be ranked in the top 10 required well over $47 billion. Clearly, these RIAs are no longer small organizations operated by a few partners. In fact, the average heavyweight firm had a team of 180 employees servicing a median 1,551 clients.

The barriers into the league of heavyweights keep growing dramatically too. The 2017 version of this list cut off firms at $2.3 billion in assets, half the size needed today. In 2012 the number was $1.1 billion in AUM.

While much of that tremendous growth was created by the financial markets, consolidation has also played a role in reshaping the RIA ecosystem.

Heavyweights Are Consolidators

In fact, M&A may be the most common path to the top of the list in recent years. Helping that trend along now is institutional capital. Forty-one percent of the top 100 firms in Financial Advisor’s RIA survey report having institutional investors.

In contrast, 20% of what we’ll call the “cruiserweights” (firms that ranked from 100 to 200 in size) have institutional investors. Only 7% of the firms ranked from 200 to 500 (“middleweights”) report outside ownership.

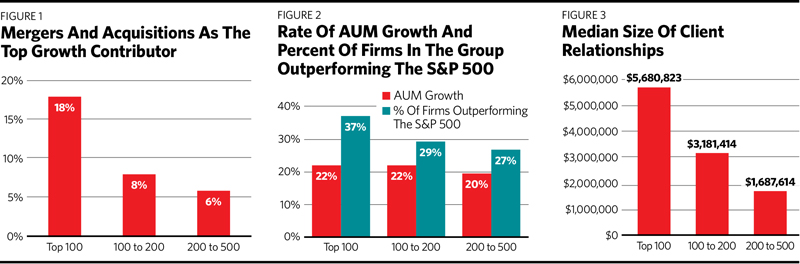

Of the top 100 firms, 18% say that their No. 1 growth driver is mergers and acquisitions. (See Figure 1.)

Heavyweights Are Surprisingly Faster

Canadians like to say you don’t have to be faster than the bear, just faster than the other guy running from the bear. But what happens when the other guys are really fast? Heavyweights grew at a median rate of 22%, the same rate as their cruiserweight counterparts and faster than the middleweights (who grew at 20%). The math suggests that we should be seeing the opposite phenomenon—that the smaller denominator should make it easier for smaller firms to grow at a faster rate. (See Figure 2.)

Clearly acquisitions, combined with bigger marketing budgets, larger reputations and more business developers, create an advantage for the largest firms.

If You Want Larger Clients, Be A Larger Firm

Most advisory firms are looking to increase the amount in assets they have per client. Bigger clients promise more profitability, which also gets firms a reputation for the sophistication of their services. It seems from our data that if you want bigger client relationships, you should strive to make your firm larger. The top 100 firms clearly demonstrate that.

The heavyweights have an average assets under management per client of $5,608,823 while the cruiserweights have $3,181,414 and the middleweights have $1,687,614.

The clients with the most assets frequently prefer the richer resources of bigger firms. (See Figure 3.)