While it was once time consuming and complex to start a private foundation, it’s simpler now and can be accomplished in less than a week. And wealthy clients who consider starting one before the end of the year can considerably dampen their tax obligations if they’ve had significant income in 2022.

Besides the philanthropic and family reasons your wealthy clients might have for establishing a private foundation, there are also short- and long-term tax benefits that are well worth considering. Donating to such a foundation allows them four tax advantages:

1. The reduction of income tax liability;

2. The tax-advantaged growth of assets contributed to the foundation;

3. The avoidance of capital gains taxes for appreciated assets; and

4. The reduction or elimination of potential estate taxes.

Income Tax Savings

One of the more immediate tax benefits donors would see is an income tax deduction for any cash amount contributed to a private foundation, a deduction of up to 30% of their adjusted gross income. The deduction is up to 20% of AGI for many non-cash—or securities—contributions.

Let’s take a hypothetical client named Carmen. She works as a healthcare executive in a high-tax state, New York, and earns an adjusted gross income of $1 million each year. Her combined federal and state income tax rate is approximately 47%. She plans to retire in five years but wants to establish a private foundation now and contribute $200,000 to it each year until she retires. Carmen is single and has no children but sees an opportunity to make her retirement productive by spending it managing a private foundation and pursuing her charitable interests.

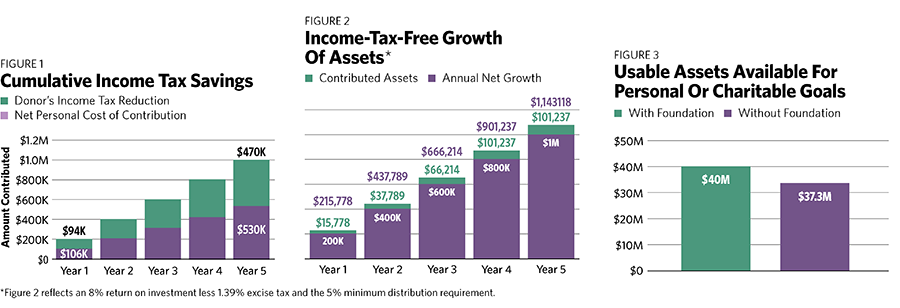

Carmen will owe nearly $470,000 a year in income taxes based on her adjusted gross income. If she establishes a private foundation and contributes $200,000 to it, she will get a tax deduction for the full amount of the contribution (since the deduction is less than 30% of her AGI), reducing her taxable income to $800,000. If her income tax rate remains approximately the same, she will now owe $376,000 a year in taxes.

So by making an annual contribution of $200,000, Carmen will save nearly $94,000 per year in income taxes over a five-year period. After five years, she will have contributed $1 million to her foundation at a net personal cost of $530,000, saving $470,000 in taxes.

Income-Tax-Free Growth Of Assets

Let’s assume that Carmen follows through with her plan to contribute $200,000 to her private foundation every year over the course of five years. Because her assets will be able to grow in the tax-advantaged environment of the private foundation—after, we assume, there’s been an 8% growth rate and after we take into account a 1.39% excise tax—the private foundation’s endowment will have increased by nearly $150,000 despite having made over $111,000 of charitable grants in satisfaction of the foundation’s minimum distribution requirement during these years. By the time Carmen retires, her foundation will be more than $1.1 million and she can focus on creating a lasting charitable legacy.

Capital Gains Tax Savings

Not only can donors get a deduction for income taxes when they contribute to a private foundation, they can also donate to it appreciated assets and thus avoid paying capital gains taxes on them.

Let’s say Carmen has a sister, Allegra, who has founded a publicly traded technology company on the West Coast and holds a lot of highly appreciated stock. Her adjusted gross income each year is $3 million. Because Allegra lives in a high-tax state, California, her combined federal and state tax rate is 47% (and the combined rate is 29% for capital gains). Allegra has seen Carmen’s personal satisfaction and philanthropic success with her private foundation and is interested in establishing one of her own. She’s particularly interested in instilling philanthropic values in her children and getting them and her husband involved with a worthwhile activity. Instead of making annual gifts to the foundation, Allegra wants to make one initial gift at the outset.