She happens to own $2 million in stock in her company, and the cost basis is $500,000. If Allegra sells the stock, she will owe $435,000 in combined state and federal capital gains taxes (not a tax she wants to incur). But if she establishes a private foundation instead and donates the stock to it, she will receive an income tax deduction for the full fair market value of the stock ($2 million). Although this deduction exceeds 20% of her AGI, she can carry it forward for five years, and over time she will save $940,000 in income taxes and she won’t pay any capital gains taxes.

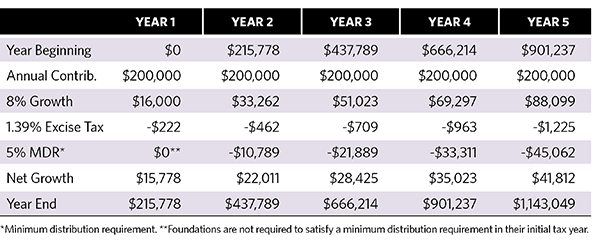

When the foundation decides to sell the stock in the future, it will pay only the nominal excise tax rate of 1.39% on the net capital gains. In fact, if the foundation uses the appreciated stock to make grants instead of cash, it can avoid the excise tax on the stock’s built-in gain entirely. What’s more, because Allegra can pass the foundation down to her children, they can become stewards of a significant charitable legacy and further her good works well beyond her life span.

Estate Tax Savings

When assets are contributed to a private foundation, they are excluded from the donor’s estate and, as a result, are not subject to either federal or state estate taxes. For high-net-worth individuals who have a strong charitable interest, private foundations offer them an opportunity to avoid paying estate taxes while simultaneously creating a lasting philanthropic legacy.

Consider Carmen and Allegra’s parents, who are proud to see that both of their children have been not only financially successful but have also developed strong charitable interests. The parents have combined assets of $40 million and want to leave a portion of their wealth to their children but are also interested in leaving some of their assets to charity. They are retired and have moved to Florida, which has no state level income tax or estate tax. Their assets are largely tied up in real estate and art, so their adjusted gross income is not large enough to justify a charitable gift simply for income tax reduction.

If the parents decide to pass all of their assets to their family, first they receive a combined federal estate tax exemption of $24.12 million ($12.06 million for each spouse), and their combined estates then owe approximately $6,300,000 in estate taxes. (The tax liability was calculated using 2022 federal tax rates.)

What if instead the parents decided to leave the exempted $24.12 million to their children and the rest of their estate ($15.88 million) to a private foundation, which would be funded when the second spouse dies? If they did, they could entirely avoid paying federal estate taxes. In addition, they would have created a foundation that preserves and promotes the family’s charitable legacy and instills their values in future generations of the family, giving new generations the opportunity to come together over common philanthropic goals. Because their children have already established their own foundations, the parents could instead simply leave the taxable portion of their assets to those foundations.

Jeffrey D. Haskell is chief legal officer for Foundation Source, which provides comprehensive support services for private foundations.