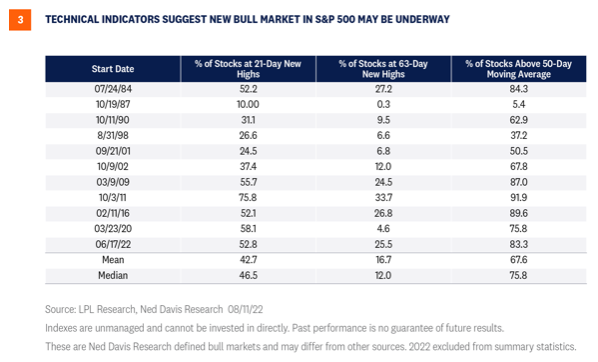

Finally, we go back to the percent of stocks above their 50-day moving averages. A very strong 83% of stocks in the Ned Davis Research multi-cap index are trading above their 50-day moving averages, well above the young bull market average of 67.6%. The statistic shown in Figure 2 is for the S&P 500, while this metric uses a broader market index used by Ned Davis and offers a very similar result.

In sum, the technical conditions of this market appear ripe for the start of a new bull market rather than a retest.

Will The S&P 500 Retest The June Lows?

Other than the question about recessions, we often get questions asking if the market will retest the June lows. Our answer to this question a month ago was probably yes, but now our answer is probably no. This is not just because of the positive technical analysis developments. It’s also about the news. The market became more comfortable with the inflation picture—seeing prices come down—and the likely path of the Fed. Meanwhile, earnings have been quite a bit better than many had feared.

However, there are some reasons to think a rollover and retest is possible:

• Bear market rallies: These are common and often large in size, although they are almost always below the 50% retracement level that the S&P 500 eclipsed last week. The 16% rally off the June 16 low is consistent with historical bear market rallies (the maximum bear market rally weighing in at 14.5% on average). The index rallied 11% in March 2022 before turning lower again.

• Lack of capitulation: Around the June lows, we did not quite see the levels of market capitulation or fear normally observed at historical major market lows that would indicate that all potential sellers have been flushed out. With some sellers still remaining, another wave of selling after this bounce is still possible, especially as the weak seasonal month of September is right around the corner.

• Fed policy mistake: A primary risk to markets at this point is the Fed overtightening, which pushes the U.S. economy into recession, causing unemployment to rise and slashing corporate profits. On the other hand, acting too slowly (or pivoting too quickly) could allow inflation to heat up even more and for inflation expectations to become untethered.

• Geopolitical risk: An escalating military conflict in Europe or Asia could potentially shock markets lower by driving commodity prices sharply higher, disrupting supply chains, and impairing consumer and business confidence (not to mention the horrible human cost of war). Though unlikely in our view, U.S.-China tensions or a broader European conflict certainly carry the potential to deliver a market shock that could push stocks back to their June lows.