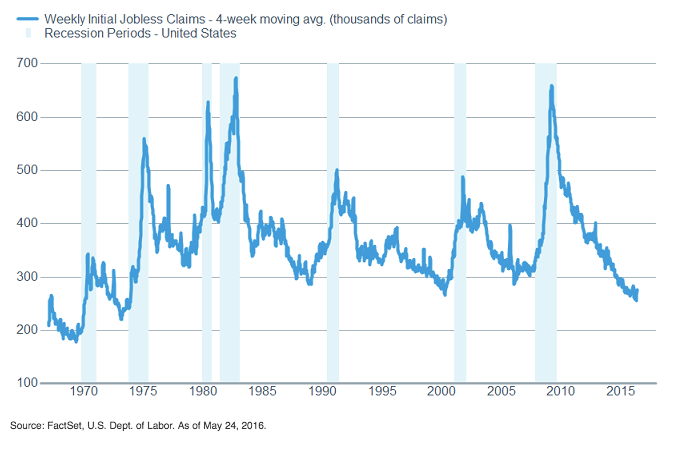

Further potential support for consumer spending comes from the continued improvement in the labor market, with the forward-looking jobless claims falling back after a brief move higher due apparently to some special timing issues, including the ongoing Verizon strike in New York. The improvement is also starting to support wage growth. For a more detailed look at wage growth, read Liz Ann’s latest report.

Source: FactSet, U.S. Dept. of Labor. As of May 24, 2016.

Claims remain low

And wages are starting to benefit

All of this doesn’t mean stocks are going to be off to the races, and we believe near-term volatility will persist, but it does open the possibility for stocks to move higher in the second half of the year as equity investors start to sniff out these potential improvements.

Fed could go from hindrance to help

Another weight on stocks has been Fed policy uncertainty. Throughout much of the first half of this year there had been a mismatch between market expectations and the Fed’s own forecasts in terms of potential interest rate hikes. But both the latest release of the Federal Open Market Committee (FOMC) minutes and commentary from many of its members suggest a rate hike in June or July. As such, the market and the Fed are now essentially aligned. While this process caused some pain in the equity markets recently, it could save pain later should the Fed actually raise rates soon.

We continue to view one or two hikes this year as the most likely scenario, but have our eye on both the rise in wages mentioned above and the bump up in inflation measures such as the Consumer Price Index (CPI), which moved up 0.4% in April, and 0.2% on the core rate. If inflation were to surprise on the upside, the Fed could be forced to be more aggressive, leading to more consternation for investors. But for now, we continue to believe the Fed will be slow and methodical in their quest to return rates to a more “normal” level, which could help to support equities in the second half of the year.

Stocks Stuck In The Muck

May 31, 2016

« Previous Article

| Next Article »

Login in order to post a comment