It is difficult to recall a time when U.K. politics have been so deeply fractured. There is a massive power vacuum at a time when clear leadership is desperately needed to calm investors.

Presuming the various parties get their acts together, attention will turn to how the government goes about invoking Article 50 of the Lisbon Treaty, the first step in separation discussions. Such an action will need to be approved in parliament, meaning there is a chance it could be voted down. Politically, though, it would be very tricky to go against the result of the referendum, even though the result is not binding.

Other European leaders have given mixed signals over the speed with which they expect exit negotiations to begin. Some want to start almost immediately, while Chancellor Merkel has counseled patience. However, one message has been made abundantly clear – the United Kingdom will not retain access to the single market without paying dues to Brussels and accepting the free movement of labor. Those, of course, were the two biggest bones of contention for the “Leave” supporters.

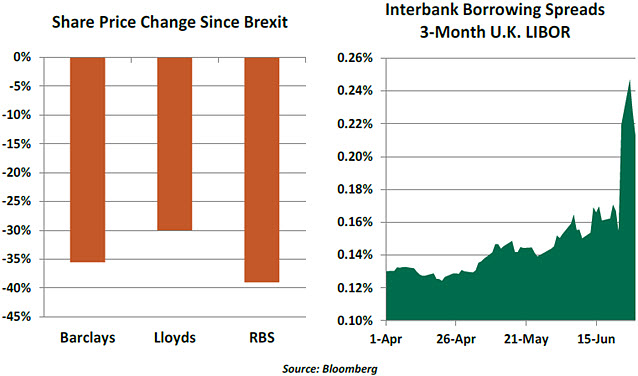

3. The situation has stressed U.K. banks. Post-Brexit challenges could cause U.K. house prices to fall, unemployment to rise and corporate insolvencies to increase, all contributing to asset quality deterioration. In response, the Bank of England (BoE) may reduce its interest rates, which would increase pressure on bank margins. BoE Governor Mark Carney signaled as much this week, suggesting that Britain was suffering “economic post-traumatic stress disorder.”

U.K. sovereign downgrade risk has risen, which will negatively affect bank credit ratings and the cost of funding to the financial sector. The rapid realignment of currencies may create trading losses for some. Few expect any of the big U.K. banks to fail, but their challenges will serve as a further drag on economic prospects.

Carney was the Governor of the Bank of Canada before taking over at the BoE. He is well-versed in the central bank crisis playbook: get engaged early, talk aggressively, follow the talk with substantial action and promise to keep the stimulus coming. We’ve wondered how a central bank that pulled out all the stops after 2008 would respond to a fresh crisis. We are about to find out if the BoE has any “dry powder.”

Institutions on the other side of the English Channel, some of which never completely healed from the 2008 financial crisis and subsequent European peripheral debt crisis, could feel renewed stress. Unfortunately, the European Central Bank (ECB) isn’t in a position to provide much more support to the beleaguered eurozone banking community. ECB President Mario Draghi called this week for close coordination with the BoE and the Federal Reserve.

Very low interest rates in developed economies, volatile markets and risk aversion remain the early consequences of Brexit. For now, there has been no significant impact on economic or market performance in the United States or Asia. But if instability persists, no one will be immune.

No one wants to go back to the old “rabbit-ear” antennas that filled our TV screens with snow. But we’ll have to keep our antennas sharply tuned in during the coming weeks to get a clear image of what’s going on in Europe and what it means for the rest of the world. Stay tuned.

Raghu’s Resignation