I’m going to repeat myself. I don’t know whether the current dose of inflation will prove to be transitory or not, but what should worry everyone is the weight that is being put on the proposition that it will soon be over. For the latest evidence, take a look at the regular monthly survey of fund managers published by BofA Securities Inc. Based on interviews with investors who between them manage an ungodly amount of money, it tells a clear story.

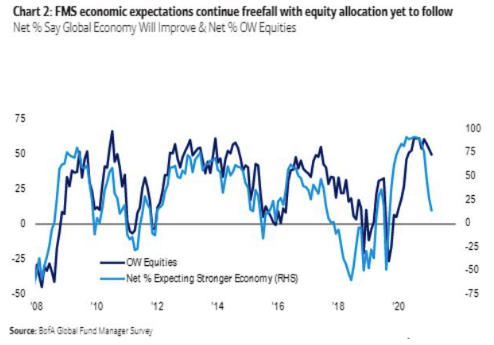

First, fund managers are growing much more negative about the prospects for a strong economic revival. BofA describes economic expectations as being in “freefall.” And yet the overwhelming majority of them say they are overweight in equities. This has barely begun to budge:

All else equal, you’d expect weakening economic prospects to damage bullishness for equities. But all isn’t totally equal, and there is a difference between the corporate sector and the economy. If earnings can survive, then so can stocks.

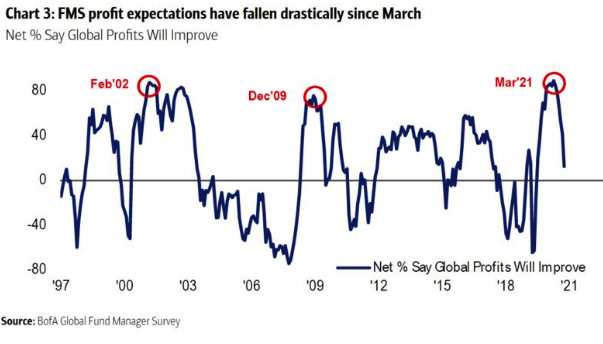

Unfortunately, hopes for profits are also sagging, dramatically:

That leads to the glum conviction that people are overweight equities in a declining economy because of their confidence that bond yields will stay low, and leave them with no choice. TINA, or There Is No Alternative, raises her ugly head again. A weak economy can help keep bond yields low and prop up stocks. But rising inflation could mess that up badly.

And so we find that stocks are in fact being propped up by a total collapse in those who believe that global inflation is heading higher. That belief had been persistent since before the pandemic took hold. Now, on balance, there are no more inflationists than deflationists:

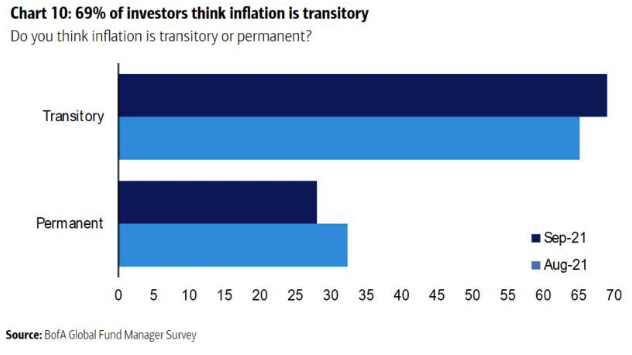

BofA handily asked some more questions, and also discovered that “Team Transitory”—those who believe that inflation will soon go away—is indeed in the majority, and its ranks are growing: