The energy transition is in full swing, and record investment is flowing into this emerging sector globally (Source: BloombergNEF Energy Transition Investment Trends). While some miners of minerals critical to the clean energy transition, particularly those focused on uranium, have seen considerable gains in 2023, lithium miners have largely underperformed. What does this mean for the energy transition, and are there opportunities for investors?

Lithium In 2023: A Bumpy Patch On A Long Road?

The returns of lithium miners are largely negative year-to-date as of November 30, 2023, but the long-term outlook suggests this may be a bump in the road for an emerging sector with significant upside potential. Lithium is a critical mineral essential to lithium-ion batteries, the predominant battery type favored by electric vehicles (EVs). As EV proliferation intensifies, a lithium supply deficit may likely last through most of the next two to three decades.

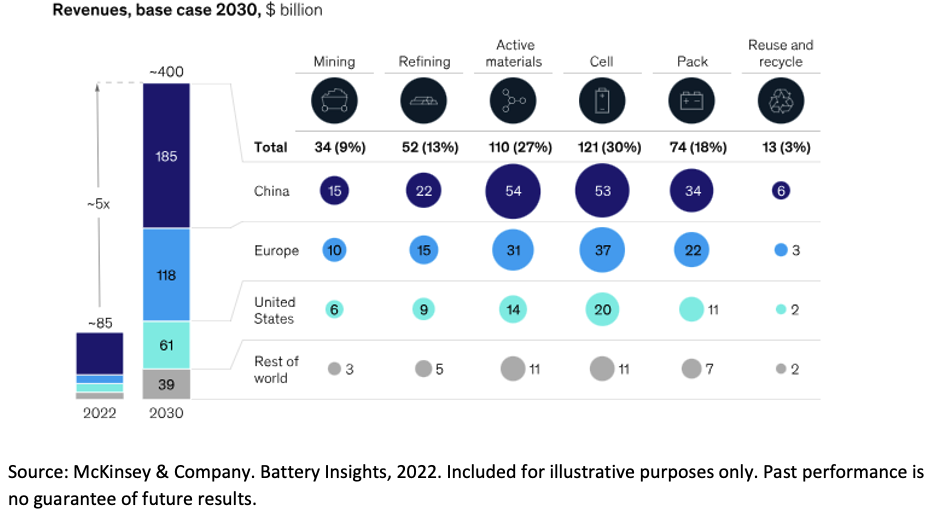

Figure 1. Lithium Supply Unlikely To Keep Up With Demand

(*Source: McKinsey & Company. Lithium Mining: How New Production Technologies Could Fuel the Global EV Revolution, April 12, 2022.)

According to BMI, the lithium supply shortage is forecasted to begin as soon as 2025. There are currently only 101 lithium mines in the world, and even as more mines and exploration projects come online, the added supply may likely not be able to keep up with demand. China alone is expected to drive a 20% yearly increase over the next decade.

Options Along The Entire Value Chain

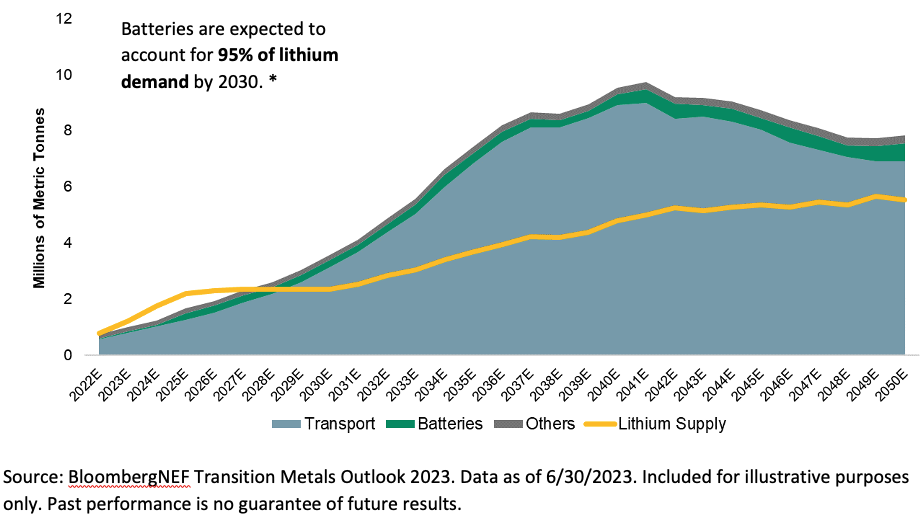

The value of lithium is not limited to the mineral itself. There are opportunities along the entire lithium supply chain, including exploration, mining, processing and compound manufacturing. Lithium miners and companies involved in the processing and refining of raw lithium may likely be poised to benefit as the demand for lithium grows. Recycling will also come into play as batteries begin to reach their end-of-life and recycled elements are reused for new batteries.

The lithium battery industry is projected to create $400 billion in annual revenue opportunities worldwide. The lithium production component of the chain has recorded margins as high as 65%, potentially making it a highly profitable sector.

Figure 2. McKinsey Model Estimates That Lithium-Ion Battery Value Chain May Provide Revenue Opportunities Of >$400 Billion By 2030